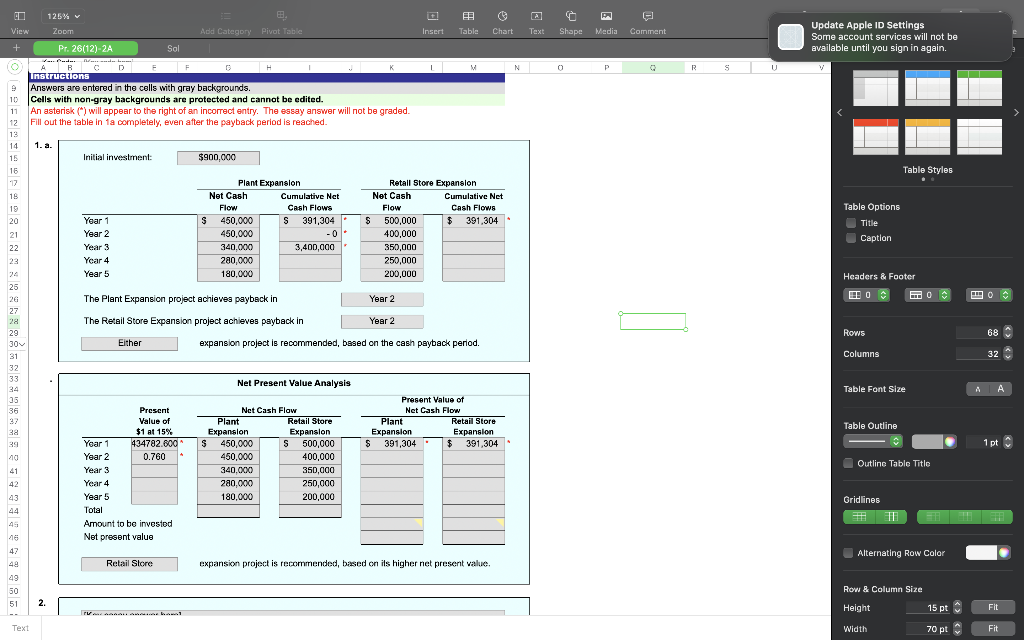

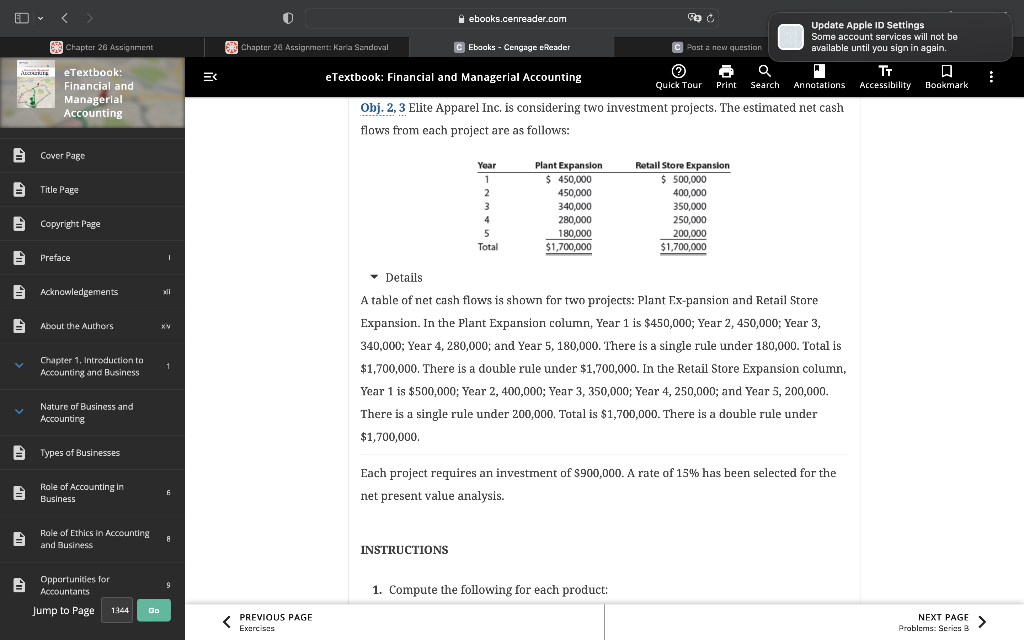

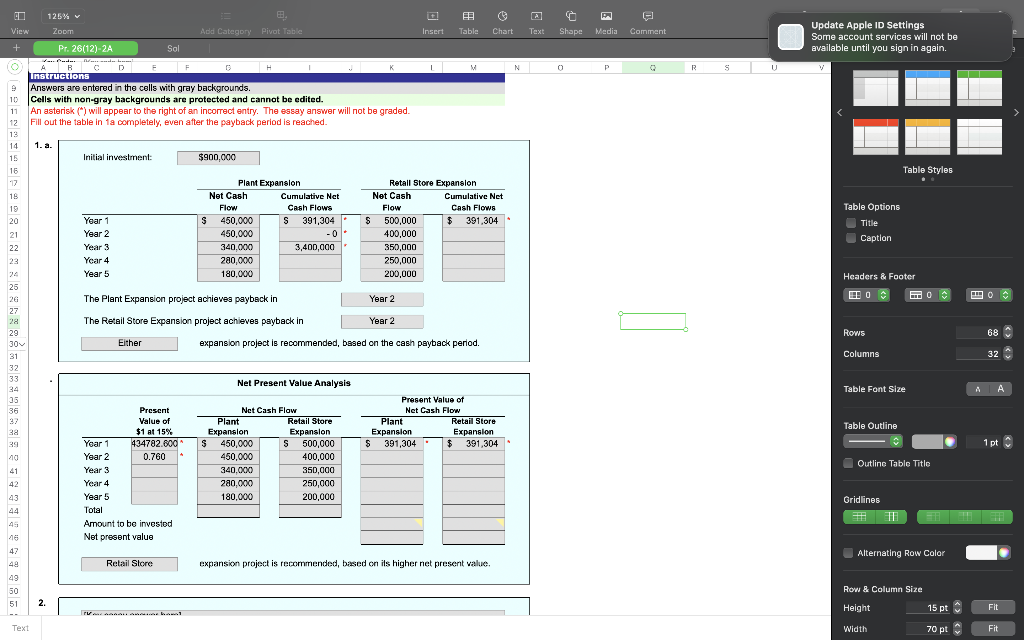

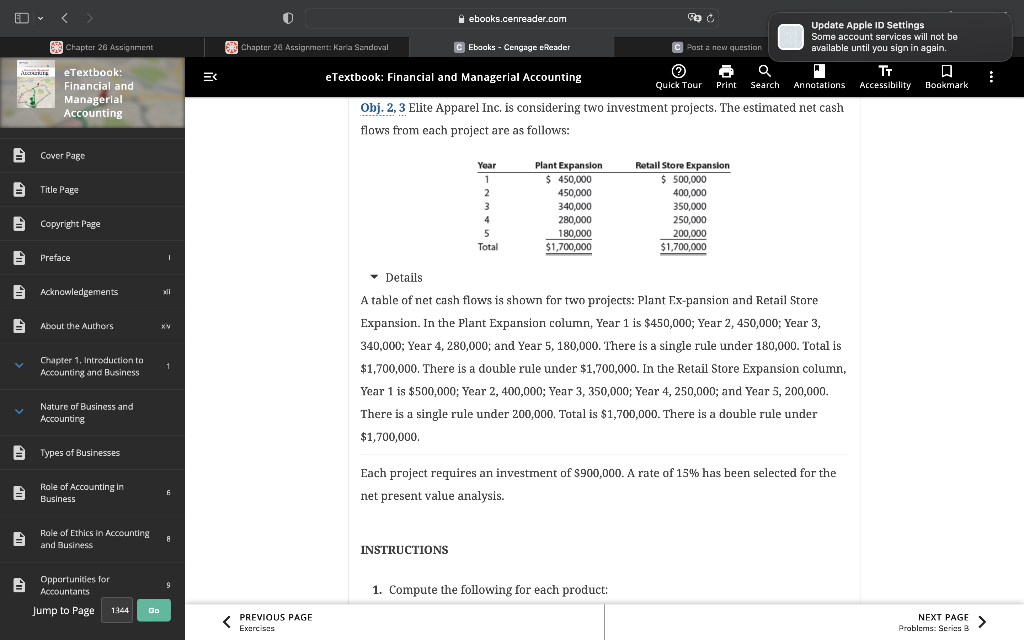

Answers ane entered in the cells with gray backgrounds. Cells with non-gray backgrounds are protected and cannot be edited. An asterisk (") will appear to the right of an incorrect entry. The essay answer will not be graded. Fill out the table in 1 a completely, even after the payback period is reached. 1. . Initial investment: expansion project is recommended, based on the cash payback period. Obj. 2, 3 Elite Apparel Inc. is considering two investment projects. The estimated net cash flows from each project are as follows: Details A table of net cash flows is shown for two projects: Plant Ex-pansion and Retail Store Expansion. In the Plant Expansion column, Year 1 is $450,000; Year 2, 450,000; Year 3 , 340,000 ; Year 4, 280,000; and Year 5, 180,000. There is a single rule under 180,000. Total is $1,700,000. There is a double rule under $1,700,000. In the Retail Store Expansion column, Year 1 is $500,000; Year 2, 400,000; Year 3, 350,000; Year 4, 250,000; and Year 5, 200,000. There is a single rule under 200,000 . Total is $1,700,000. There is a double rule under $1,700,000. Each project requires an investment of $900,000. A rate of 15% has been selected