Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Answer with solution pls 12. La Luna Papula has a beta of 1.20, the risk free rate of 5.5% and the required market return of

Answer with solution pls

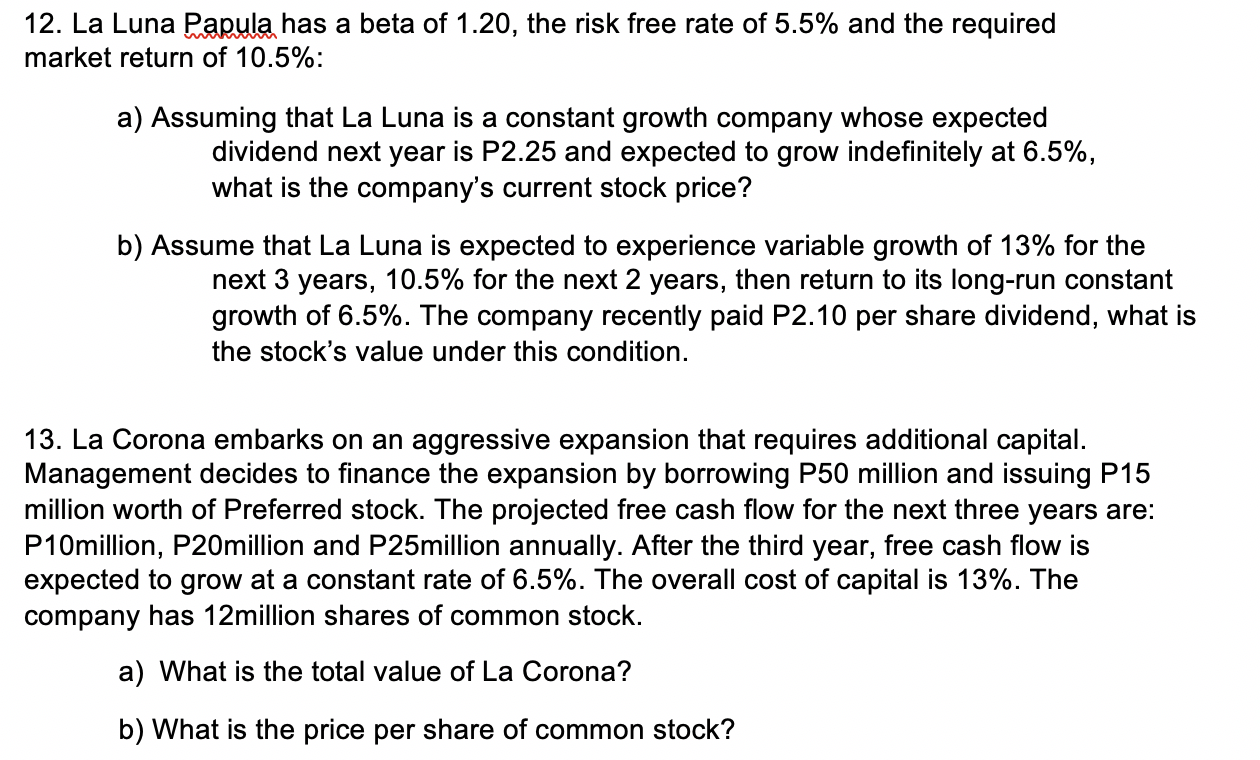

12. La Luna Papula has a beta of 1.20, the risk free rate of 5.5% and the required market return of 10.5% : a) Assuming that La Luna is a constant growth company whose expected dividend next year is P2.25 and expected to grow indefinitely at 6.5%, what is the company's current stock price? b) Assume that La Luna is expected to experience variable growth of 13% for the next 3 years, 10.5% for the next 2 years, then return to its long-run constant growth of 6.5%. The company recently paid P2.10 per share dividend, what is the stock's value under this condition. 13. La Corona embarks on an aggressive expansion that requires additional capital. Management decides to finance the expansion by borrowing P50 million and issuing P15 million worth of Preferred stock. The projected free cash flow for the next three years are: P10million, P20million and P25million annually. After the third year, free cash flow is expected to grow at a constant rate of 6.5%. The overall cost of capital is 13%. The company has 12 million shares of common stock. a) What is the total value of La Corona? b) What is the price per share of common stock? 12. La Luna Papula has a beta of 1.20, the risk free rate of 5.5% and the required market return of 10.5% : a) Assuming that La Luna is a constant growth company whose expected dividend next year is P2.25 and expected to grow indefinitely at 6.5%, what is the company's current stock price? b) Assume that La Luna is expected to experience variable growth of 13% for the next 3 years, 10.5% for the next 2 years, then return to its long-run constant growth of 6.5%. The company recently paid P2.10 per share dividend, what is the stock's value under this condition. 13. La Corona embarks on an aggressive expansion that requires additional capital. Management decides to finance the expansion by borrowing P50 million and issuing P15 million worth of Preferred stock. The projected free cash flow for the next three years are: P10million, P20million and P25million annually. After the third year, free cash flow is expected to grow at a constant rate of 6.5%. The overall cost of capital is 13%. The company has 12 million shares of common stock. a) What is the total value of La Corona? b) What is the price per share of common stockStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started