Answers are shown. I need to see how they were found.

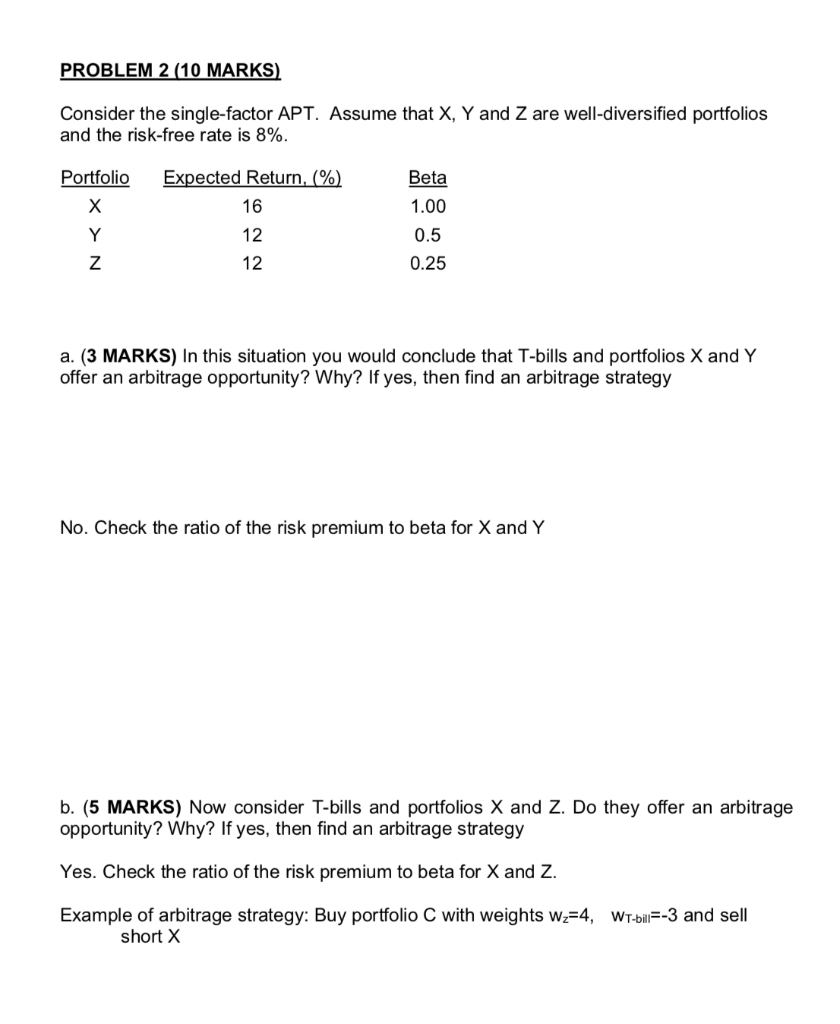

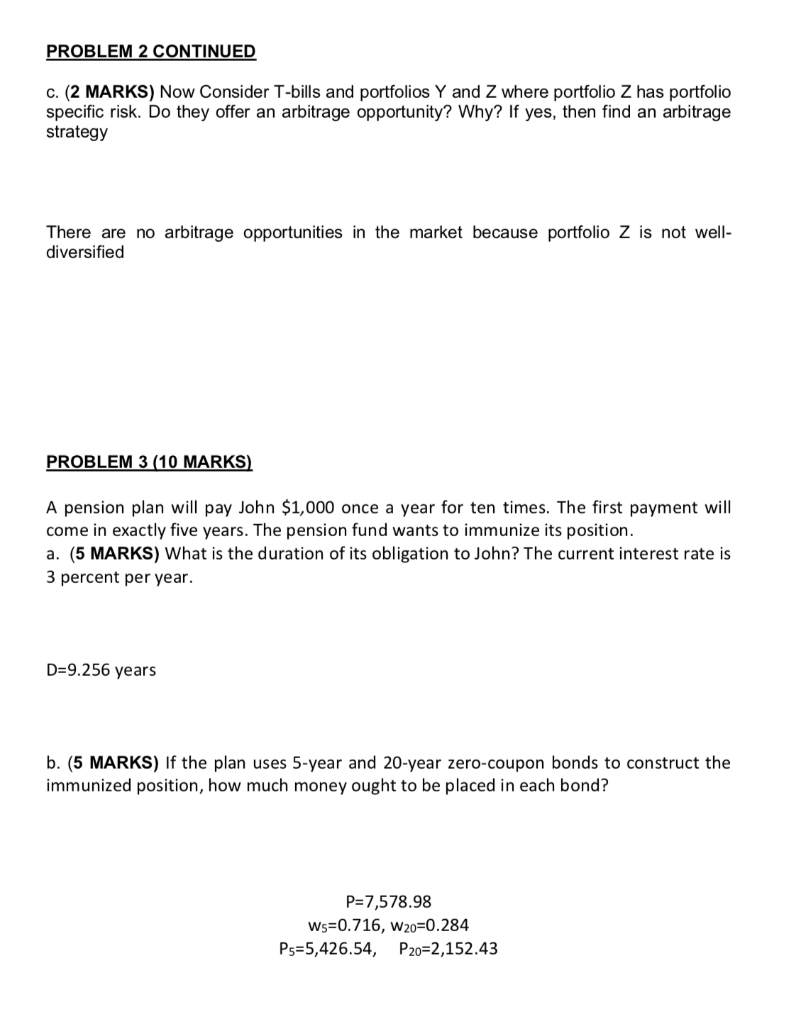

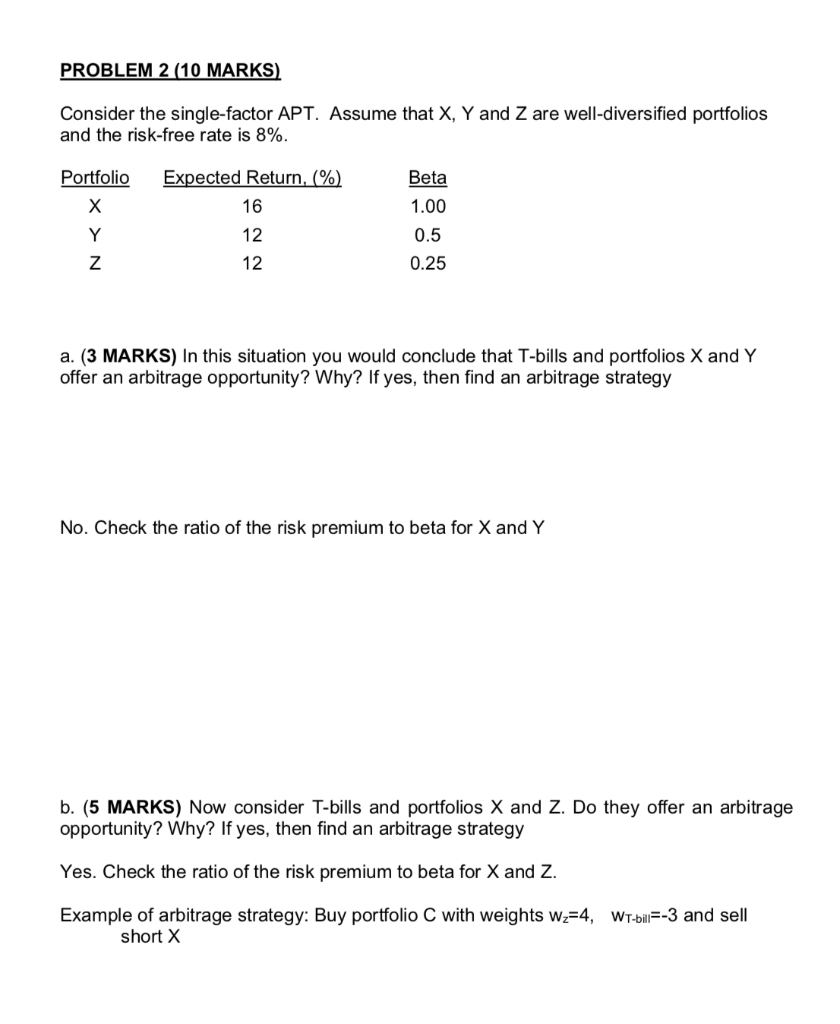

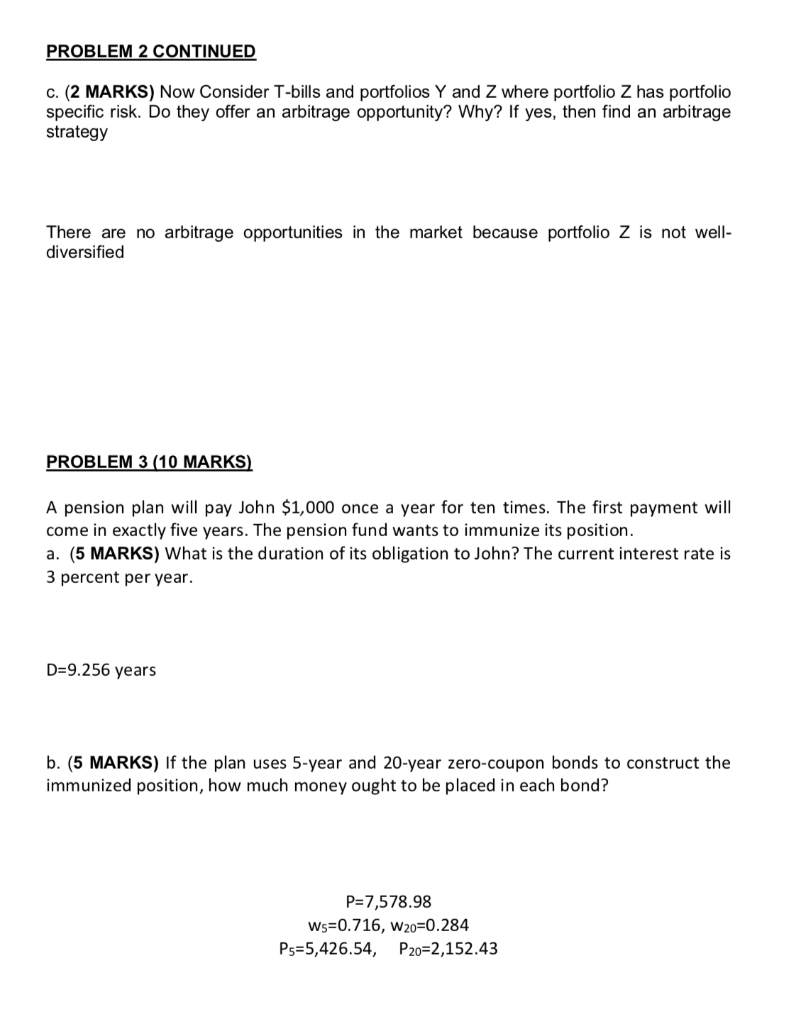

PROBLEM 2 (10 MARKS) Consider the single-factor APT. Assume that X, Y and Z are well-diversified portfolios and the risk-free rate is 8%. Portfolio Expected Return, (%) Beta X 16 1.00 Y 12 0.5 Z 12 0.25 a. (3 MARKS) In this situation you would conclude that T-bills and portfolios X and Y offer an arbitrage opportunity? Why? If yes, then find an arbitrage strategy No. Check the ratio of the risk premium to beta for X and Y b. (5 MARKS) Now consider T-bills and portfolios X and Z. Do they offer an arbitrage opportunity? Why? If yes, then find an arbitrage strategy Yes. Check the ratio of the risk premium to beta for X and Z. Example of arbitrage strategy: Buy portfolio C with weights w-4, WT-bill=-3 and sell short X PROBLEM 2 CONTINUED c. (2 MARKS) Now Consider T-bills and portfolios Y and Z where portfolio Z has portfolio specific risk. Do they offer an arbitrage