Answers are in bold, I just need the explanation!

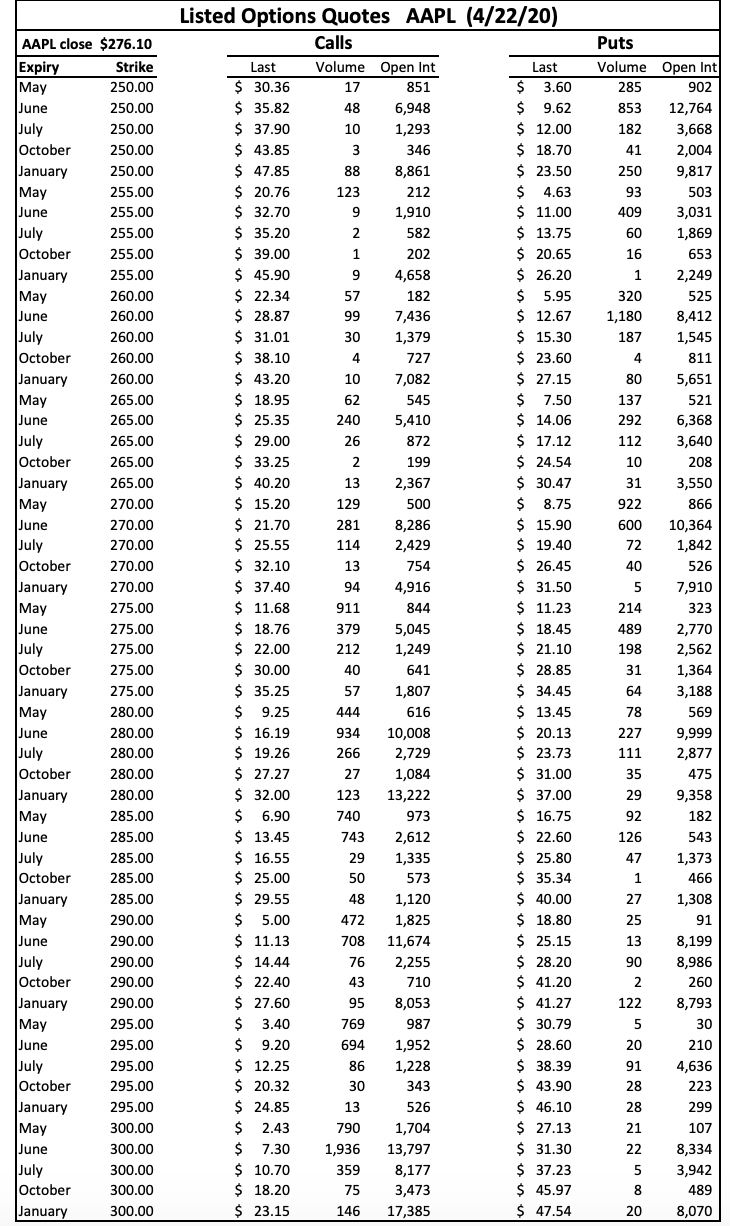

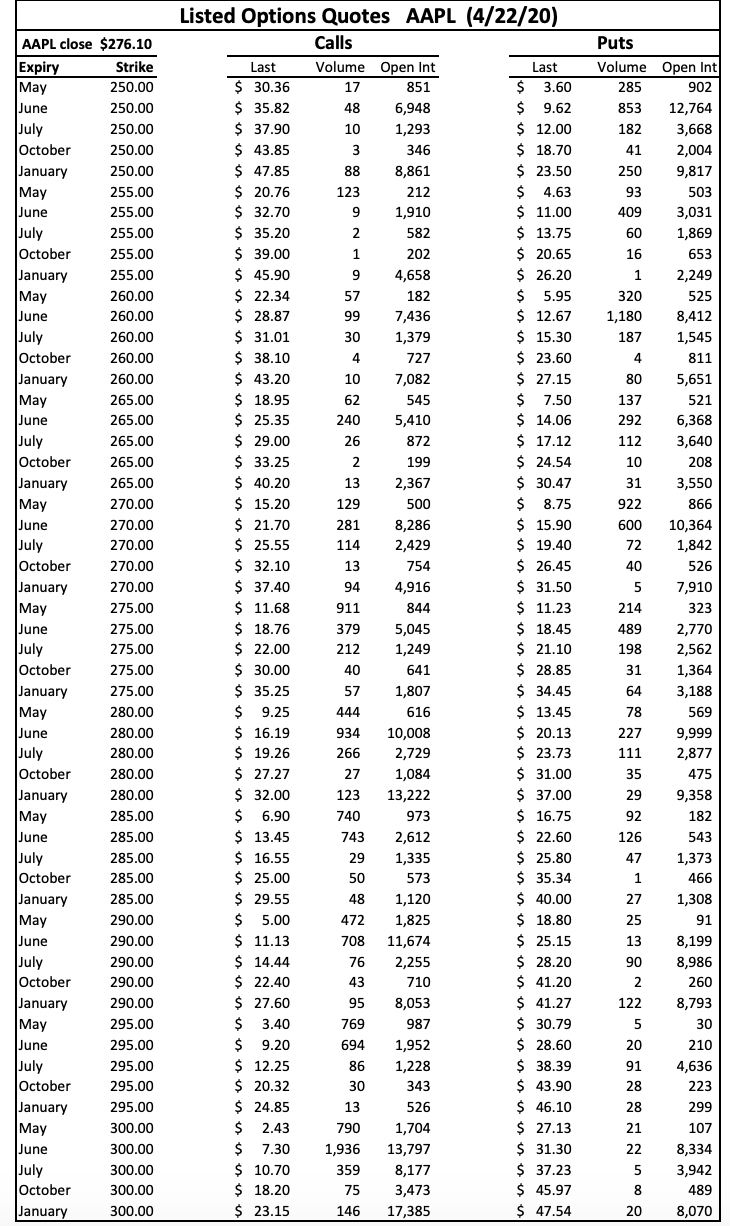

a. 30. Suppose in April we construct a bull spread on 5 AAPL call contracts, using the July 275 and the July 285 contracts. Solve for the investor's profit for the following AAPL stock prices at expiration: $258.00, $270.00, $282.00, $294.00, $306.00. -$2,725; -$2,725; $775; $2,275; $2,275 b. At what price on AAPL shares does the investor break even? $280.45 The same spread on puts may be a more profitable strategy. Answer questions a) and b) again assuming we buy 5 July 275 puts and write 5 July 285 puts. -$2,650; -$2,650; $850; $2,350; $2,350; BE is $280.30 d. Which strategy would you prefer and why? Puts C. Listed Options Quotes AAPL (4/22/20) 1,379 10 AAPL close $276.10 Expiry Strike May 250.00 June 250.00 July 250.00 October 250.00 January 250.00 May 255.00 June 255.00 July 255.00 October 255.00 January 255.00 May 260.00 June 260.00 July 260.00 October 260.00 January 260.00 |May 265.00 June 265.00 July 265.00 October 265.00 January 265.00 May 270.00 June 270.00 July 270.00 October 270.00 January 270.00 |May 275.00 June 275.00 July 275.00 October 275.00 January 275.00 May 280.00 June 280.00 July 280.00 October 280.00 January 280.00 |May 285.00 June 285.00 July 285.00 October 285.00 January 285.00 May 290.00 June 290.00 July 290.00 October 290.00 January 290.00 |May 295.00 June 295.00 July 295.00 October 295.00 January 295.00 May 300.00 June 300.00 July 300.00 October 300.00 January 300.00 Last $ 30.36 $ 35.82 $ 37.90 $ 43.85 $ 47.85 $ 20.76 $ 32.70 $ 35.20 $ 39.00 $ 45.90 $ 22.34 $ 28.87 $ 31.01 $ 38.10 $ 43.20 $18.95 $ 25.35 $ 29.00 $ 33.25 $ 40.20 $ 15.20 $ 21.70 $ 25.55 $ 32.10 $ 37.40 $ 11.68 $ 18.76 $ 22.00 $ 30.00 $ 35.25 $ 9.25 $ 16.19 $ 19.26 $ 27.27 $ 32.00 $ 6.90 $ 13.45 $ 16.55 $ 25.00 $ 29.55 $ 5.00 $ 11.13 $ 14.44 $ 22.40 $ 27.60 $ 3.40 $ 9.20 $ 12.25 $ 20.32 $ 24.85 $ $ 2.43 $ 7.30 $ 10.70 $ 18.20 $ 23.15 Calls Volume Open Int 17 851 48 6,948 10 1,293 3 346 88 8,861 123 212 9 1,910 2 582 1 202 9 4,658 57 182 99 7,436 30 4 727 7,082 62 545 240 5,410 26 872 2 199 13 2,367 129 500 281 8,286 114 2,429 13 754 94 4,916 911 844 379 5,045 212 1,249 641 57 1,807 444 616 934 10,008 266 2,729 27 1,084 123 740 973 743 2,612 29 1,335 50 573 48 1,120 472 1,825 708 11,674 76 2,255 43 710 95 8,053 769 987 694 1,952 1,228 30 343 13 526 790 1,704 1,936 13,797 359 8,177 75 3,473 146 17,385 Last $ 3.60 $ 9.62 $ 12.00 $ 18.70 $ 23.50 $ 4.63 $ 11.00 $ 13.75 $ 20.65 $ 26.20 $5.95 $ 12.67 $ 15.30 $ 23.60 $ 27.15 $ 7.50 $ 14.06 $ 17.12 $ 24.54 $ 30.47 $ 8.75 $ 15.90 $ 19.40 $ 26.45 $ 31.50 $ 11.23 $18.45 $ 21.10 $ 28.85 $ 34.45 $ 13.45 $ 20.13 $ 23.73 $ 31.00 $ 37.00 $ 16.75 $ 22.60 $ 25.80 $ 35.34 $ 40.00 $ 18.80 $ 25.15 $ 28.20 $ 41.20 $ 41.27 $ 30.79 $ 28.60 $ 38.39 $ 43.90 $ 46.10 $ 27.13 $ 31.30 $ 37.23 $ 45.97 $ 47.54 Puts Volume Open Int 285 902 853 12,764 182 3,668 41 2,004 250 9,817 93 503 409 3,031 60 1,869 16 653 1 2,249 320 525 1,180 8,412 187 1,545 4 4 811 80 5,651 137 521 292 6,368 112 3,640 10 208 31 3,550 922 866 600 10,364 72 1,842 40 526 5 7,910 214 323 489 2,770 198 2,562 31 1,364 64 3,188 78 569 227 9,999 111 2,877 35 475 29 9,358 92 182 126 543 47 1,373 1 466 27 1,308 25 91 13 8,199 90 8,986 2 260 122 8,793 5 30 20 210 91 4,636 