Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Answers for the first 3 questions were given. Answers for the 4 the question, cost of its new common stock (rounded to two decimal places)

Answers for the first 3 questions were given.

Answers for the first 3 questions were given.

Answers for the 4 the question, "cost of its new common stock (rounded to two decimal places) should be" (13.52%, 12.17%, 10.82%, 11.49%).

If correct, I will make sure to thumbs up. Thank you!

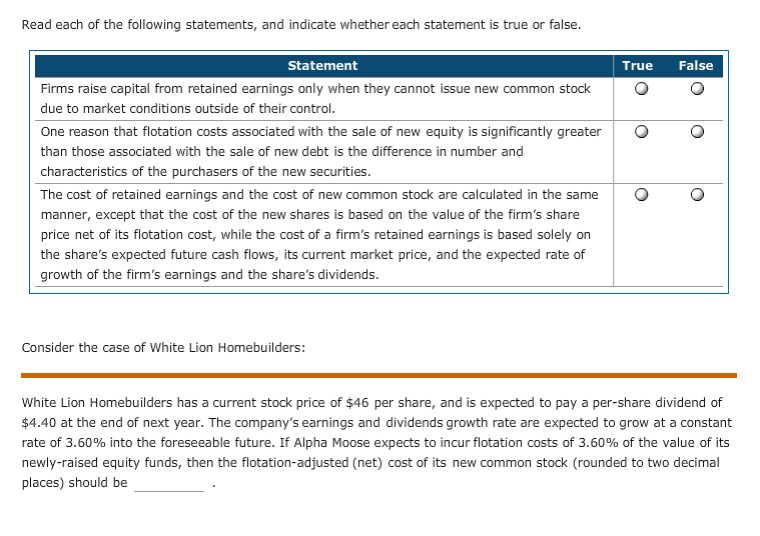

Read each of the following statements, and indicate whether each statement is true or false. Statement True False Firms raise capital from retained earnings only when they cannot issue new common stock due to market conditions outside of their control. One reason that flotation costs associated with the sale of new equity is significantly greater O O than those associated with the sale of new debt is the difference in number and characteristics of the purchasers of the new securities. The cost of retained earnings and the cost of new common stock are calculated in the sameO manner, except that the cost of the new shares is based on the value of the firm's share price net of its flotation cost, while the cost of a firm's retained earnings is based solely on the share's expected future cash flows, its current market price, and the expected rate of growth of the firm's earnings and the share's dividends. Consider the case of White Lion Homebuilders: White Lion Homebuilders has a current stock price of $46 per share, and is expected to pay a per-share dividend of $4.40 at the end of next year. The company's earnings and dividends growth rate are expected to grow at a constant rate of 3.60% into the foreseeable future. If Alpha Moose expects to incur flotation costs of 3.60% of the value of its newly-raised equity funds, then the flotation-adjusted (net) cost of its new common stock (rounded to two decimal places) should beStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started