Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Answer with 4 decimals Consider three 5 year bonds; each bond has a face value of $100. All bonds mature on the same date. All

Answer with 4 decimals

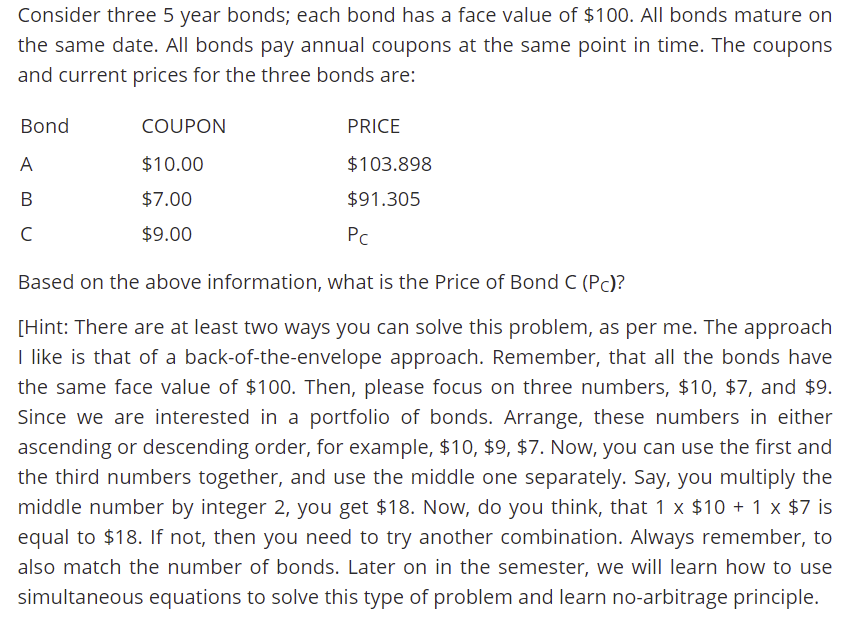

Consider three 5 year bonds; each bond has a face value of $100. All bonds mature on the same date. All bonds pay annual coupons at the same point in time. The coupons and current prices for the three bonds are: Bond COUPON PRICE A $10.00 $103.898 $91.305 B $7.00 $9.00 Pc Based on the above information, what is the price of Bond C (P)? [Hint: There are at least two ways you can solve this problem, as per me. The approach I like is that of a back-of-the-envelope approach. Remember, that all the bonds have the same face value of $100. Then, please focus on three numbers, $10, $7, and $9. Since we are interested in a portfolio of bonds. Arrange, these numbers in either ascending or descending order, for example, $10, $9, $7. Now, you can use the first and the third numbers together, and use the middle one separately. Say, you multiply the middle number by integer 2, you get $18. Now, do you think, that 1 x $10 + 1 x $7 is equal to $18. If not, then you need to try another combination. Always remember, to also match the number of bonds. Later on in the semester, we will learn how to use simultaneous equations to solve this type of problem and learn no-arbitrage principleStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started