Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Answers: 1) cash flow in each year = 318 incremental cash flow in year 2= 198 incremental cash flow in year 5=438 Answer for 2)

Answers: 1) cash flow in each year = 318 incremental cash flow in year 2= 198 incremental cash flow in year 5=438

Answer for 2) NPV= $267.80

Answers are provided but I'm not sure how to solve. Please show all steps and calculations so I can fully understand how to solve. thank you!

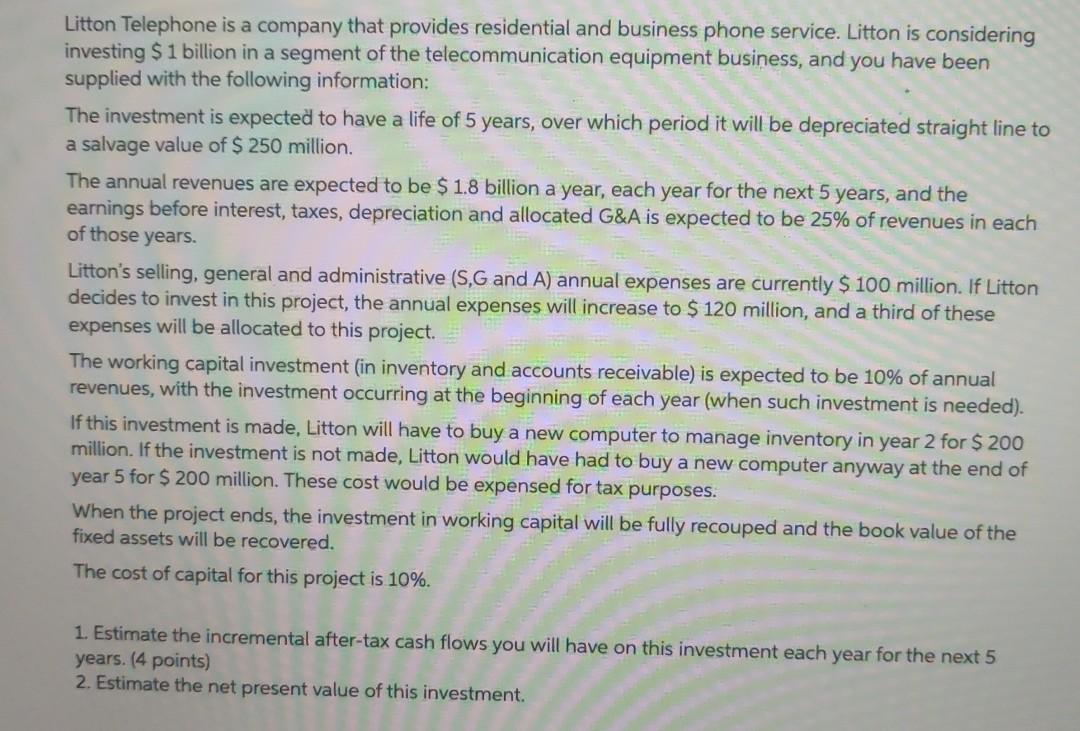

Litton Telephone is a company that provides residential and business phone service. Litton is considering investing $ 1 billion in a segment of the telecommunication equipment business, and you have been supplied with the following information: The investment is expected to have a life of 5 years, over which period it will be depreciated straight line to a salvage value of $ 250 million. The annual revenues are expected to be $ 1.8 billion a year, each year for the next 5 years, and the earnings before interest, taxes, depreciation and allocated G&A is expected to be 25% of revenues in each of those years. Litton's selling, general and administrative (S,G and A) annual expenses are currently $ 100 million. If Litton decides to invest in this project, the annual expenses will increase to $ 120 million, and a third of these expenses will be allocated to this project. The working capital investment (in inventory and accounts receivable) is expected to be 10% of annual revenues, with the investment occurring at the beginning of each year (when such investment is needed). If this investment is made, Litton will have to buy a new computer to manage inventory in year 2 for $ 200 2 million. If the investment is not made, Litton would have had to buy a new computer anyway at the end of year 5 for $ 200 million. These cost would be expensed for tax purposes. When the project ends, the investment in working capital will be fully recouped and the book value of the fixed assets will be recovered. The cost of capital for this project is 10%. 1. Estimate the incremental after-tax cash flows you will have on this investment each year for the next 5 years. (4 points) 2. Estimate the net present value of this investmentStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started