Answered step by step

Verified Expert Solution

Question

1 Approved Answer

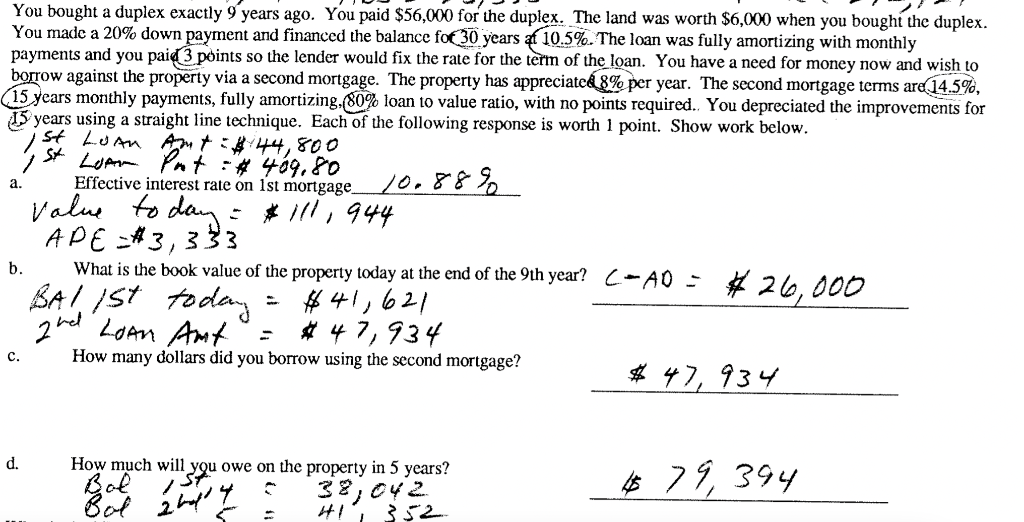

Answers are provided, I need to know how to solve them using a a HP10bll calculator please show work! 2 value today What is the

Answers are provided, I need to know how to solve them using a a HP10bll calculator please show work!

2 value today What is the book value of the property today at the end of the 9th year? C=A0 = 26,000 today You bought a duplex exactly 9 years ago. You paid $56,000 for the duplex. The land was worth $6,000 when you bought the duplex. You made a 20% down payment and financed the balance for 30 years at 10.5%. The loan was fully amortizing with monthly payments and you paid 3 points so the lender would fix the rate for the term of the loan. You have a need for money now and wish to borrow against the property via a second mortgage. The property has appreciated 8% per year. The second mortgage terms are 14.5%, 15 years monthly payments, fully amortizing (80% loan to value ratio, with no points required. You depreciated the improvements for 15 years using a straight line technique. Each of the following response is worth 1 point. Show work below. st Loan Amt :$ 44,800 St Luar Put # 469.80 a. Effective interest rate on 1st mortgage_10.8850 ill, 944 APE #3333 b. BALIST $41,621 2nd Loan Amt $ 47,934 How many dollars did you borrow using the second mortgage? $ 47,934 c. d. How much will il you owe on the property in 5 years? 2014 32,042 HI 352 679, 394 Bol 2 value today What is the book value of the property today at the end of the 9th year? C=A0 = 26,000 today You bought a duplex exactly 9 years ago. You paid $56,000 for the duplex. The land was worth $6,000 when you bought the duplex. You made a 20% down payment and financed the balance for 30 years at 10.5%. The loan was fully amortizing with monthly payments and you paid 3 points so the lender would fix the rate for the term of the loan. You have a need for money now and wish to borrow against the property via a second mortgage. The property has appreciated 8% per year. The second mortgage terms are 14.5%, 15 years monthly payments, fully amortizing (80% loan to value ratio, with no points required. You depreciated the improvements for 15 years using a straight line technique. Each of the following response is worth 1 point. Show work below. st Loan Amt :$ 44,800 St Luar Put # 469.80 a. Effective interest rate on 1st mortgage_10.8850 ill, 944 APE #3333 b. BALIST $41,621 2nd Loan Amt $ 47,934 How many dollars did you borrow using the second mortgage? $ 47,934 c. d. How much will il you owe on the property in 5 years? 2014 32,042 HI 352 679, 394 BolStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started