Answered step by step

Verified Expert Solution

Question

1 Approved Answer

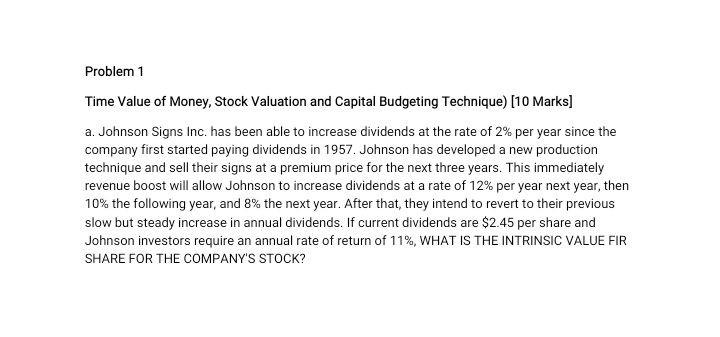

answers for financial management and risk appraisal please Problem 1 Time Value of Money, Stock Valuation and Capital Budgeting Technique) [10 Marks] a. Johnson Signs

answers for financial management and risk appraisal please

Problem 1 Time Value of Money, Stock Valuation and Capital Budgeting Technique) [10 Marks] a. Johnson Signs Inc. has been able to increase dividends at the rate of 2% per year since the company first started paying dividends in 1957. Johnson has developed a new production technique and sell their signs at a premium price for the next three years. This immediately revenue boost will allow Johnson to increase dividends at a rate of 12% per year next year, then 10% the following year, and 8% the next year. After that they intend to revert to their previous slow but steady increase in annual dividends. If current dividends are $2.45 per share and Johnson investors require an annual rate of return of 11%, WHAT IS THE INTRINSIC VALUE FIR SHARE FOR THE COMPANY'S STOCKStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started