Answers from our experts for your tough

Answers from our experts for your tough

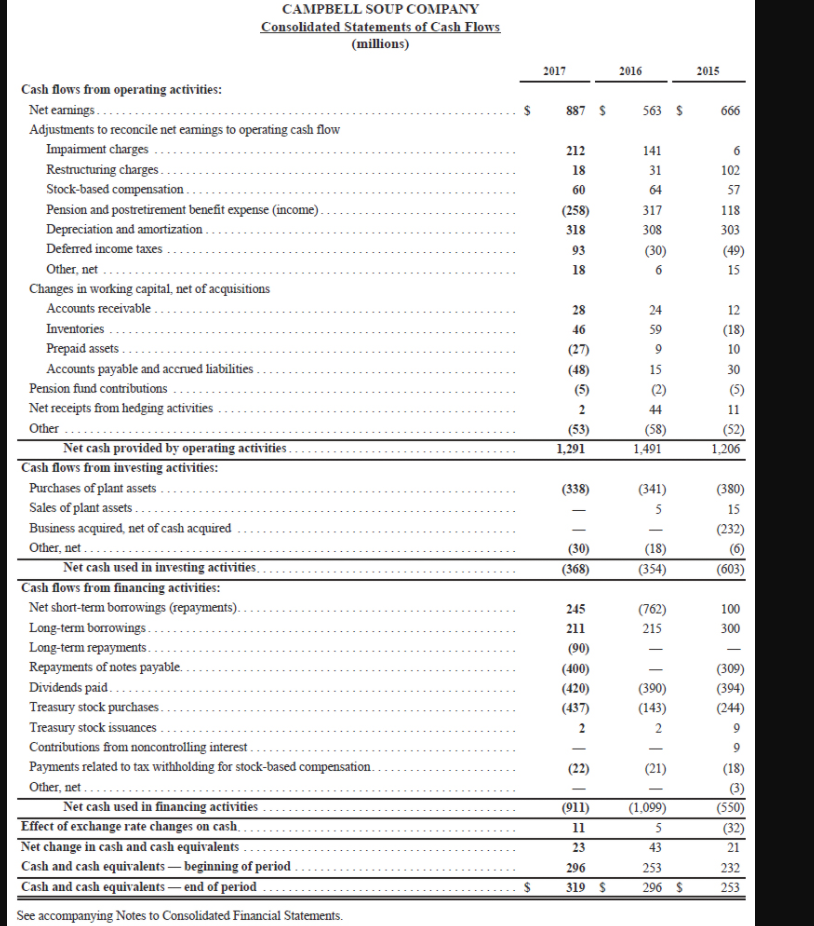

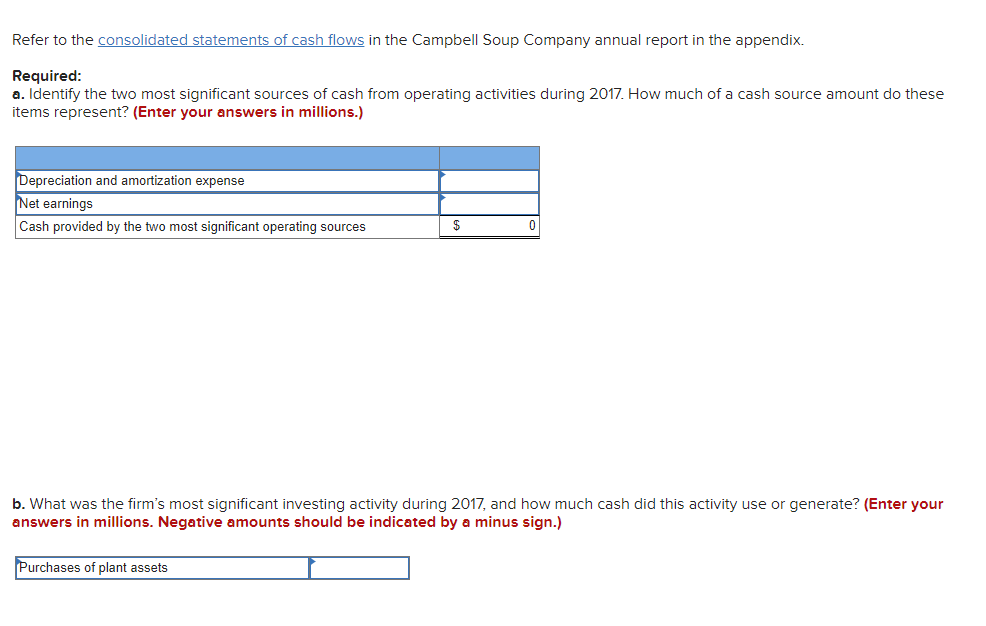

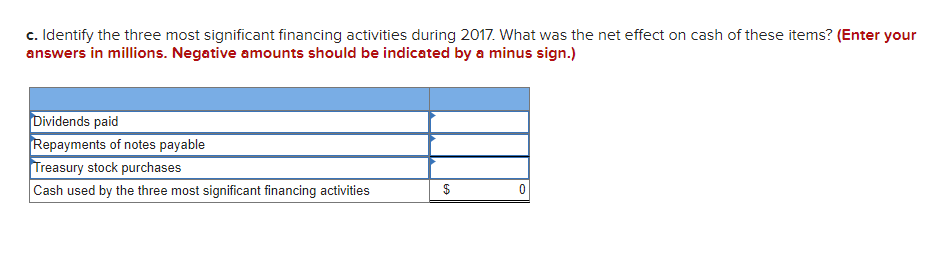

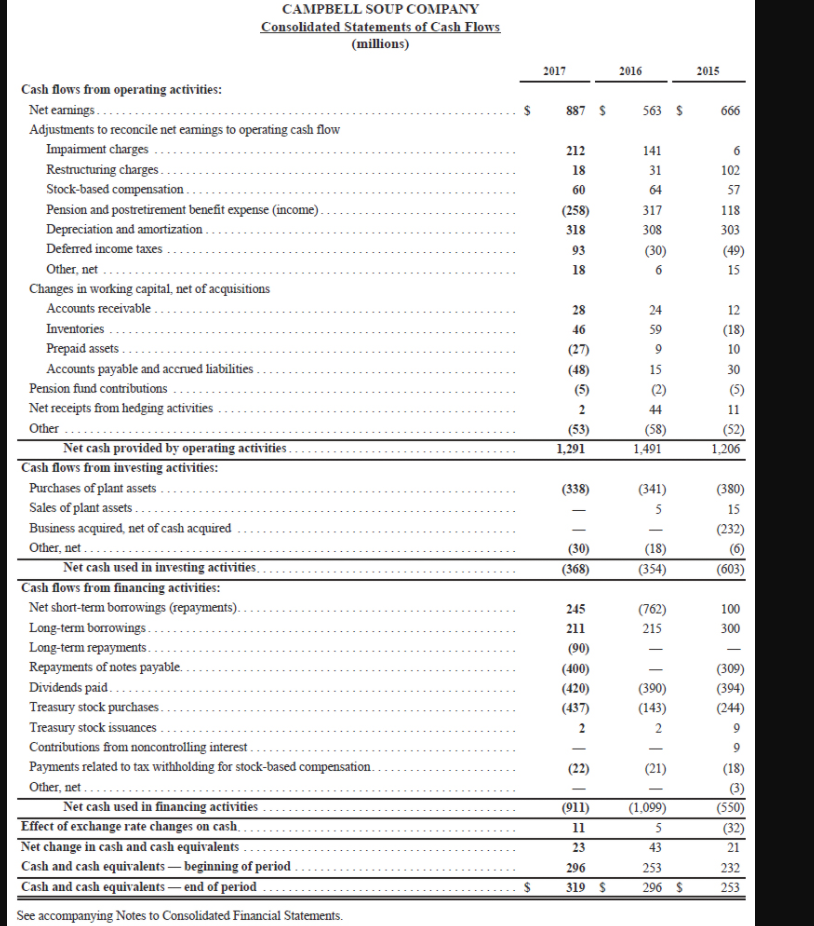

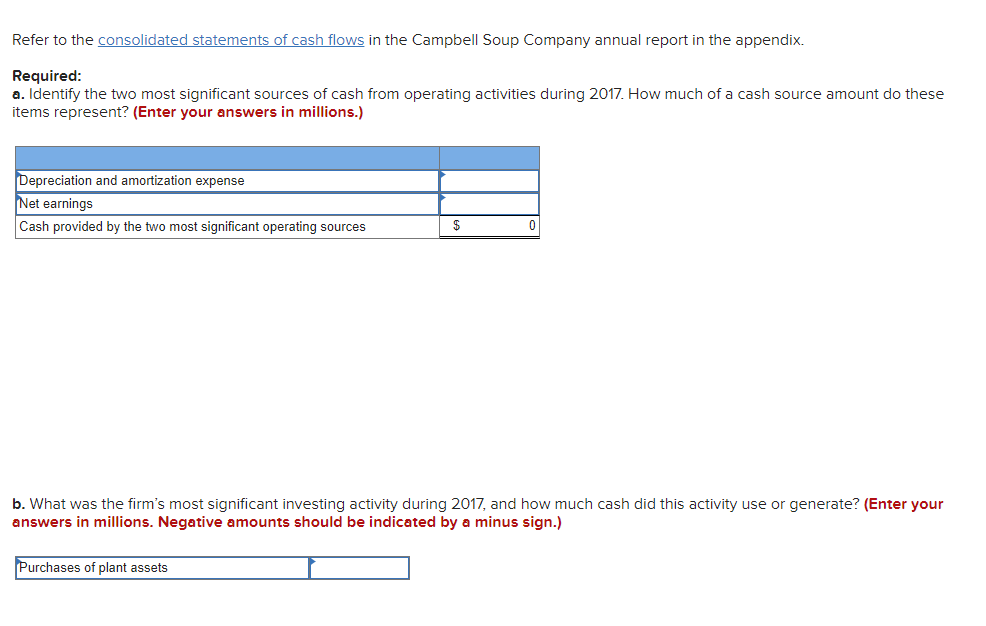

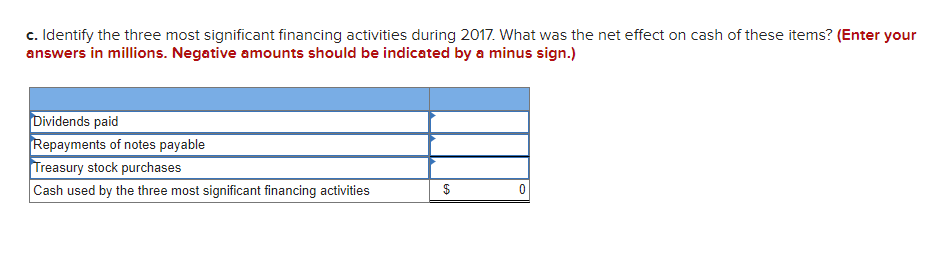

CAMPBELL SOUP COMPANY Consolidated Statements of Cash Flows (millions) 2017 2016 2015 $ 887 $ 563 $ 666 212 18 60 (258) 318 93 18 141 31 64 317 308 (30) 6 6 102 57 118 303 (49) 15 28 46 (27) (48) 24 59 9 15 12 (18) 10 30 (5) 11 (52) 1,206 2 (53) 44 (58) 1,491 1,291 (338) Cash flows from operating activities: Net earnings...... Adjustments to reconcile net earnings to operating cash flow Impaiment charges Restructuring charges Stock-based compensation Pension and postretirement benefit expense (income). Depreciation and amortization.. Deferred income taxes Other, net Changes in working capital, net of acquisitions Accounts receivable Inventories Prepaid assets Accounts payable and accrued liabilities Pension fund contributions Net receipts