Answer urgently please?

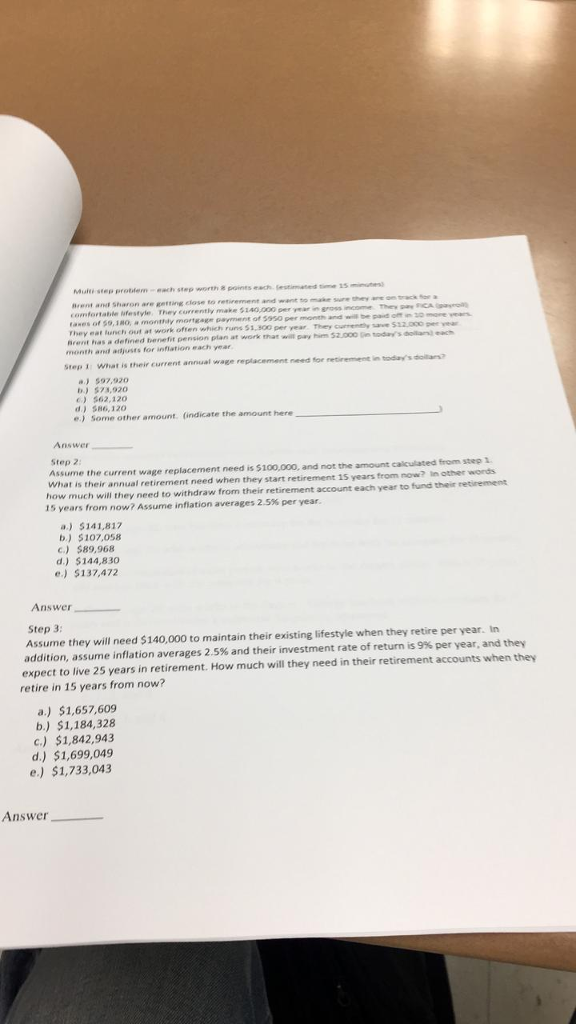

Misti step protbfem-each step worth 8 points each rent anE Sharon are getting close to retirement and want to make sure on track or a omfortatiet tases of 59,180, a monthdy mortag ayment of 5950 per month They eat lunch out at work often which uns 51,s00 per year Brent pvas detined bernervt pension plan at work that will pay him $2 000 n todas dollan each month ad adjusts for inflation each year Step I What is their current annual wage replacement need for a) 597,920 b) $73,920 c) $62,120 d.) S86,120 e.) Some other amount, (indicate the amount here Answer Step 2: how her annual replacemen how much will they need to withdraw from their retirement account ssume the current wage replacement need is 5100,000, and not the amount calculated from step 1 What is their annual retirement need when they start retirement 15 years from now? lin other words each year to fund their retirement 15 years from now? Assume inflation averages 2.5% per year a.) $141,817 b.) $107,0s8 C) $89,968 d.) $144,830 e.) $137,472 Answe Step 3: Assume they will need $140,000 to maintain their existing lifestyle when they retire per year. In addition, assume inflation averages 2.5% and their investment rate of return is 9% per year, and they expect to live 25 years in retirement. How much will they need in their retirement accounts when retire in 15 years from now? a.) $1,657,609 b) $1,184,328 c.) $1,842,943 d.) $1,699,049 e.) $1,733,043 Answer Misti step protbfem-each step worth 8 points each rent anE Sharon are getting close to retirement and want to make sure on track or a omfortatiet tases of 59,180, a monthdy mortag ayment of 5950 per month They eat lunch out at work often which uns 51,s00 per year Brent pvas detined bernervt pension plan at work that will pay him $2 000 n todas dollan each month ad adjusts for inflation each year Step I What is their current annual wage replacement need for a) 597,920 b) $73,920 c) $62,120 d.) S86,120 e.) Some other amount, (indicate the amount here Answer Step 2: how her annual replacemen how much will they need to withdraw from their retirement account ssume the current wage replacement need is 5100,000, and not the amount calculated from step 1 What is their annual retirement need when they start retirement 15 years from now? lin other words each year to fund their retirement 15 years from now? Assume inflation averages 2.5% per year a.) $141,817 b.) $107,0s8 C) $89,968 d.) $144,830 e.) $137,472 Answe Step 3: Assume they will need $140,000 to maintain their existing lifestyle when they retire per year. In addition, assume inflation averages 2.5% and their investment rate of return is 9% per year, and they expect to live 25 years in retirement. How much will they need in their retirement accounts when retire in 15 years from now? a.) $1,657,609 b) $1,184,328 c.) $1,842,943 d.) $1,699,049 e.) $1,733,043