Answered step by step

Verified Expert Solution

Question

1 Approved Answer

answer to those two exercise + quick explantions and do not use the debit and credit methode use like A= L+ SE ... please no

answer to those two exercise + quick explantions and do not use the debit and credit methode use like A= L+ SE ... please no handwritings

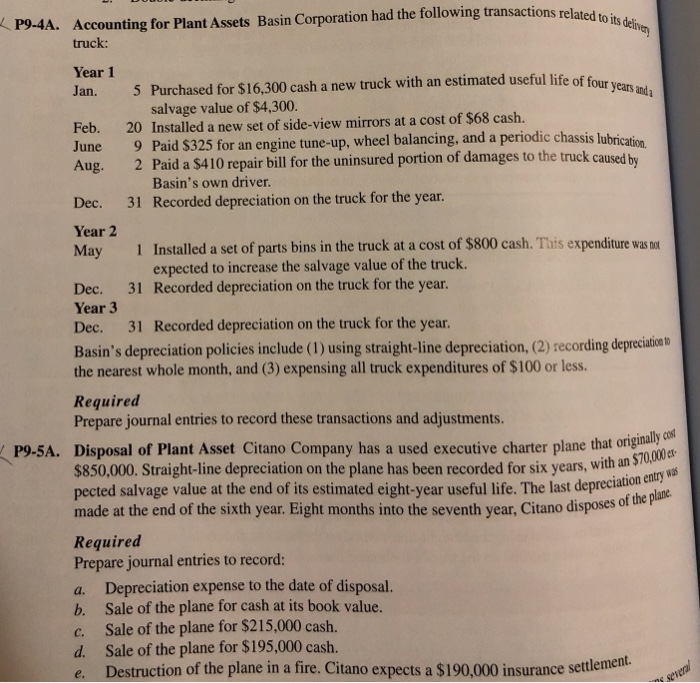

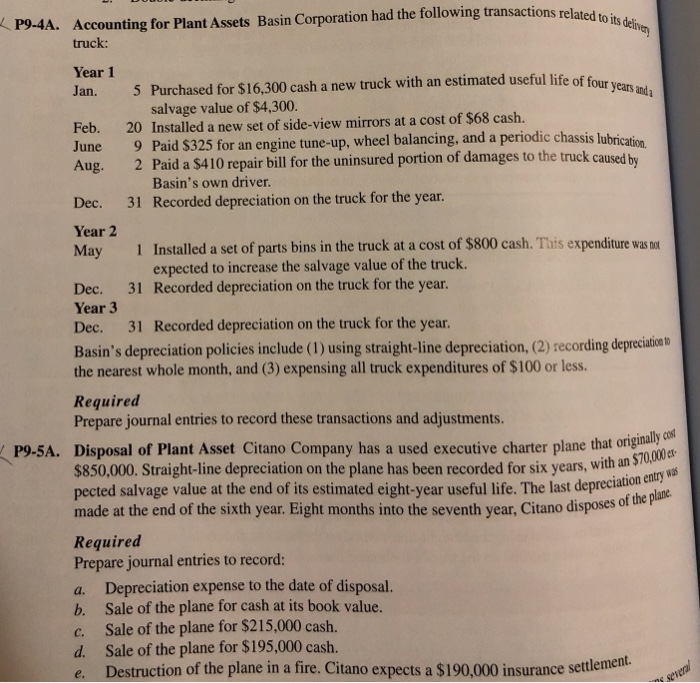

P9-4A. Accounting for Plant Assets Basin Corporation had the following transactions related ons related to it truck: Year 1 Jan. Feb. Aug. Purchased for $16,300 cash a new truck with an estimated useful life of four 5 20 2 31 salvage value of $4,300. Installed a new set of side-view mirrors at a cost of $68 cash. 25 for an engine tune-up, whel balancing, and a periodic chassis lubrica caused by Paid a $410 repair bill for the uninsured portion of damages to the truck ca Basin's own driver. Recorded depreciation on the truck for the year. Dec. Year 2 May Installed a set of parts bins in the truck at a cost of $800 cash. This expenditure was no expected to increase the salvage value of the truck. 1 Dec. 31 Recorded depreciation on the truck for the year. Year 3 Dec. 31 Recorded depreciation on the truck for the year. Basin's depreciation policies include (1) using straight-line depreciation, (2) recordingdepreition ation to the nearest whole month, and (3) expensing all truck expenditures of $100 or less. Required Prepare journal entries to record these transactions and adjustments. P9-5A. Disposal of Plant Asset Citano Company has a used executive charter plane that originally co $850,000. Straight-line depreciation on the plane has been recorded for six years, wi pected salvage value at the end of its estimated eight-year useful life. The last depreciation made at the end of the sixth year. Eight months into the seventh year, Citano disposes o rs, with an $70,00 a entry the plane Required Prepare journal entries to record: a. Depreciation expense to the date of disposal. b. Sale of the plane for cash at its book value. c. Sale of the plane for $215,000 cash. d. Sale of the plane for $195,000 cash. e. Destruction of the plane in a fire. Citano expects a $190,000 insurance settlemeit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started