Answered step by step

Verified Expert Solution

Question

1 Approved Answer

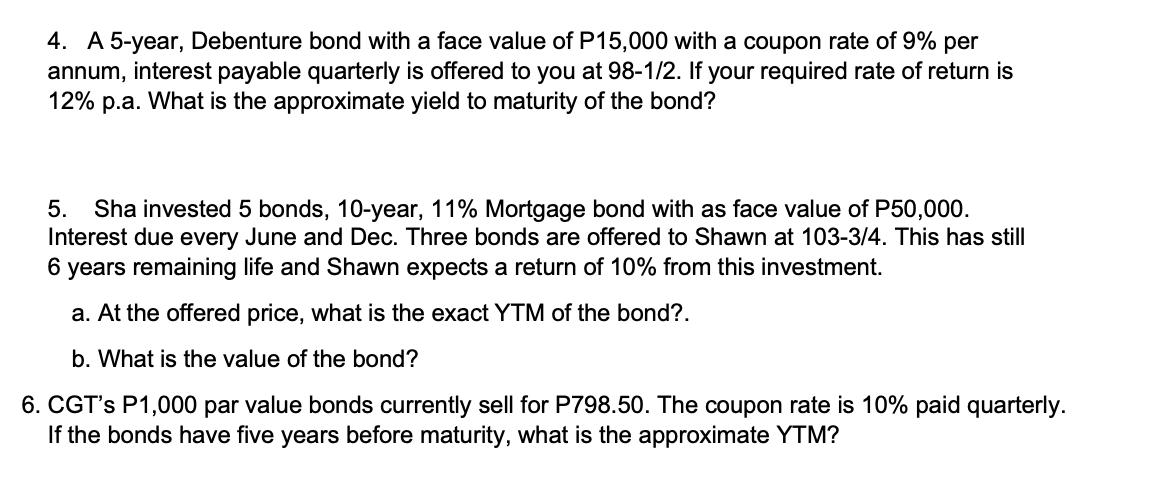

Answer with solution 4. A 5-year, Debenture bond with a face value of P15,000 with a coupon rate of 9% per annum, interest payable quarterly

Answer with solution

4. A 5-year, Debenture bond with a face value of P15,000 with a coupon rate of 9% per annum, interest payable quarterly is offered to you at 981/2. If your required rate of return is 12% p.a. What is the approximate yield to maturity of the bond? 5. Sha invested 5 bonds, 10-year, 11% Mortgage bond with as face value of P50,000. Interest due every June and Dec. Three bonds are offered to Shawn at 103-3/4. This has still 6 years remaining life and Shawn expects a return of 10% from this investment. a. At the offered price, what is the exact YTM of the bond?. b. What is the value of the bond? 5. CGT's P1,000 par value bonds currently sell for P798.50. The coupon rate is 10% paid quarterly If the bonds have five years before maturity, what is the approximate YTM

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started