answers given, i dont know how to solve both

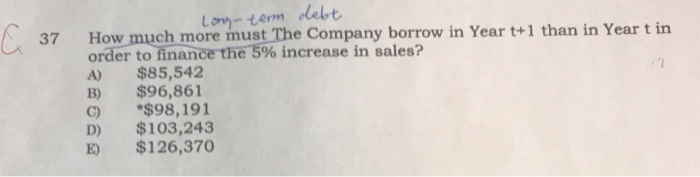

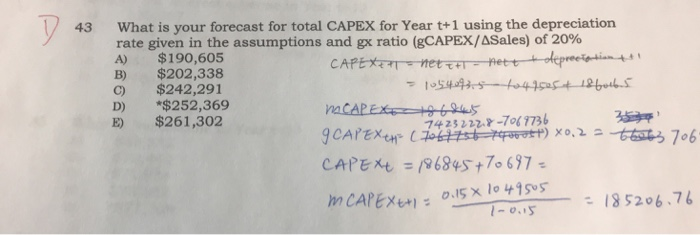

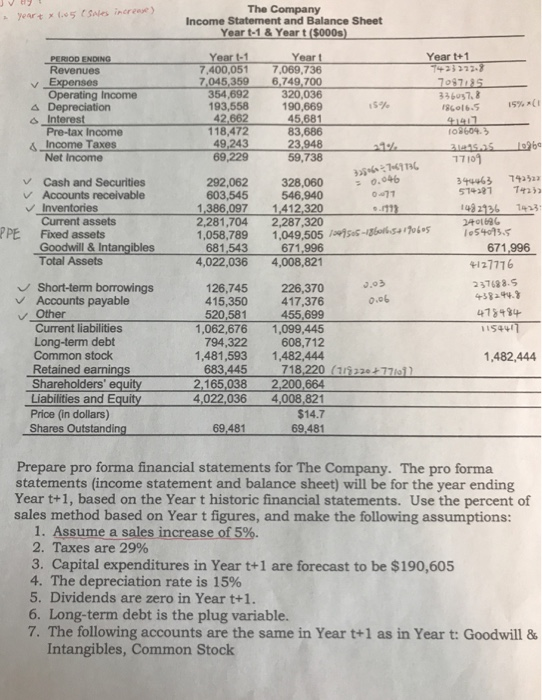

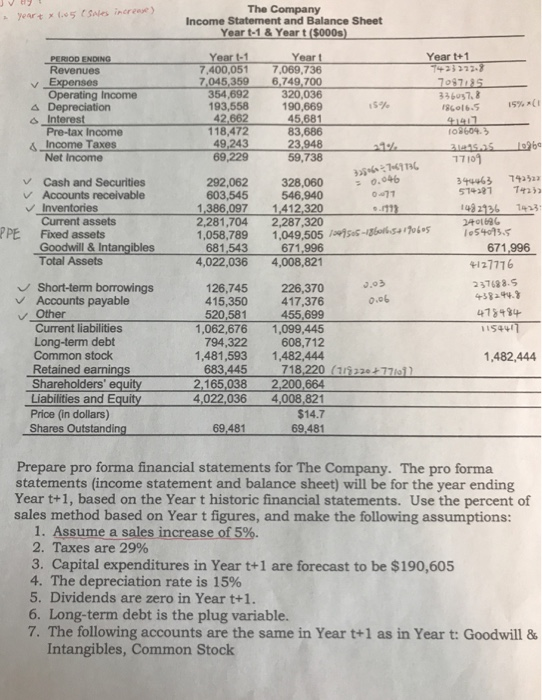

The Company Income Statement and Balance Sheet Year t-1& Year t(5000s) Year t+1 Year t 7.400,051 7,069,736 7,045,359 6,749,700 ,692 320,036 90,669 45,681 83,686 23,948 59,738 PERIOD ENDING Year t-1 336057, 86o16.5 Operating Income 193,558 42,662 118,472 49,243 69,229 1S% Depreciation o Interest s Income Taxes Pre-tax Income 108604.3 Net Income V Cash and Securities v Accounts receivable VInventories 292,062 328,0600.046 603,545 344463 7423 546,940 1.386,097 1412.320 2,281,704 2,287,320 Current assets PPE Fixed assets 1,049,505 /mis-quons, thi.s 1,058,789 681,543 Goodwill & Intangibles Total Assets 671,996 4,022,036 4,008,821 671,996 +127776 Short-term borrowings 237688.S 8294.3 126,745 226,370 415,350 417,376 520,581 455,699 1,062,676 1,099,445 794,322 608,712 1,481,593 1,482,444 VAccounts payable 0.06 Current liabilities Long-term debt Common stock Retained earnings 11544 1,482,444 683,445 2.165,038 2,200,664 4,022,036 4,008,821 $14.7 69.481 Price (in dollars) Shares Outstanding 69.481 Prepare pro forma financial statements for The Company. The pro forma statements (income statement and balance sheet) will be for the year ending Year t+1, based on the Year t historic financial statements. Use the percent of sales method based on Year t figures, and make the following assumptions: 1. Assume a sales increase of 5%. 2. Taxes are 29% 3. Capital expenditures in Year t+1 are forecast to be $190,605 4. The depreciation rate is 15% 5. Dividends are zero in Year t+1. 6. Long-term debt is the plug variable. 7The following accounts are the same in Year t+1 as in Year t: Goodwill & Intangibles, Common Stock Lom- term lebt 3 37 Hoermoc han rethuis % here as pany borrow in Year t+ 1 than in Year t in e-5% increase in sales? A) $85,542 B) $96,861 C $98,191 D) $103,243 E) $126,370 43 What is your forecast for total CAPEX for Year t+1 using the depreciation rate given in the assumptions and gx ratio (gCAPEX/dSales) of 20% A) $190,605 