Answered step by step

Verified Expert Solution

Question

1 Approved Answer

answer this only if you know plzzz. thank u Assume that the City of Coyote has already produced its financial statements for December 31, 2017,

answer this only if you know plzzz. thank u

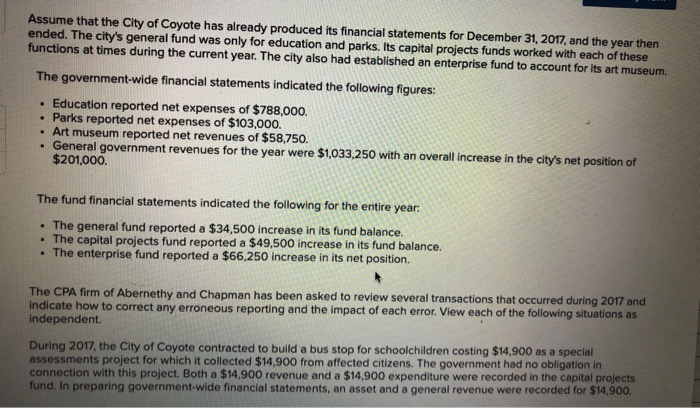

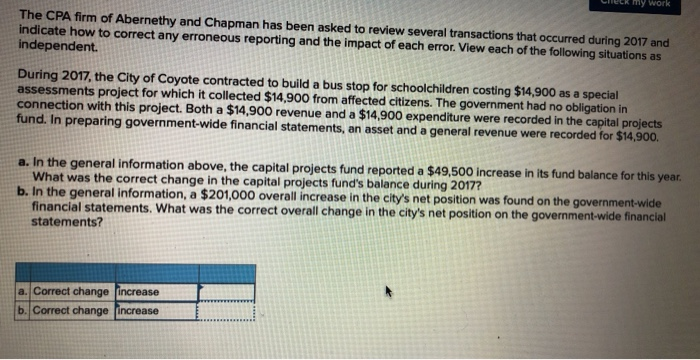

Assume that the City of Coyote has already produced its financial statements for December 31, 2017, and the year then ended. The city's general fund was only for education and parks. Its capital projects funds worked with each of these functions at times during the current year. The city also had established an enterprise fund to account for its art museum. The government-wide financial statements indicated the following figures: Education reported net expenses of $788,000. Parks reported net expenses of $103,000. . Art museum reported net revenues of $58,750. General government revenues for the year were $1,033,250 with an overall increase in the city's net position of $201,000. The fund financial statements indicated the following for the entire year. The general fund reported a $34,500 increase in its fund balance. The capital projects fund reported a $49,500 increase in its fund balance. The enterprise fund reported a $66,250 increase in its net position. The CPA firm of Abernethy and Chapman has been asked to review several transactions that occurred during 2017 and indicate how to correct any erroneous reporting and the impact of each error. View each of the following situations as independent During 2017, the City of Coyote contracted to build a bus stop for schoolchildren costing $14,900 as a special assessments project for which it collected $14,900 from affected citizens. The government had no obligation in connection with this project. Both a $14,900 revenue and a $14,900 expenditure were recorded in the capital projects fund. In preparing government-wide financial statements, an asset and a general revenue were recorded for $14,900. Ck my work The CPA firm of Abernethy and Chapman has been asked to review several transactions that occurred during 2017 and indicate how to correct any erroneous reporting and the impact of each error. View each of the following situations as independent. During 2017, the City of Coyote contracted to build a bus stop for schoolchildren costing $14,900 as a special assessments project for which it collected $14,900 from affected citizens. The government had no obligation in connection with this project. Both a $14,900 revenue and a $14,900 expenditure were recorded in the capital projects fund. In preparing government-wide financial statements, an asset and a general revenue were recorded for $14,900. a. In the general information above, the capital projects fund reported a $49,500 increase in its fund balance for this year. What was the correct change in the capital projects fund's balance during 2017? b. In the general information, a $201,000 overall increase in the city's net position was found on the government-wide financial statements. What was the correct overall change in the city's net position on the government-wide financial statements? a. Correct change increase b. Correct change increase Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started