for the net present value analysis. INSTRUCTIONS 1. Compute the following for each product: $1,700,000. There is a double rule under $1,700,000. In the Retail Store Expansion column, Year 1 is $500,000; Year 2, 400,000; Year 3, 350,000; Year 4, 250,000; and Year 5, 200,000. There is a single rule under 200,000 . Total is $1,700,000. There is a double rule under $1,700,000. Each project requires an investment of $900,000. A rate of 15% has been selected for the net present value analysis. INSTRUCTIONS 1. Compute the following for each product: a. Cash payback period. b. The net present value. Use the present value table appearing in Exhibit 2 of this chapter. 2. Prepare a brief report advising management on the relative merits of each project. Answers ane entered in the cells with gray backgrounds. Cells with non-gray backgrounds are protected and cannot be edited. An asterisk (") will appear to the right of an incorrect entry. The essay answer will not be graded. Fill out the table in 1 a completely, even after the payback period is reached. 1. . Initial investment: expansion project is recommended, based on the cash payback period. Obj. 2, 3 Elite Apparel Inc. is considering two investment projects. The estimated net cash flows from each project are as follows: Details A table of net cash flows is shown for two projects: Plant Ex-pansion and Retail Store Expansion. In the Plant Expansion column, Year 1 is $450,000; Year 2, 450,000; Year 3 , 340,000 ; Year 4, 280,000; and Year 5, 180,000. There is a single rule under 180,000. Total is $1,700,000. There is a double rule under $1,700,000. In the Retail Store Expansion column, Year 1 is $500,000; Year 2, 400,000; Year 3, 350,000; Year 4, 250,000; and Year 5, 200,000. There is a single rule under 200,000 . Total is $1,700,000. There is a double rule under $1,700,000. Each project requires an investment of $900,000. A rate of 15% has been selected for the net present value analysis. INSTRUCTIONS 1. Compute the following for each product: $1,700,000. There is a double rule under $1,700,000. In the Retail Store Expansion column, Year 1 is $500,000; Year 2, 400,000; Year 3, 350,000; Year 4, 250,000; and Year 5, 200,000. There is a single rule under 200,000 . Total is $1,700,000. There is a double rule under $1,700,000. Each project requires an investment of $900,000. A rate of 15% has been selected for the net present value analysis. INSTRUCTIONS 1. Compute the following for each product: a. Cash payback period. b. The net present value. Use the present value table appearing in Exhibit 2 of this chapter. 2. Prepare a brief report advising management on the relative merits of each project