answers given, how to do

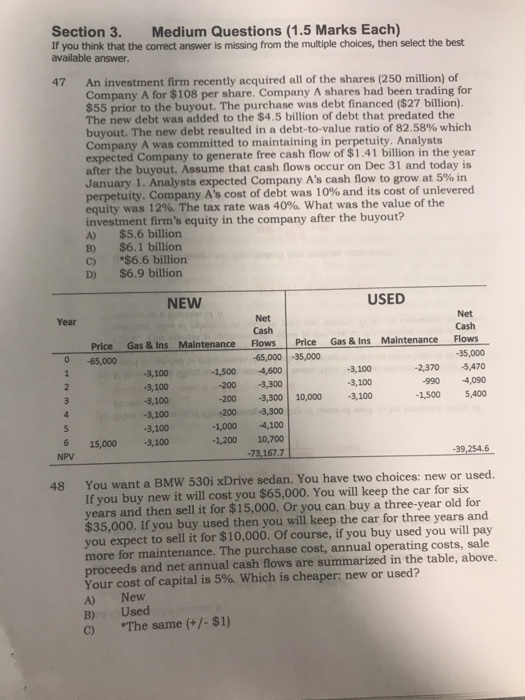

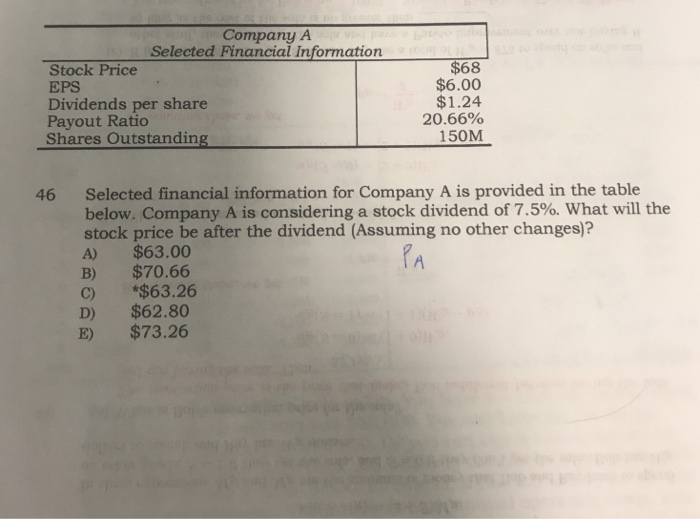

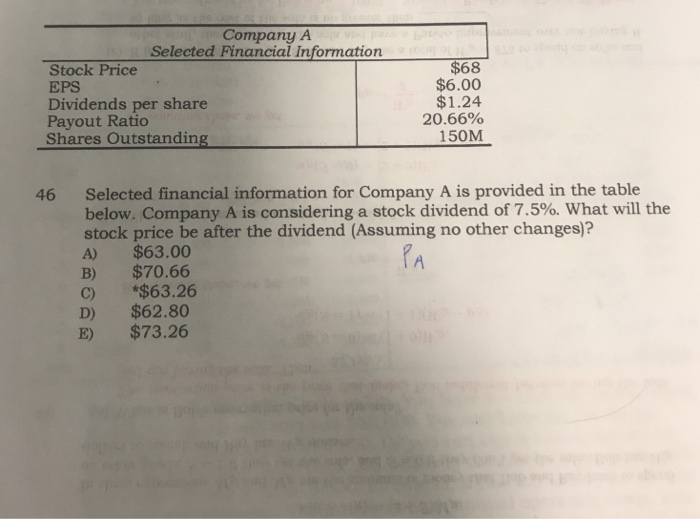

Company A Selected Financial Information Stock Price EPS Dividends per share Payout Ratio Shares Outstanding $68 $6.00 $1.24 20.66% 150M Selected financial information for Company A is provided in the table below. Company A is considering a stock dividend of 7.500, what will the stock price be after the dividend (Assuming no other changes)? A) $63.00 B) $70.66 C) $63.26 D) $62.80 E) $73.26 46 PA Section 3. Medium Questions (1.5 Marks Each) If you think that the correct answer is missing from the multiple choices, then select the best available answer. 47 An investment firm recently acquired all of the shares (250 million) of Company A for $108 per share. Company A shares had been trading for $55 prior to the buyout. The purchase was debt financed ($27 billion). The new debt was added to the $4.5 billion of debt that predated the buyout. The new debt resulted in a debt-to-value ratio of 82.58% which Company A was committed to maintaining in perpetuity. Analysts ted Company to generate free cash flow of $1.41 billion in the year after the buyout. Assume that cash flows occur on Dec 31 and today is January 1. Analysts expected Company A's cash flow to grow at 5% in perpetuity. Company A's cost of debt was 10% and its cost of unlevered equity was 12%. The tax rate was 40%, what was the value of the investment firm's equity in the company after the buyout? A) $5.6 billion B) $6.1 billion c) $6.6 billion D) $6.9 billion NEW USED Year Net Flows -65,000 -35,000 Net Cash aintenance Flows Price Gas & Ins Maintenance Flows 35,000 -2,370 5,470 -990 4,090 -1,500 5,400 Price 0 -65,000 Gas & Ins 3,100 -3,100 3,100 -3,100 3,100 6 15,000 3,100 -1,500-4,600 200-3,300 3,100 -3,300 10,000 3,100 -200 2003,300 1,000 4,100 1,200 10,700 73,167.7 NPV 39,254.6 You want a BMW 530i xDrive sedan. You have two choices: new or used. If you buy new it will cost you $65,000. You will keep the car for six years and then sell it for $15,000. Or you can buy a three-year old for $35,000. If you buy used then you will keep the car for three years and you expect to sell it for $10,000. Of course, if you buy used you will pay more for maintenance. The purchase cost, annual operating costs, sale proceeds and net annual cash flows are summarized in the table, above. Your cost of capital is 5%, which is cheaper: new or used? A) New B)Used C) 48 "The same (+/- $1)

answers given, how to do

answers given, how to do