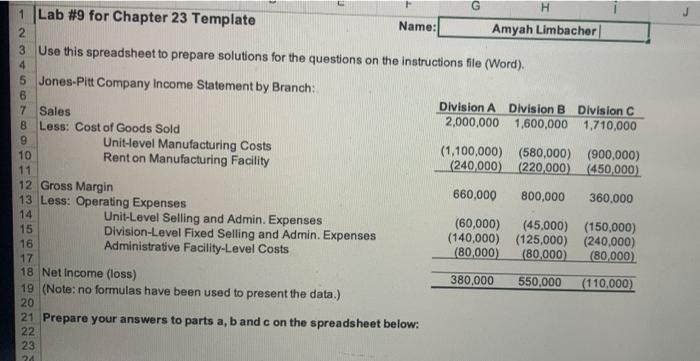

answers and workings to A, B, and C using provided information

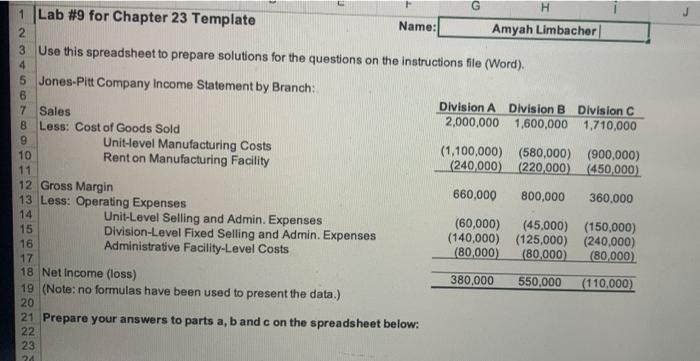

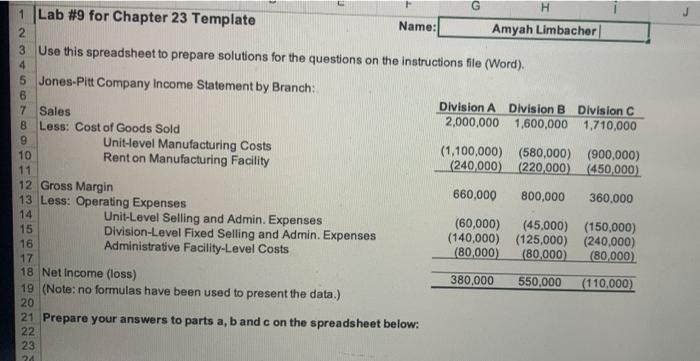

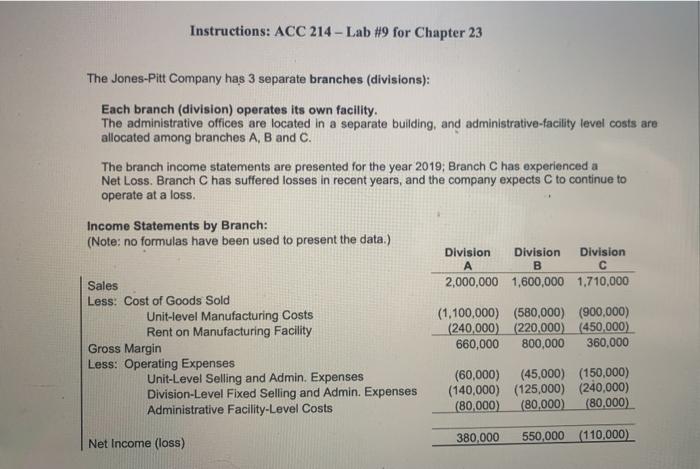

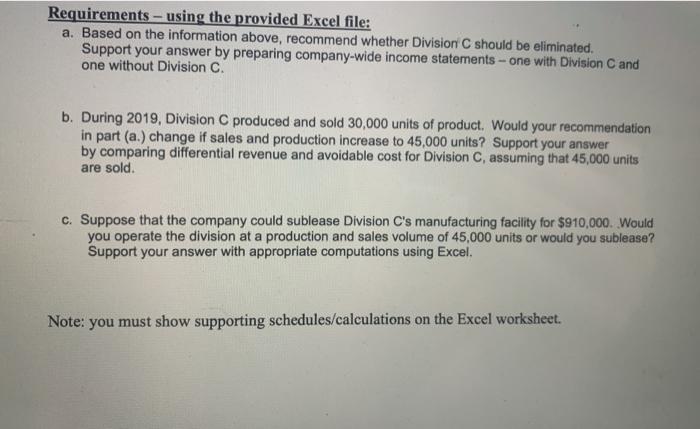

1 Lab #9 for Chapter 23 Template Name: Amyah Limbacher 2 3 Use this spreadsheet to prepare solutions for the questions on the instructions file (Word) 4 5 Jones-Pitt Company Income Statement by Branch: 6 Division A Division B Division C 7 Sales 2,000,000 1,600,000 1,710,000 8 Less: Cost of Goods Sold 9 Unit-level Manufacturing Costs (1,100,000) (580,000) (900,000) 10 Renton Manufacturing Facility (240,000) (220,000) (450,000) 11 12 Gross Margin 660,000 800,000 360,000 13 Less: Operating Expenses 14 Unit-Level Selling and Admin. Expenses (60,000) (45,000) (150,000) 15 Division-Level Fixed Selling and Admin. Expenses (140,000) (125,000) (240,000) 16 Administrative Facility-Level Costs (80,000) (80,000) (80,000) 18 Net Income (loss) 380,000 550,000 (110,000) 19 (Note: no formulas have been used to present the data.) 21 Prepare your answers to parts a, b and c on the spreadsheet below: 22 23 24 Instructions: ACC 214 - Lab #9 for Chapter 23 The Jones-Pitt Company has 3 separate branches (divisions): Each branch (division) operates its own facility. The administrative offices are located in a separate building, and administrative-facility level costs are allocated among branches A, B and C. The branch income statements are presented for the year 2019; Branch C has experienced a Net Loss. Branch C has suffered losses in recent years, and the company expects to continue to operate at a loss Income Statements by Branch: (Note: no formulas have been used to present the data.) Division Division Division A B C 2,000,000 1,600,000 1,710,000 Sales Less: Cost of Goods Sold Unit-level Manufacturing Costs Rent on Manufacturing Facility Gross Margin Less: Operating Expenses Unit-Level Selling and Admin. Expenses Division-Level Fixed Selling and Admin. Expenses Administrative Facility-Level Costs (1,100,000) (580,000) (900,000) (240,000) (220.000) (450,000) 660,000 800,000 360,000 (60,000) (45,000) (150,000) (140,000) (125,000) (240,000) (80,000) (80,000) (80,000) Net Income (loss) 380,000 550,000 (110,000) Requirements - using the provided Excel file: a. Based on the information above, recommend whether Division C should be eliminated. Support your answer by preparing company-wide income statements - one with Division C and one without Division C. b. During 2019, Division produced and sold 30,000 units of product. Would your recommendation in part (a.) change if sales and production increase to 45,000 units ? Support your answer by comparing differential revenue and avoidable cost for Division C, assuming that 45,000 units are sold. c. Suppose that the company could sublease Division C's manufacturing facility for $910,000. Would you operate the division at a production and sales volume of 45,000 units or would you sublease? Support your answer with appropriate computations using Excel. Note: you must show supporting schedules/calculations on the Excel worksheet