Answered step by step

Verified Expert Solution

Question

1 Approved Answer

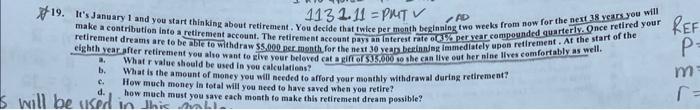

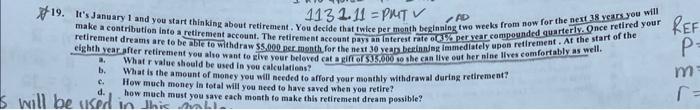

Answer this Time Value of Money question using the formula sheet provided and a regular calculator. 113111=PMT ou start thinking about retirement, You deelde that

Answer this Time Value of Money question using the formula sheet provided and a regular calculator.

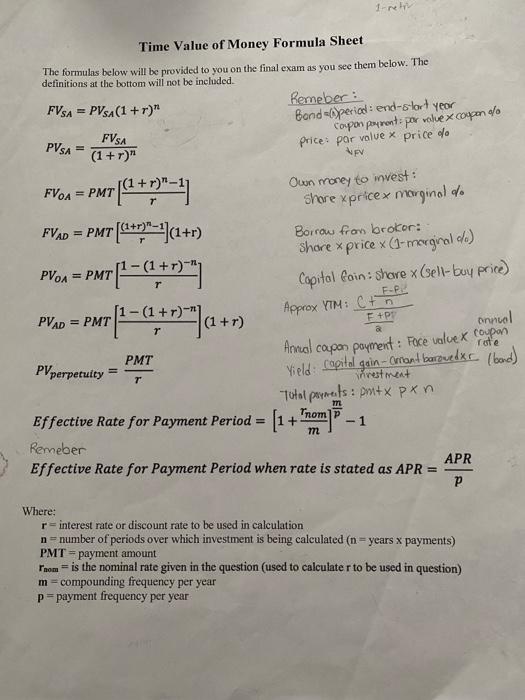

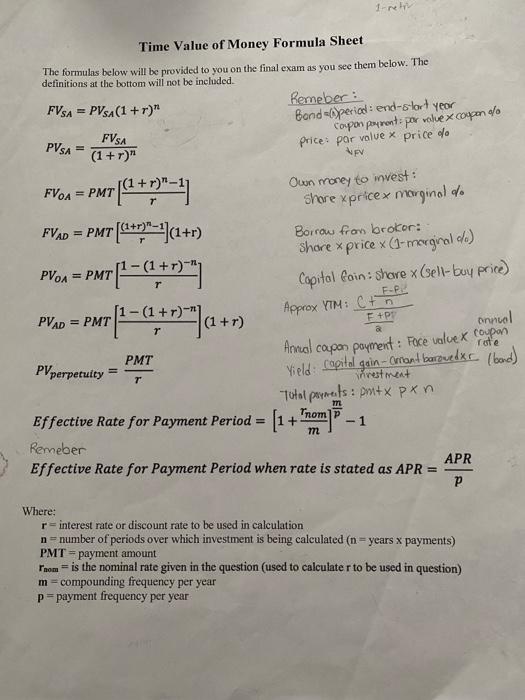

113111=PMT ou start thinking about retirement, You deelde that twice per month beginn - AD weeks from now for the next 38 vears you will make a contribution into a retirement account. The retiremest acceunt pays an Interest rate oCj\% per wear compounded quarterly. Qnce retired your a. What r value should be used in you calculatieas? b. What is the amount of money you will aceded to afford your nosthly withdrawal dering retirement? c. How much money in total will you need to have saved when you retire? d. how much mast you save each month to make this retirement dream possible? Time Value of Money Formula Sheet The formulas below will be provided to you on the final exam as you see them below. The definitions at the bottom will not be ineluded. FVSA=PVSA(1+r)nPVSA=(1+r)nFVSAFVOA=PMT[r(1+r)n1]FVAD=PMT[r(1+r)n1](1+r)PVOA=PMT[r1(1+r)n]PVAD=PMT[r1(1+r)n](1+r)PVperpetuity=rPMT Remeber: Bondali)periad: end-start year price: par value price % Own morey to invest: share eprice x margind % Borrow from brokor: Borrow from brokor: Share price (1-marginal /0) Capital Gain: share x (sell-buy price) Approx YTM: 2F+PYC+nFP onnual Amral capon poyment: Face value X coupon Yield: copital gain-criant barovedxr (bond) Total proveats: pm+xpn Effective Rate for Payment Period =[1+mrnom]pm1 Remeber Effective Rate for Payment Period when rate is stated as APR =pAPR Where; r= interest rate or discount rate to be used in calculation n= number of periods over which investment is being calculated ( n= years x payments) PMT = payment amount rnom= is the nominal rate given in the question (used to calculate r to be used in question) m= compounding frequency per year p= payment frequency per year 113111=PMT ou start thinking about retirement, You deelde that twice per month beginn - AD weeks from now for the next 38 vears you will make a contribution into a retirement account. The retiremest acceunt pays an Interest rate oCj\% per wear compounded quarterly. Qnce retired your a. What r value should be used in you calculatieas? b. What is the amount of money you will aceded to afford your nosthly withdrawal dering retirement? c. How much money in total will you need to have saved when you retire? d. how much mast you save each month to make this retirement dream possible? Time Value of Money Formula Sheet The formulas below will be provided to you on the final exam as you see them below. The definitions at the bottom will not be ineluded. FVSA=PVSA(1+r)nPVSA=(1+r)nFVSAFVOA=PMT[r(1+r)n1]FVAD=PMT[r(1+r)n1](1+r)PVOA=PMT[r1(1+r)n]PVAD=PMT[r1(1+r)n](1+r)PVperpetuity=rPMT Remeber: Bondali)periad: end-start year price: par value price % Own morey to invest: share eprice x margind % Borrow from brokor: Borrow from brokor: Share price (1-marginal /0) Capital Gain: share x (sell-buy price) Approx YTM: 2F+PYC+nFP onnual Amral capon poyment: Face value X coupon Yield: copital gain-criant barovedxr (bond) Total proveats: pm+xpn Effective Rate for Payment Period =[1+mrnom]pm1 Remeber Effective Rate for Payment Period when rate is stated as APR =pAPR Where; r= interest rate or discount rate to be used in calculation n= number of periods over which investment is being calculated ( n= years x payments) PMT = payment amount rnom= is the nominal rate given in the question (used to calculate r to be used in question) m= compounding frequency per year p= payment frequency per year

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started