Answer to Question 2 (please explain in an easier way)

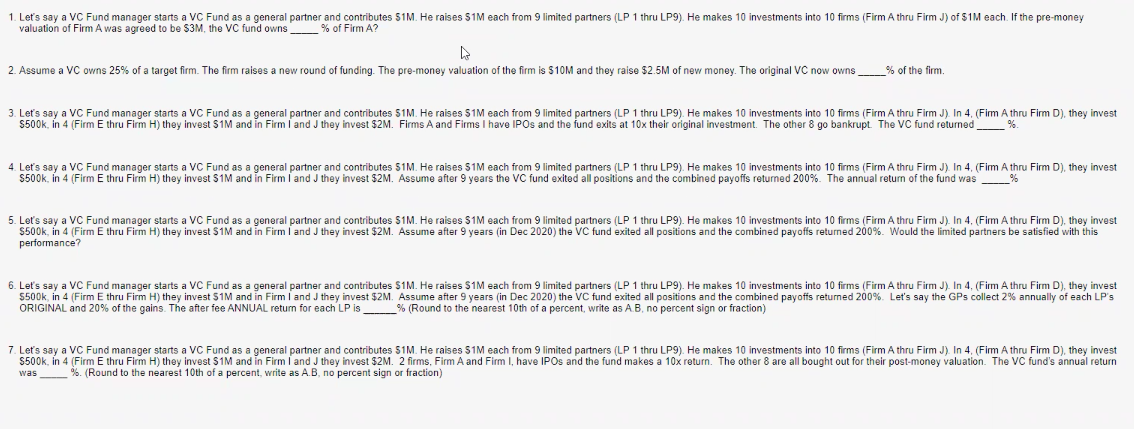

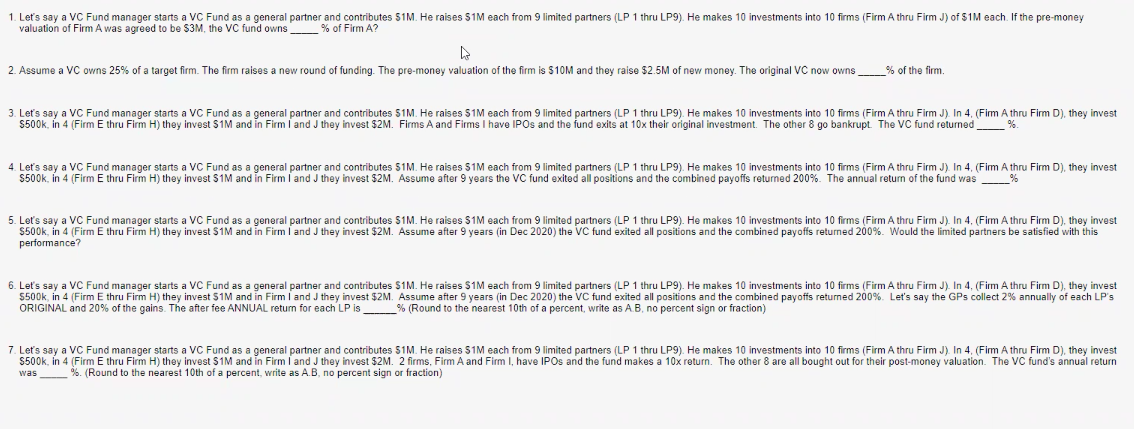

1. Let's say a VC Fund manager starts a VC Fund as a general partner and contributes 51M. He raises 51M each from 9 limited partners (LP 1 thru LP9). He makes 10 investments into 10 firms (Firm Athru Firm J) of $1M each. If the pre-money valuation of Firm A was agreed to be $3M, the VC fund owns % of Firm A? 2. Assume a VC owns 25% of a target firm. The firm raises a new round of funding. The pre-money valuation of the firm is $10M and they raise $2.5M of new money. The original VC now owns % of the firm 3. Let's say a VC Fund manager starts a VC Fund as a general partner and contributes 51M. He raises 51M each from 9 limited partners (LP 1 thru LP9). He makes 10 investments into 10 firms (Firm A thru Firm J). In 4. (Fim Athru Fim D), they invest $500k, in 4 (Firm E thru Firm H) they invest $1M and in Firm I and they invest $2M. Firms A and Firms I have IPOs and the fund exits at 10x their original investment. The other 8 go bankrupt. The VC fund returned__% 4. Let's say a VC Fund manager starts a VC Fund as a general partner and contributes 51M. He raises 51M each from 9 limited partners (LP 1 thru LP9). He makes 10 investments into 10 firms (Firm A thru Firm J). In 4. (Fim A thru Fim D), they invest S500k, in 4 (Firm E thru Firm H) they invest $1M and in Firm I and they invest $2M. Assume after 9 years the VC fund exited all positions and the combined payoffs returned 200%. The annual return of the fund was % 5. Let's say a VC Fund manager starts a VC Fund as a general partner and contributes 51M. He raises $1M each from 9 limited partners (LP 1 thru LP9). He makes 10 investments into 10 firms (Firm A thru Firm J). In 4, (Fim Athru Firm D)they invest $500k, in 4 (Firm E thru Firm H) they invest $1M and in Firm I and they invest $2M. Assume after 9 years (in Dec 2020) the VC fund exited all positions and the combined payoffs returned 200%. Would the limited partners be satisfied with this performance? 6. Let's say a VC Fund manager starts a VC Fund as a general partner and contributes $1M. He raises $1M each from 9 limited partners (LP 1 thru LP9). He makes 10 investments into 10 firms (Firm A thru Firm J). In 4. (Firm A thru Firm D), they invest 5500k, in 4 (Firm E thru Firm H) they invest $1M and in Firm I and they invest $2M. Assume after 9 years (in Dec 2020) the VC fund exited all positions and the combined payoffs returned 200%. Let's say the GPs collect 2% annually of each LP's ORIGINAL and 20% of the gains. The after fee ANNUAL return for each LP is _% (Round to the nearest 10th of a percent, write as A.B, no percent sign or fraction) 7. Let's say a VC Fund manager starts a VC Fund as a general partner and contributes 51M. He raises 51M each from 9 limited partners (LP 1 thru LP9). He makes 10 investments into 10 firms (Firm A thru Firm J). In 4. (Fimm Athru Fim D), they invest $500k, in 4 (Firm E thru Firm H) they invest S1M and in Firm I and J they invest $2M. 2 firms, Firm A and Firm I have IPOs and the fund makes a 10x return. The other 8 are all bought out for their post-money valuation. The VC fund's annual return %. (Round to the nearest 10th of a percent, write as A.B, no percent sign or fraction) was