answer this fast

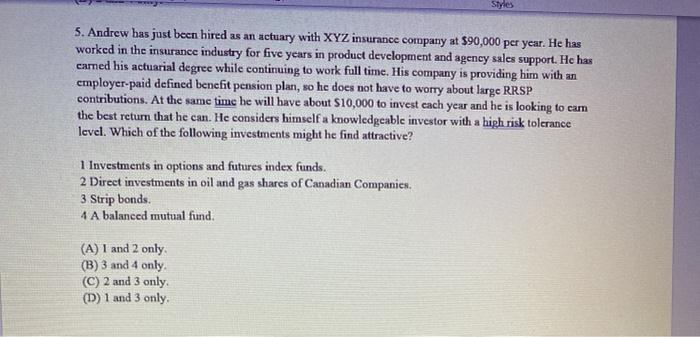

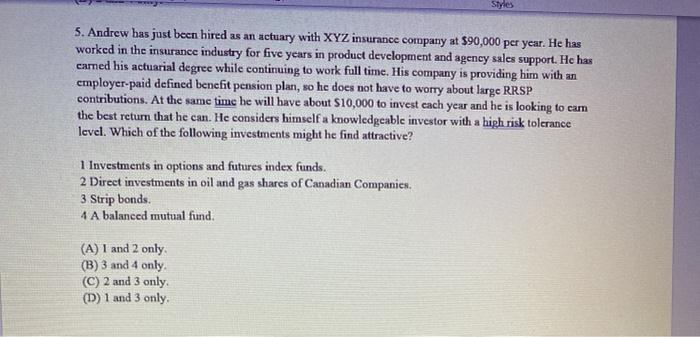

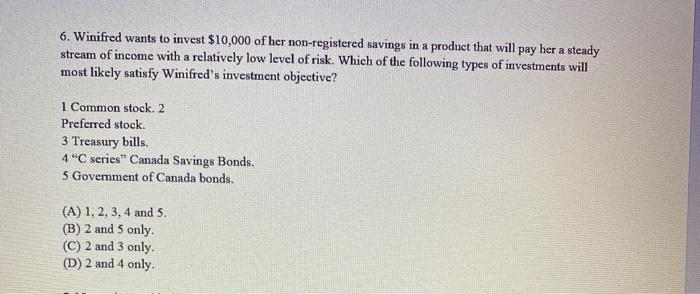

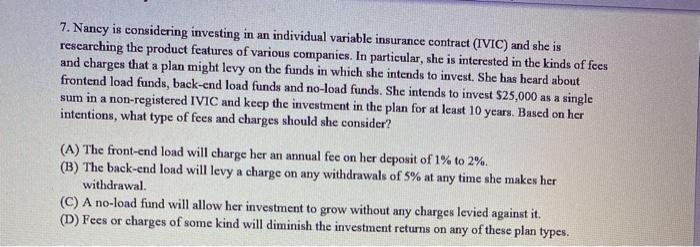

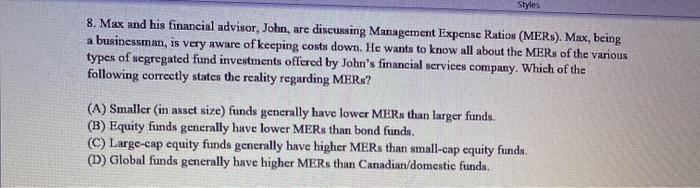

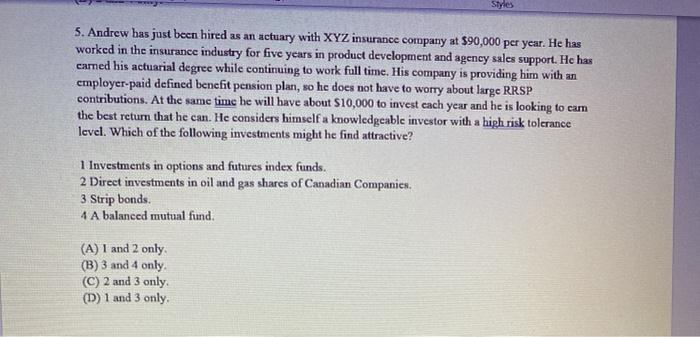

Styles 5. Andrew has just becn hired as an actuary with XYZ insurance company at $90,000 per year. He has worked in the insurance industry for five years in product development and agency sales support. He has cared his actuarial degree while continuing to work full time. His company is providing him with an employer-paid defined benefit pension plan, so he does not have to worry about large RRSP contributions. At the same time he will have about $10,000 to invest cach year and he is looking to cam the best return that he can. He considers himself a knowledgeable investor with a high risk tolerance level. Which of the following investments might he find attractive? 1 Investments in options and futures index funds. 2 Direct investments in oil and gas shares of Canadian Companies. 3 Strip bonds 4 A balanced mutual fund. (A) 1 and 2 only (B) 3 and 4 only (C) 2 and 3 only (D) 1 and 3 only 6. Winifred wants to invest $10,000 of her non-registered savings in a product that will pay her a steady stream of income with a relatively low level of risk. Which of the following types of investments will most likely satisfy Winifred's investment objective? 1 Common stock. 2 Preferred stock. 3 Treasury bills. 4 "C series" Canada Savings Bonds. 5 Government of Canada bonds. (A) 1, 2, 3, 4 and 5. (B) 2 and 5 only (C) 2 and 3 only. (D) 2 and 4 only 7. Nancy is considering investing in an individual variable insurance contract (IVIC) and she is researching the product features of various companies. In particular, she is interested in the kinds of fees and charges that a plan might levy on the funds in which she intends to invest. She has heard about frontend load funds, back-end load funds and no-load funds. She intends to invest $25,000 as a single sum in a non-registered IVIC and keep the investment in the plan for at least 10 years. Based on her intentions, what type of fees and charges should she consider? (A) The front-end load will charge her an annual fee on her deposit of 1% to 2% (B) The back-end load will levy a charge on any withdrawals of 5% at any time she makes her withdrawal. (C) A no-load fund will allow her investment to grow without any charges levied against it. (D) Fees or charges of some kind will diminish the investment returns on any of these plan types. Styles 8. Max and his financial advisor, John, are discussing Management Expense Ratios (MERS). Max, being a businessman, is very aware of keeping costs down. He wants to know all about the MERs of the various types of segregated fund investments offered by John's financial services company. Which of the following correctly states the reality regarding MERS? (A) Smaller (in asset size) funds generally have lower MERs than larger funds. (B) Equity funds generally have lower MERs than bond funds. (C) Large-cap equity funds generally have higher MERs than small-cap equity funds (D) Global funds generally have higher MERs than Canadian/domestic funds