Answered step by step

Verified Expert Solution

Question

1 Approved Answer

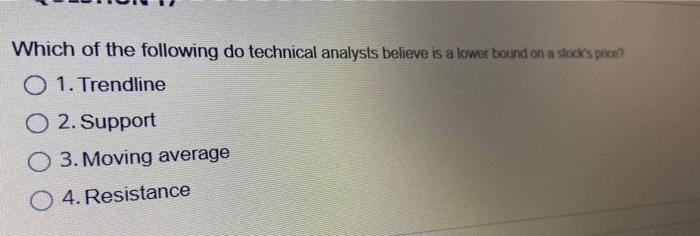

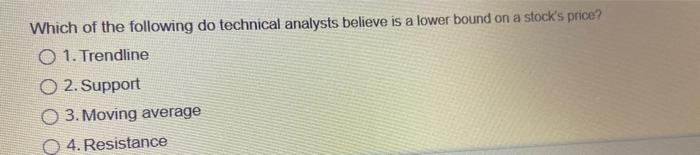

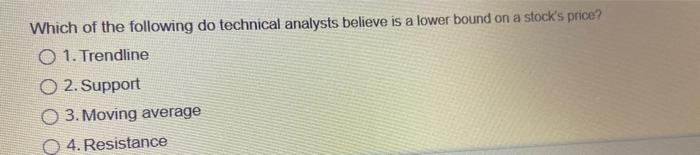

answer this Which of the following do technical analysts believe is a lower bound on a stock's prie? O 1. Trendline O 2. Support O

answer this

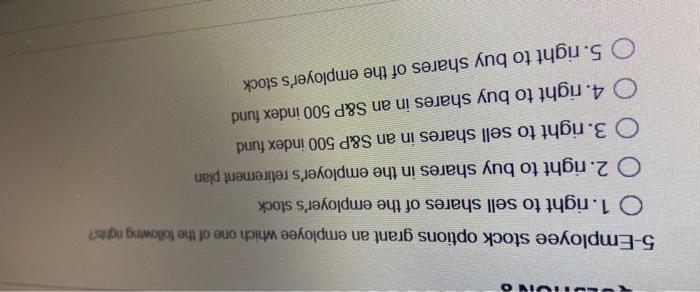

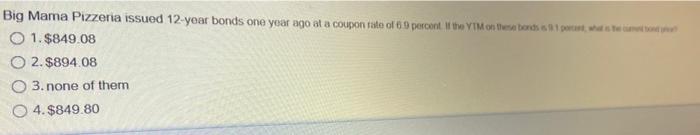

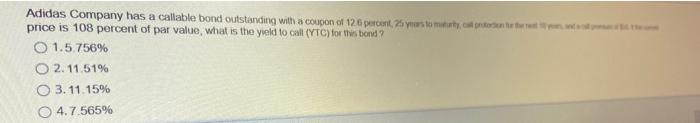

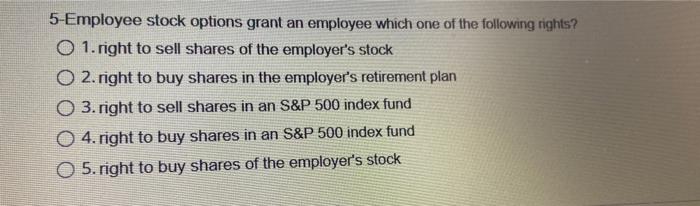

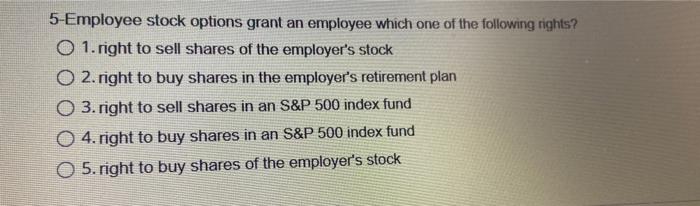

Which of the following do technical analysts believe is a lower bound on a stock's prie? O 1. Trendline O 2. Support O 3. Moving average 4. Resistance VIVO 5-Employee stock options grant an employee which one of the following rights? O 1. right to sell shares of the employer's stock O 2. right to buy shares in the employer's retirement plan O 3. right to sell shares in an S&P 500 index fund 4. right to buy shares in an S&P 500 index fund O 5. right to buy shares of the employer's stock Big Mama Pizzeria issued 12-year bonds one year ago at a coupon rate of 6.9 percent. If the Month percet, was rele O 1.$849.08 2. $894.08 O 3. none of them O 4.$849.80 Adidas Company has a callable bond outstanding with a coupon of 126 percent, 25 yearstomaton. price is 108 percent of par value, what is the yield to call (YTC) for this bond? O 1.5.756% O 2.11.51% O 3.11.15% 4.7.565% Which of the following do technical analysts believe is a lower bound on a stock's price? O 1. Trendline 2. Support O 3. Moving average 4. Resistance 5-Employee stock options grant an employee which one of the following rights? 1. right to sell shares of the employer's stock O 2. right to buy shares in the employer's retirement plan O 3. right to sell shares in an S&P 500 index fund 4. right to buy shares in an S&P 500 index fund O 5. right to buy shares of the employer's stock

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started