opportunity? Why? If yes, then find an arbitrage strategy There are no arbitrage opportunities in the market because portfolio Z is not well- diversified PROBLEM 3 (10 MAR A pension plan will pay John $1,000 once a year for ten times. The first payment will come in exactly five years. The pension fund wants to immunize its position. a. (5 MARKS) What is the duration of its obligation to John? The current interest rate is 3 percent per year. D=9.256 years b. (5 MARKS) If the plan uses 5-year and 20-year zero-coupon bonds to construct the immunized position, how much money ought to be placed in each bond? P=7,578.98 Ws=0.716, W20=0.284 Ps=5,426.54, P20=2,152.43 PROBLEM 2 (10 MARKS) Consider the single-factor APT. Assume that X, Y and Z are well-diversified portfolios and the risk-free rate is 8%. Portfolio Expected Return, (%) Beta X 16 1.00 Y 12 0.5 Z 12 0.25 a. (3 MARKS) In this situation you would conclude that T-bills and portfolios X and Y offer an arbitrage opportunity? Why? If yes, then find an arbitrage strategy No. Check the ratio of the risk premium to beta for X and Y b. (5 MARKS) Now consider T-bills and portfolios X and Z. Do they offer an arbitrage opportunity? Why? If yes, then find an arbitrage strategy Yes. Check the ratio of the risk premium to beta for X and Z. Example of arbitrage strategy: Buy portfolio C with weights w-4, WT-bill=-3 and sell short X PROBLEM 2 CONTINUED c. (2 MARKS) Now Consider T-bills and portfolios Y and Z where portfolio Z has portfolio specific risk. Do they offer an arbitrage opportunity? Why? If yes, then find an arbitrage strategy There are no arbitrage opportunities in the market because portfolio Z is not well- diversified PROBLEM 3 (10 MAR A pension plan will pay John $1,000 once a year for ten times. The first payment will come in exactly five years. The pension fund wants to immunize its position. a. (5 MARKS) What is the duration of its obligation to John? The current interest rate is 3 percent per year. D=9.256 years b. (5 MARKS) If the plan uses 5-year and 20-year zero-coupon bonds to construct the immunized position, how much money ought to be placed in each bond? P=7,578.98 Ws=0.716, W20=0.284 Ps=5,426.54, P20=2,152.43