Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Answer what is required. with solution. thankyou so much Prod Property Plant and equipment Inventory Trade receivables Trade payables Cash West Company disclosed the following

Answer what is required. with solution. thankyou so much

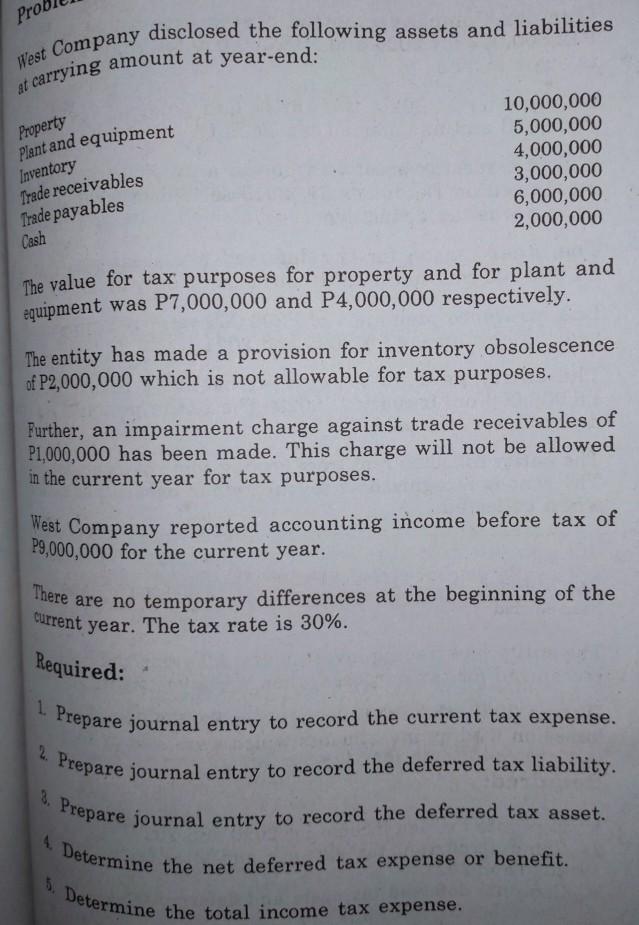

Prod Property Plant and equipment Inventory Trade receivables Trade payables Cash West Company disclosed the following assets and liabilities at carrying amount at year-end: current year. The tax rate is 30%. 1. Prepare journal entry to record the current tax expense. 2. Prepare journal entry to record the deferred tax liability. 2. Prepare journal entry to record the deferred tax asset. 4. Determine the net deferred tax expense or benefit. 5. Determine the total income tax expense. 10,000,000 5,000,000 4,000,000 3,000,000 6,000,000 2,000,000 The value for tax purposes for property and for plant and equipment was P7,000,000 and P4,000,000 respectively. The entity has made a provision for inventory obsolescence of P2,000,000 which is not allowable for tax purposes. Further, an impairment charge against trade receivables of P1,000,000 has been made. This charge will not be allowed in the current year for tax purposes. West Company reported accounting income before tax of P9,000,000 for the current year. There are no temporary differences at the beginning of the . RequiredStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started