B) $202,338 C) $242,291 D) $252,369 E) $261,302 CAPE -0185206 76 The Company Income Statement and Balance Sheet Year t-1& Year t(5000s) Year t+1 Year t 7.400,051 7,069,736 7,045,359 6,749,700 ,692 320,036 90,669 45,681 83,686 23,948 59,738 PERIOD ENDING Year t-1 336057, 86o16.5 Operating Income 193,558 42,662 118,472 49,243 69,229 1S% Depreciation o Interest s Income Taxes Pre-tax Income 108604.3 Net Income V Cash and Securities v Accounts receivable VInventories 292,062 328,0600.046 603,545 344463 7423 546,940 1.386,097 1412.320 2,281,704 2,287,320 Current assets PPE Fixed assets 1,049,505 /mis-quons, thi.s 1,058,789 681,543 Goodwill & Intangibles Total Assets 671,996 4,022,036 4,008,821 671,996 +127776 Short-term borrowings 237688.S 8294.3 126,745 226,370 415,350 417,376 520,581 455,699 1,062,676 1,099,445 794,322 608,712 1,481,593 1,482,444 VAccounts payable 0.06 Current liabilities Long-term debt Common stock Retained earnings 11544 1,482,444 683,445 2.165,038 2,200,664 4,022,036 4,008,821 $14.7 69.481 Price (in dollars) Shares Outstanding 69.481 Prepare pro forma financial statements for The Company. The pro forma statements (income statement and balance sheet) will be for the year ending Year t+1, based on the Year t historic financial statements. Use the percent of sales method based on Year t figures, and make the following assumptions: 1. Assume a sales increase of 5%. 2. Taxes are 29% 3. Capital expenditures in Year t+1 are forecast to be $190,605 4. The depreciation rate is 15% 5. Dividends are zero in Year t+1. 6. Long-term debt is the plug variable. 7The following accounts are the same in Year t+1 as in Year t: Goodwill & Intangibles, Common Stock Lom- term lebt 3 37 Hoermoc han rethuis % here as pany borrow in Year t+ 1 than in Year t in e-5% increase in sales? A) $85,542 B) $96,861 C $98,191 D) $103,243 E) $126,370 43 What is your forecast for total CAPEX for Year t+1 using the depreciation rate given in the assumptions and gx ratio (gCAPEX/dSales) of 20% A) $190,605 B) $202,338 C) $242,291 D) $252,369 E) $261,302 CAPE -0185206 76

answers given, i dont know how to solve both

answers given, i dont know how to solve both