Answered step by step

Verified Expert Solution

Question

1 Approved Answer

answers? 15- if a bank has 200S million in deposits, the required reserve ratio is 20%, the required reserves the banks must hold a. 10

answers?

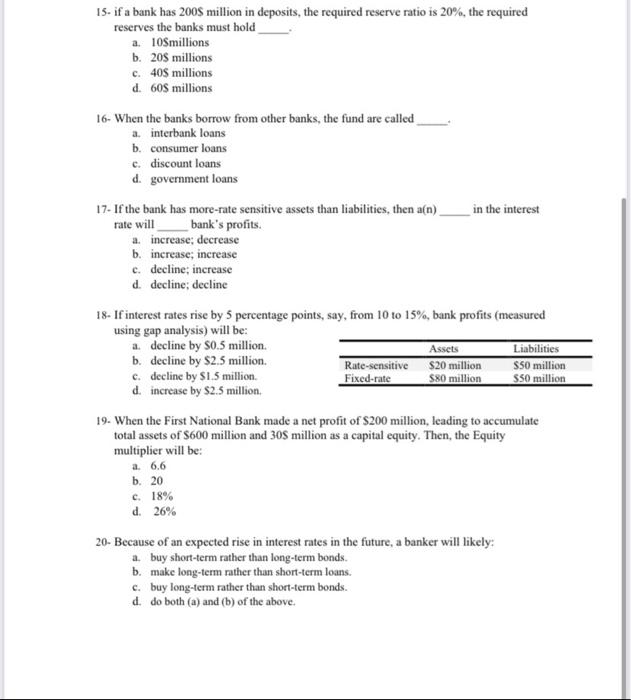

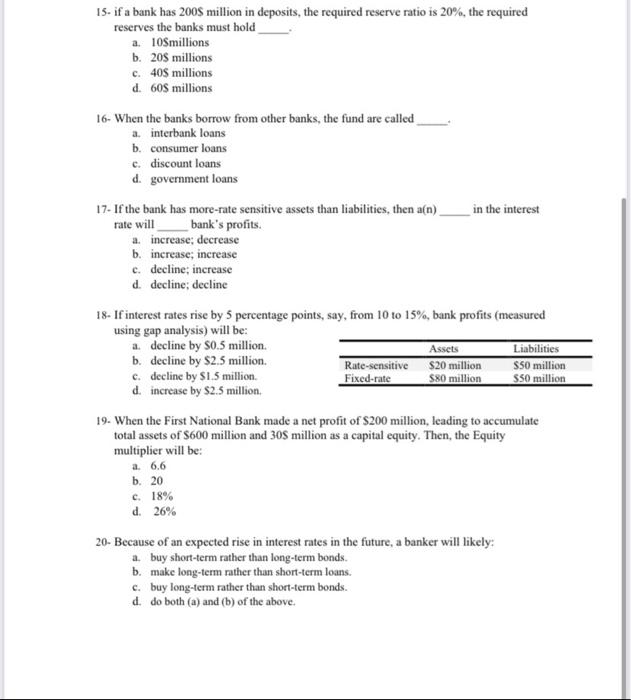

15- if a bank has 200S million in deposits, the required reserve ratio is 20%, the required reserves the banks must hold a. 10 millions b. 205 millions c. 405 millions d. 605 millions 16- When the banks borrow from other banks, the fund are called a. interbank loans b. consumer loans c. discount loans d. government loans 17. If the bank has more-rate sensitive assets than liabilities, then a(n) in the interest rate will bank's profits. a. increase; decrease b. increase; increase c. decline; increase d. decline; decline 18- If interest rates rise by 5 percentage points, say, from 10 to 15%, bank profits (measured using gap analysis) will be: a. decline by $0.5 million. b. decline by $2.5 million. c. decline by $1.5 million. d. increase by $2.5 million. \begin{tabular}{lll} \hline & Assets & Liabilities \\ \hline Rate-sensitive & $20 million & $50 million \\ Fixed-rate & $80 million & $50 million \\ \hline \end{tabular} 19. When the First National Bank made a net profit of $200 million, leading to accumulate total assets of $600 million and 305 million as a capital equity. Then, the Equity multiplier will be: a. 6.6 b. 20 c. 18% d. 26% 20- Because of an expected rise in interest rates in the future, a banker will likely: a. buy short-term rather than long-term bonds. b. make long-term rather than short-term loans. c. buy long-term rather than short-term bonds. d. do both (a) and (b) of the above

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started