Answered step by step

Verified Expert Solution

Question

1 Approved Answer

answer with necessary computation pls Luv Yah, vice president of LabDiscount Stores has decided which of the following fiove projects should be accepted by her

answer with necessary computation pls

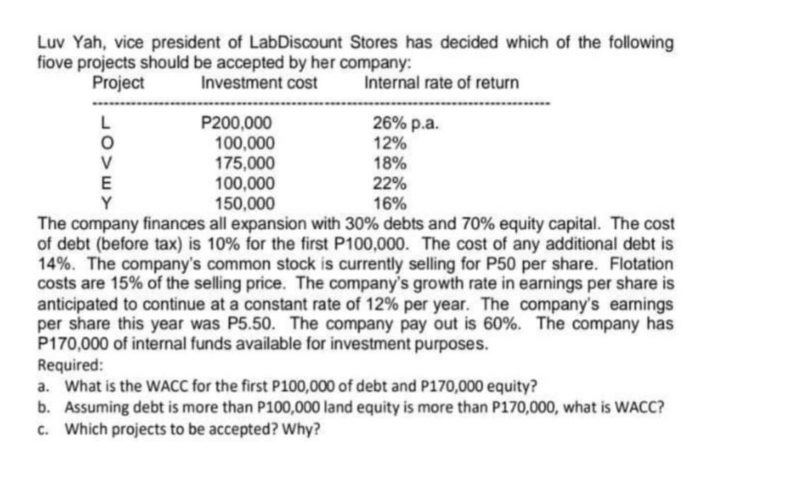

Luv Yah, vice president of LabDiscount Stores has decided which of the following fiove projects should be accepted by her company: The company finances all expansion with 30% debts and 70% equity capital. The cost of debt (before tax) is 10% for the first P100,000. The cost of any additional debt is 14%. The company's common stock is currently selling for P50 per share. Flotation costs are 15% of the selling price. The company's growth rate in earnings per share is anticipated to continue at a constant rate of 12% per year. The company's earnings per share this year was P5.50. The company pay out is 60%. The company has P170,000 of internal funds available for investment purposes. Required: a. What is the WACC for the first P100,000 of debt and P170,000 equity? b. Assuming debt is more than P100,000 land equity is more than P170,000, what is WACC? c. Which projects to be accepted? Why? Luv Yah, vice president of LabDiscount Stores has decided which of the following fiove projects should be accepted by her company: The company finances all expansion with 30% debts and 70% equity capital. The cost of debt (before tax) is 10% for the first P100,000. The cost of any additional debt is 14%. The company's common stock is currently selling for P50 per share. Flotation costs are 15% of the selling price. The company's growth rate in earnings per share is anticipated to continue at a constant rate of 12% per year. The company's earnings per share this year was P5.50. The company pay out is 60%. The company has P170,000 of internal funds available for investment purposes. Required: a. What is the WACC for the first P100,000 of debt and P170,000 equity? b. Assuming debt is more than P100,000 land equity is more than P170,000, what is WACC? c. Which projects to be accepted? WhyStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started