28 223 28 299 21 107 22 8,334 3,942 489 20 8,070 40 13,222 86 Ou on a. 30. Suppose in April we construct a bull spread on 5 AAPL call contracts, using the July 275 and the July 285 contracts. Solve for the investor's profit for the following AAPL stock prices at expiration: $258.00, $270.00, $282.00, $294.00, $306.00. -$2,725; -$2,725; $775; $2,275; $2,275 b. At what price on AAPL shares does the investor break even? $280.45 The same spread on puts may be a more profitable strategy. Answer questions a) and b) again assuming we buy 5 July 275 puts and write 5 July 285 puts. -$2,650; -$2,650; $850; $2,350; $2,350; BE is $280.30 d. Which strategy would you prefer and why? Puts C. Listed Options Quotes AAPL (4/22/20) 1,379 10 AAPL close $276.10 Expiry Strike May 250.00 June 250.00 July 250.00 October 250.00 January 250.00 May 255.00 June 255.00 July 255.00 October 255.00 January 255.00 May 260.00 June 260.00 July 260.00 October 260.00 January 260.00 |May 265.00 June 265.00 July 265.00 October 265.00 January 265.00 May 270.00 June 270.00 July 270.00 October 270.00 January 270.00 |May 275.00 June 275.00 July 275.00 October 275.00 January 275.00 May 280.00 June 280.00 July 280.00 October 280.00 January 280.00 |May 285.00 June 285.00 July 285.00 October 285.00 January 285.00 May 290.00 June 290.00 July 290.00 October 290.00 January 290.00 |May 295.00 June 295.00 July 295.00 October 295.00 January 295.00 May 300.00 June 300.00 July 300.00 October 300.00 January 300.00 Last $ 30.36 $ 35.82 $ 37.90 $ 43.85 $ 47.85 $ 20.76 $ 32.70 $ 35.20 $ 39.00 $ 45.90 $ 22.34 $ 28.87 $ 31.01 $ 38.10 $ 43.20 $18.95 $ 25.35 $ 29.00 $ 33.25 $ 40.20 $ 15.20 $ 21.70 $ 