Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Answer two separate questions a ) and b ) below. a) [10 marks] All Foods Market, Inc. has an obligation to pay its supplier $363,000

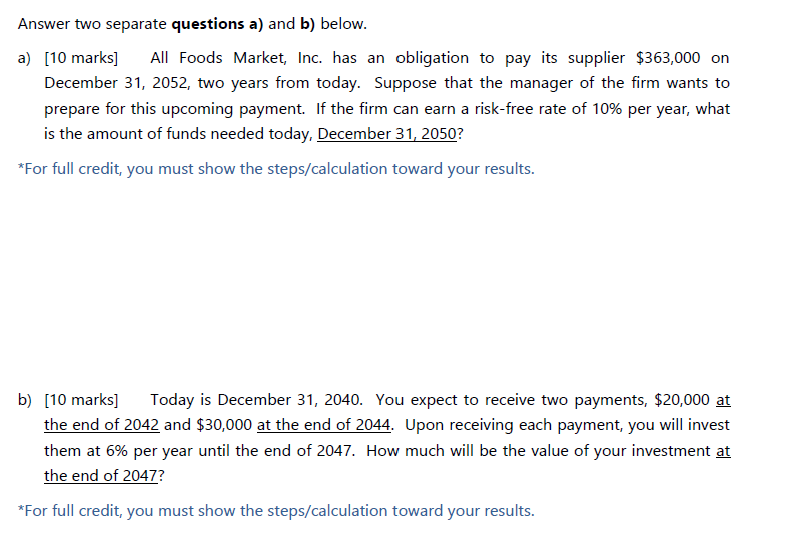

Answer two separate questions a ) and b ) below. a) [10 marks] All Foods Market, Inc. has an obligation to pay its supplier $363,000 on December 31, 2052, two years from today. Suppose that the manager of the firm wants to prepare for this upcoming payment. If the firm can earn a risk-free rate of 10% per year, what is the amount of funds needed today, December 31, 2050? For full credit, you must show the steps/calculation toward your results. b) [10 marks] Today is December 31, 2040. You expect to receive two payments, $20,000 at the end of 2042 and $30,000 at the end of 2044. Upon receiving each payment, you will invest them at 6% per year until the end of 2047 . How much will be the value of your investment at the end of 2047 ? *For full credit, you must show the steps/calculation toward your results

Answer two separate questions a ) and b ) below. a) [10 marks] All Foods Market, Inc. has an obligation to pay its supplier $363,000 on December 31, 2052, two years from today. Suppose that the manager of the firm wants to prepare for this upcoming payment. If the firm can earn a risk-free rate of 10% per year, what is the amount of funds needed today, December 31, 2050? For full credit, you must show the steps/calculation toward your results. b) [10 marks] Today is December 31, 2040. You expect to receive two payments, $20,000 at the end of 2042 and $30,000 at the end of 2044. Upon receiving each payment, you will invest them at 6% per year until the end of 2047 . How much will be the value of your investment at the end of 2047 ? *For full credit, you must show the steps/calculation toward your results Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started