answer within 20 minutes for garunteed upvote!

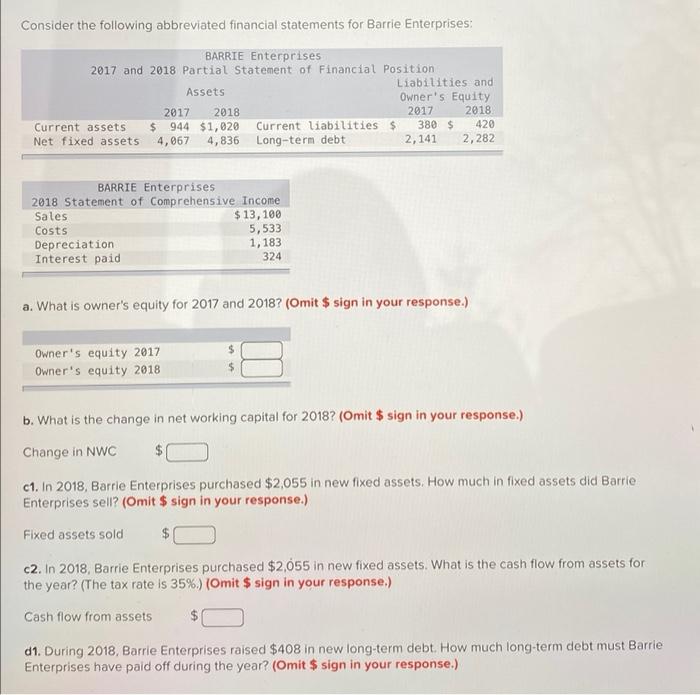

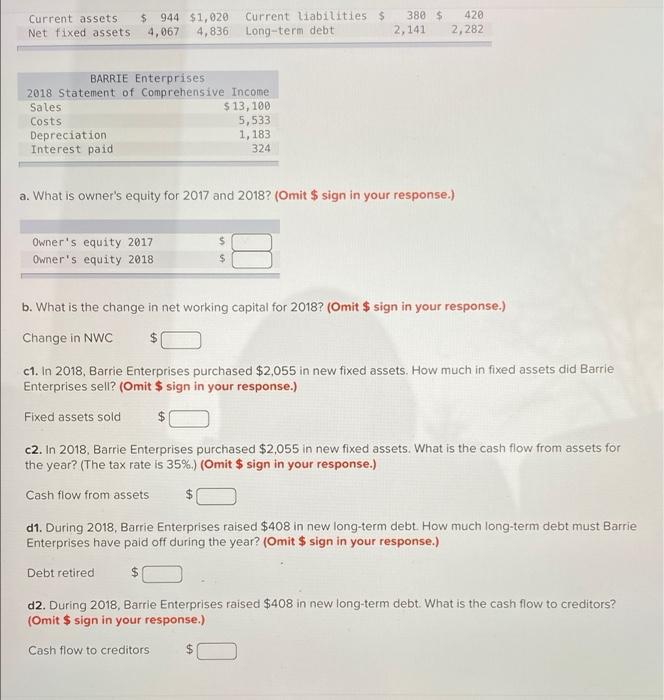

Consider the following abbreviated financial statements for Barrie Enterprises: BARRIE Enterprises 2017 and 2018 Partial Statement of Financial Position Liabilities and Assets Owner's Equity 2017 2018 2017 2018 Current assets $ 944 $1,020 Current liabilities $ 380 $ 420 Net fixed assets 4,067 4,836 Long-term debt 2,141 2,282 BARRIE Enterprises 2018 Statement of Comprehensive Income Sales $ 13, 108 Costs 5,533 Depreciation 1,183 Interest paid 324 a. What is owner's equity for 2017 and 2018? (Omit $ sign in your response.) Owner's equity 2017 Owner's equity 2018 $ b. What is the change in net working capital for 2018? (Omit $ sign in your response.) Change in NWC c1. In 2018, Barrie Enterprises purchased $2,055 in new fixed assets. How much in fixed assets did Barrie Enterprises sell? (Omit $ sign in your response.) Fixed assets sold $ c2. In 2018, Barrie Enterprises purchased $2,055 in new fixed assets. What is the cash flow from assets for the year? (The tax rate is 35%) (Omit $ sign in your response.) Cash flow from assets d1. During 2018, Barrie Enterprises raised $408 in new long-term debt. How much long-term debt must Barrie Enterprises have paid off during the year? (Omit $ sign in your response.) Current assets Net fixed assets $ 944 $1,020 Current liabilities $ 4,067 4,836 Long-term debt 380 $ 2,141 420 2,282 BARRIE Enterprises 2018 Statement of Comprehensive Income Sales $ 13, 100 Costs 5,533 Depreciation 1,183 Interest paid 324 a. What is owner's equity for 2017 and 2018? (Omit $ sign in your response.) $ Owner's equity 2017 Owner's equity 2018 b. What is the change in net working capital for 2018? (Omit $ sign in your response.) Change in NWC C1. In 2018, Barrie Enterprises purchased $2,055 in new fixed assets. How much in fixed assets did Barrie Enterprises sell? (Omit $ sign in your response.) Fixed assets sold c2. In 2018, Barrie Enterprises purchased $2,055 in new fixed assets. What is the cash flow from assets for the year? (The tax rate is 35%) (Omit $ sign in your response.) Cash flow from assets $ d1. During 2018, Barrie Enterprises raised $408 in new long-term debt. How much long-term debt must Barrie Enterprises have paid off during the year? (Omit $ sign in your response.) Debt retired d2. During 2018, Barrle Enterprises raised $408 in new long-term debt. What is the cash flow to creditors? (Omit $ sign in your response.) Cash flow to creditors $