Answered step by step

Verified Expert Solution

Question

1 Approved Answer

answer with solution pls 5. The Global Advertising Company has a tax rate of 30%. The company can raise debt at a 12% interest rate

answer with solution pls

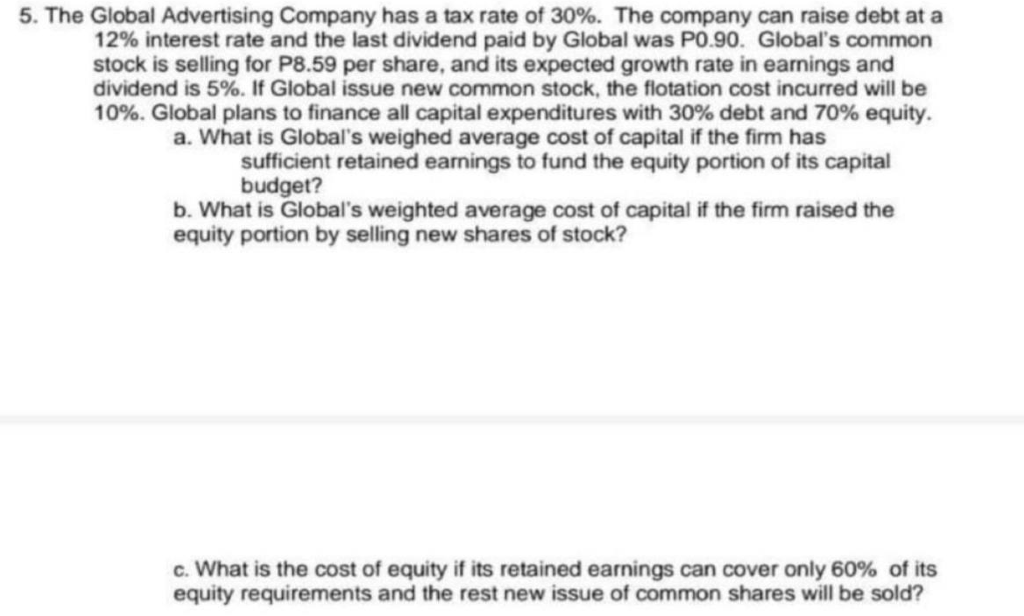

5. The Global Advertising Company has a tax rate of 30%. The company can raise debt at a 12% interest rate and the last dividend paid by Global was P0.90. Global's common stock is selling for P8.59 per share, and its expected growth rate in earnings and dividend is 5%. If Global issue new common stock, the flotation cost incurred will be 10%. Global plans to finance all capital expenditures with 30% debt and 70% equity. a. What is Global's weighed average cost of capital if the firm has sufficient retained earnings to fund the equity portion of its capital budget? b. What is Global's weighted average cost of capital if the firm raised the equity portion by selling new shares of stock? c. What is the cost of equity if its retained earnings can cover only 60% of its equity requirements and the rest new issue of common shares will be soldStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started