ANSWERS FOR C i. and ii. ONLY.

a) = $509,384.31

b) = number of units sold > 6706

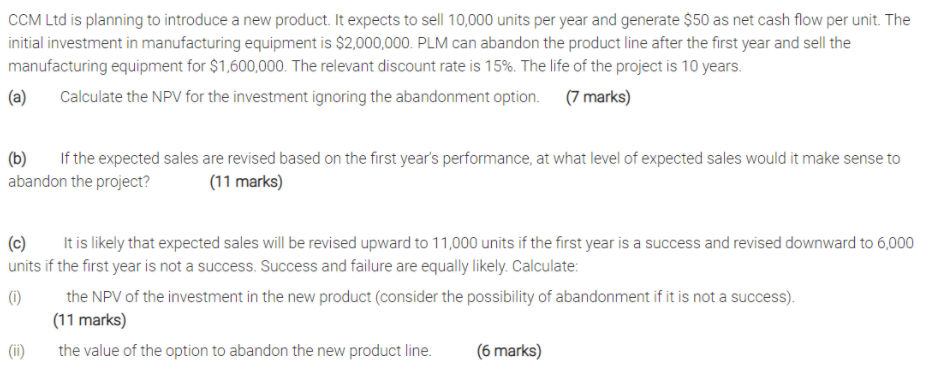

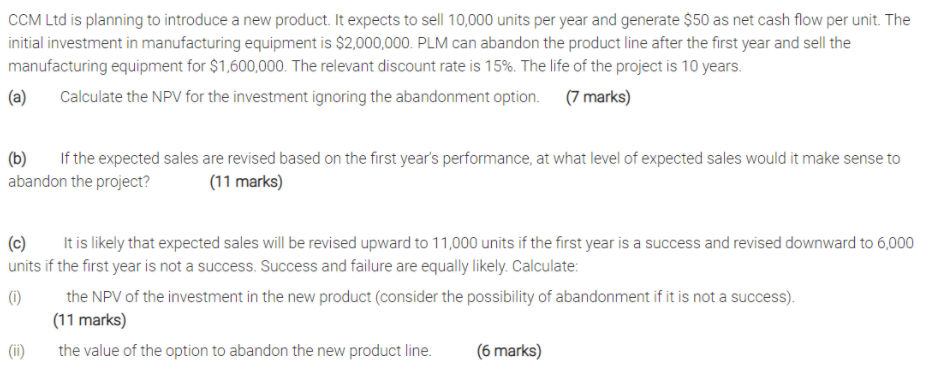

CCM Ltd is planning to introduce a new product. It expects to sell 10,000 units per year and generate $50 as net cash flow per unit. The initial investment in manufacturing equipment is $2,000,000. PLM can abandon the product line after the first year and sell the manufacturing equipment for $1,600,000. The relevant discount rate is 15%. The life of the project is 10 years. (a) Calculate the NPV for the investment ignoring the abandonment option. (7 marks) (b) If the expected sales are revised based on the first year's performance, at what level of expected sales would it make sense to abandon the project? (11 marks) (c) It is likely that expected sales will be revised upward to 11,000 units if the first year is a success and revised downward to 6,000 units if the first year is not a success. Success and failure are equally likely. Calculate: (0) the NPV of the investment in the new product (consider the possibility of abandonment if it is not a success). (11 marks) (ii) the value of the option to abandon the new product line. (6 marks) CCM Ltd is planning to introduce a new product. It expects to sell 10,000 units per year and generate $50 as net cash flow per unit. The initial investment in manufacturing equipment is $2,000,000. PLM can abandon the product line after the first year and sell the manufacturing equipment for $1,600,000. The relevant discount rate is 15%. The life of the project is 10 years. (a) Calculate the NPV for the investment ignoring the abandonment option. (7 marks) (b) If the expected sales are revised based on the first year's performance, at what level of expected sales would it make sense to abandon the project? (11 marks) (c) It is likely that expected sales will be revised upward to 11,000 units if the first year is a success and revised downward to 6,000 units if the first year is not a success. Success and failure are equally likely. Calculate: (0) the NPV of the investment in the new product (consider the possibility of abandonment if it is not a success). (11 marks) (ii) the value of the option to abandon the new product line. (6 marks)