from hedging activities Other ... Net cash provided by operating activities Cash flows from investing activities: Purchases of plant assets Sales of plant assets Business acquired, net of cash acquired Other, net Net cash used in investing activities. Cash flows from financing activities: Net short-term borrowings (repayments) Long-term borrowings Long-term repayments. Repayments of notes payable. Dividends paid...... Treasury stock purchases Treasury stock issuances Contributions from noncontrolling interest Payments related to tax withholding for stock-based compensation Other, net. Net cash used in financing activities Effect of exchange rate changes on cash. Net change in cash and cash equivalents Cash and cash equivalents beginning of period Cash and cash equivalents -- end of period See accompanying Notes to Consolidated Financial Statements. (341) 5 (380) 15 (232) (30) (368) (18) (354) (603) 245 (762) 215 100 300 211 (90) (400) (420) (437) 2 (390) (143) 2 (309) (394) (244) 9 9 (22) (21) (18) (911) 11 23 (1,099) 5 43 (550) (32) 21 232 253 296 253 296 $ 319 $ Refer to the consolidated statements of cash flows in the Campbell Soup Company annual report in the appendix. Required: a. Identify the two most significant sources of cash from operating activities during 2017. How much of a cash source amount do these items represent? (Enter your answers in millions.) Depreciation and amortization expense Net earnings Cash provided by the two most significant operating sources $ b. What was the firm's most significant investing activity during 2017, and how much cash did this activity use or generate? (Enter your answers in millions. Negative amounts should be indicated by a minus sign.) Purchases of plant assets c. Identify the three most significant financing activities during 2017. What was the net effect on cash of these items? (Enter your answers in millions. Negative amounts should be indicated by a minus sign.) Dividends paid Repayments of notes payable Treasury stock purchases Cash used by the three most significant financing activities $ 0

Answers from our experts for your tough

Answers from our experts for your tough