Answered step by step

Verified Expert Solution

Question

1 Approved Answer

answer what you know ! its short question 6. At present, 20-year Treasury bonds are yielding 4.9% while some 20-year corporate bonds that you are

answer what you know ! its short question

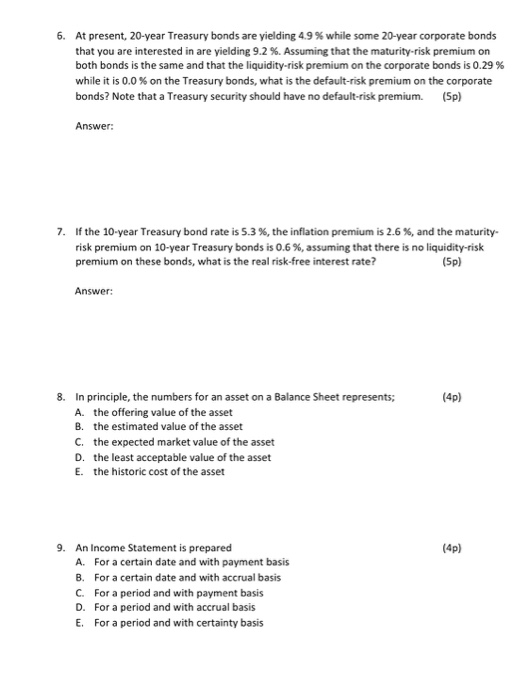

6. At present, 20-year Treasury bonds are yielding 4.9% while some 20-year corporate bonds that you are interested in are yielding 9.2 %. Assuming that the maturity-risk premium on both bonds is the same and that the liquidity-risk premium on the corporate bonds is 0.29% while it is 0.0% on the Treasury bonds, what is the default-risk premium on the corporate bonds? Note that a Treasury security should have no default-risk premium. (Sp) Answer: 7. If the 10-year Treasury bond rate is 5.3 %, the inflation premium is 2.6 %, and the maturity risk premium on 10-year Treasury bonds is 0.6 %, assuming that there is no liquidity risk premium on these bonds, what is the real risk-free interest rate? (5p) Answer: (4p) 8. In principle, the numbers for an asset on a Balance Sheet represents; A. the offering value of the asset B. the estimated value of the asset C. the expected market value of the asset D. the least acceptable value of the asset E. the historic cost of the asset (4p) 9. An Income Statement is prepared A. For a certain date and with payment basis B. For a certain date and with accrual basis C. For a period and with payment basis D. For a period and with accrual basis E. For a period and with certainty basis Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started