25.55 $ 32.10 $ 37.40 $ 11.68 $ 18.76 $ 22.00 $ 30.00 $ 35.25 $ 9.25 $ 16.19 $ 19.26 $ 27.27 $ 32.00 $ 6.90 $ 13.45 $ 16.55 $ 25.00 $ 29.55 $ 5.00 $ 11.13 $ 14.44 $ 22.40 $ 27.60 $ 3.40 $ 9.20 $ 12.25 $ 20.32 $ 24.85 $ $ 2.43 $ 7.30 $ 10.70 $ 18.20 $ 23.15 Calls Volume Open Int 17 851 48 6,948 10 1,293 3 346 88 8,861 123 212 9 1,910 2 582 1 202 9 4,658 57 182 99 7,436 30 4 727 7,082 62 545 240 5,410 26 872 2 199 13 2,367 129 500 281 8,286 114 2,429 13 754 94 4,916 911 844 379 5,045 212 1,249 641 57 1,807 444 616 934 10,008 266 2,729 27 1,084 123 740 973 743 2,612 29 1,335 50 573 48 1,120 472 1,825 708 11,674 76 2,255 43 710 95 8,053 769 987 694 1,952 1,228 30 343 13 526 790 1,704 1,936 13,797 359 8,177 75 3,473 146 17,385 Last $ 3.60 $ 9.62 $ 12.00 $ 18.70 $ 23.50 $ 4.63 $ 11.00 $ 13.75 $ 20.65 $ 26.20 $5.95 $ 12.67 $ 15.30 $ 23.60 $ 27.15 $ 7.50 $ 14.06 $ 17.12 $ 24.54 $ 30.47 $ 8.75 $ 15.90 $ 19.40 $ 26.45 $ 31.50 $ 11.23 $18.45 $ 21.10 $ 28.85 $ 34.45 $ 13.45 $ 20.13 $ 23.73 $ 31.00 $ 37.00 $ 16.75 $ 22.60 $ 25.80 $ 35.34 $ 40.00 $ 18.80 $ 25.15 $ 28.20 $ 41.20 $ 41.27 $ 30.79 $ 28.60 $ 38.39 $ 43.90 $ 46.10 $ 27.13 $ 31.30 $ 37.23 $ 45.97 $ 47.54 Puts Volume Open Int 285 902 853 12,764 182 3,668 41 2,004 250 9,817 93 503 409 3,031 60 1,869 16 653 1 2,249 320 525 1,180 8,412 187 1,545 4 4 811 80 5,651 137 521 292 6,368 112 3,640 10 208 31 3,550 922 866 600 10,364 72 1,842 40 526 5 7,910 214 323 489 2,770 198 2,562 31 1,364 64 3,188 78 569 227 9,999 111 2,877 35 475 29 9,358 92 182 126 543 47 1,373 1 466 27 1,308 25 91 13 8,199 90 8,986 2 260 122 8,793 5 30 20 210 91 4,636 28 223 28 299 21 107 22 8,334 3,942 489 20 8,070 40 13,222 86 Ou on