Answered step by step

Verified Expert Solution

Question

1 Approved Answer

answer true or false. use second photo 11. The leverage factor will reduce the percentage loss to the investor if the stocks declines in price.

answer true or false.

use second photo

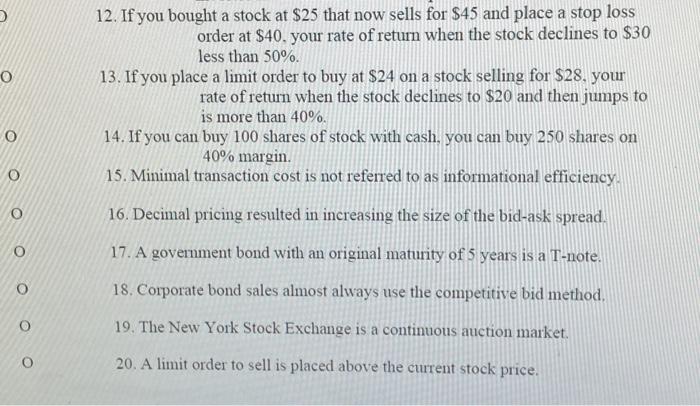

11. The leverage factor will reduce the percentage loss to the investor if the stocks declines in price. 12. If you bought a stock at $25 that now sells for $45 and place a stop loss order at $40, your rate of return when the stock declines to $ less than 50%. 13. If you place a limit order to buy at $24 on a stock selling for $28, your rate of return when the stock declines to $20 and then jumps is more than 40%. 14. If you can buy 100 shares of stock with cash, you can buy 250 shares or 40% margin. 15. Minimal transaction cost is not referred to as informational efficiency. 16. Decimal pricing resulted in increasing the size of the bid-ask spread. 17. A government bond with an original maturity of 5 years is a T-note. 18. Corporate bond sales almost always use the competitive bid method. 19. The New York Stock Exchange is a continuous auction market. 20. A limit order to sell is placed above the current stock price. o 12. If you bought a stock at $25 that now sells for $45 and place a stop loss order at $40. your rate of return when the stock declines to $30 less than 50%. 13. If you place a limit order to buy at $24 on a stock selling for $28. your rate of return when the stock declines to $20 and then jumps to is more than 40% 14. If you can buy 100 shares of stock with cash, you can buy 250 shares on 40% margin. 15. Minimal transaction cost is not referred to as informational efficiency O O 16. Decimal pricing resulted in increasing the size of the bid-ask spread. o 17. A government bond with an original maturity of 5 years is a T-note. O 18. Corporate bond sales almost always use the competitive bid method. 19. The New York Stock Exchange is a continuous auction market. O 20. A limit order to sell is placed above the current stock price Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started