Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Answers for 28-33 For Problems 28-31, assume you own a manufacturing business and are thinking about purchasing a labor-saving device at a cost of $267,000.

Answers for 28-33

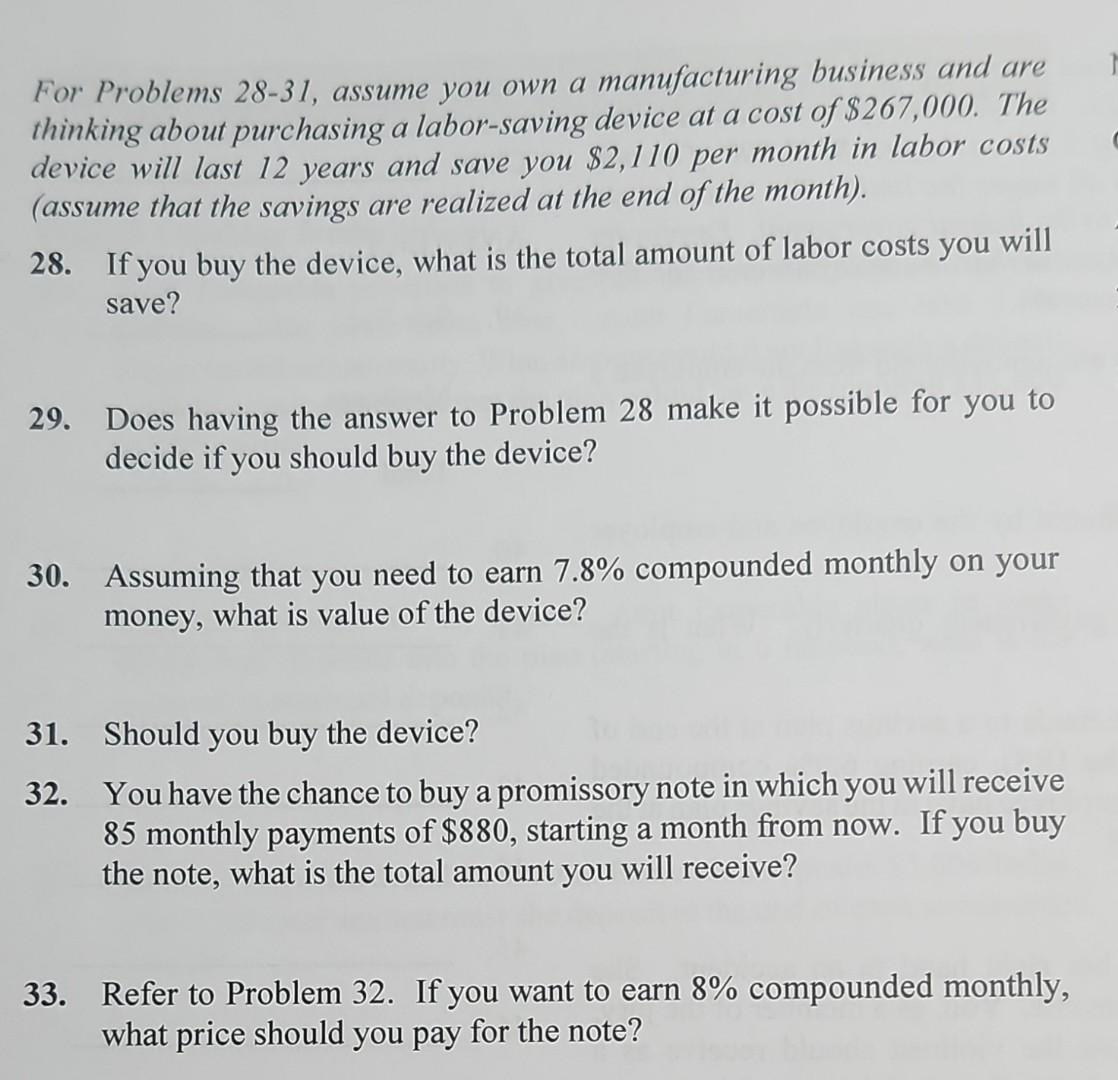

For Problems 28-31, assume you own a manufacturing business and are thinking about purchasing a labor-saving device at a cost of $267,000. The device will last 12 years and save you $2,110 per month in labor costs (assume that the savings are realized at the end of the month). 28. If you buy the device, what is the total amount of labor costs you will save? 29. Does having the answer to Problem 28 make it possible for you to decide if you should buy the device? 30. Assuming that you need to earn 7.8% compounded monthly on your money, what is value of the device? 31. Should you buy the device? 32. You have the chance to buy a promissory note in which you will receive 85 monthly payments of $880, starting a month from now. If you buy the note, what is the total amount you will receive? 33. Refer to Problem 32. If you want to earn 8% compounded monthly, what price should you pay for the note? For Problems 28-31, assume you own a manufacturing business and are thinking about purchasing a labor-saving device at a cost of $267,000. The device will last 12 years and save you $2,110 per month in labor costs (assume that the savings are realized at the end of the month). 28. If you buy the device, what is the total amount of labor costs you will save? 29. Does having the answer to Problem 28 make it possible for you to decide if you should buy the device? 30. Assuming that you need to earn 7.8% compounded monthly on your money, what is value of the device? 31. Should you buy the device? 32. You have the chance to buy a promissory note in which you will receive 85 monthly payments of $880, starting a month from now. If you buy the note, what is the total amount you will receive? 33. Refer to Problem 32. If you want to earn 8% compounded monthly, what price should you pay for the

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started