answers in excel formulas please

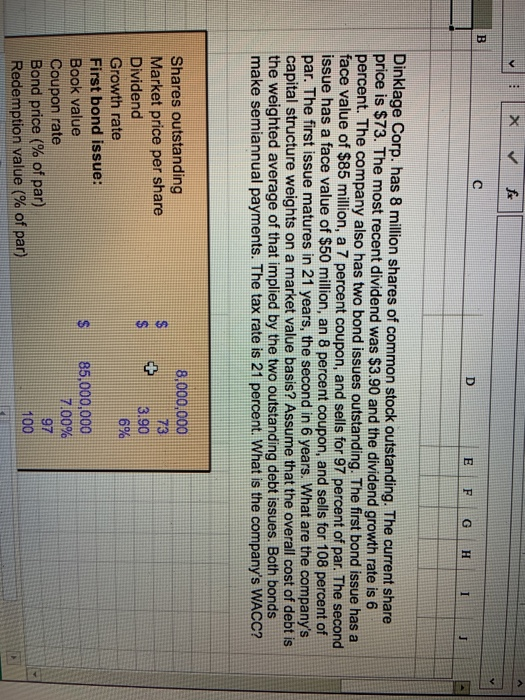

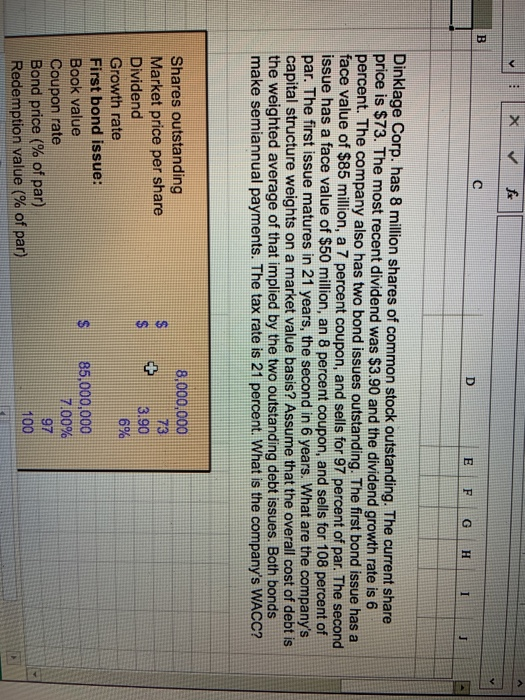

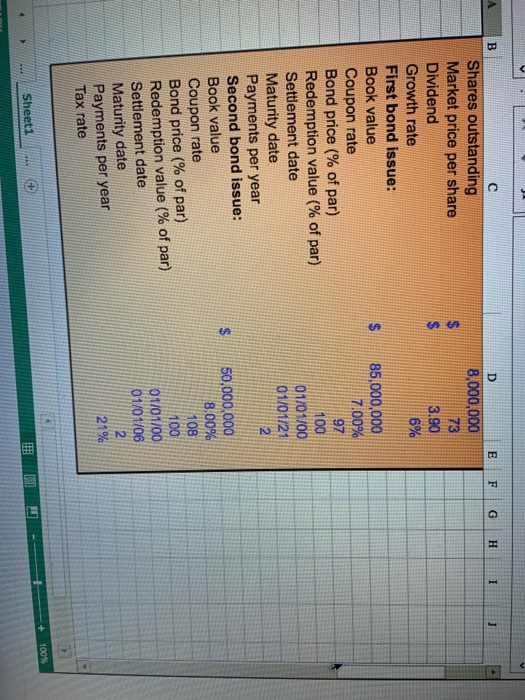

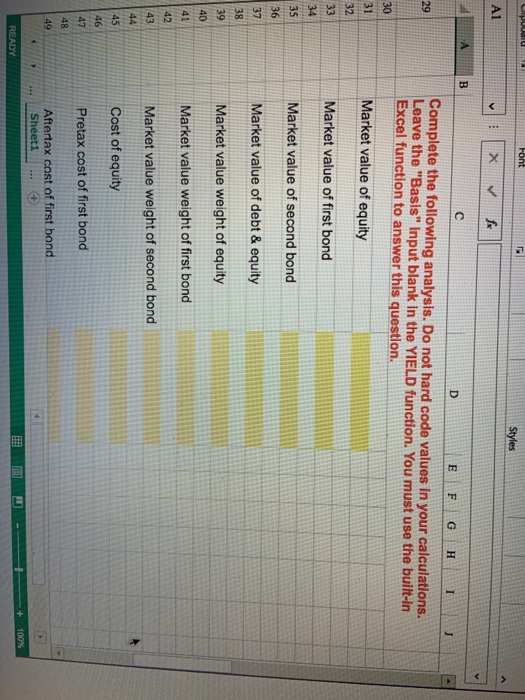

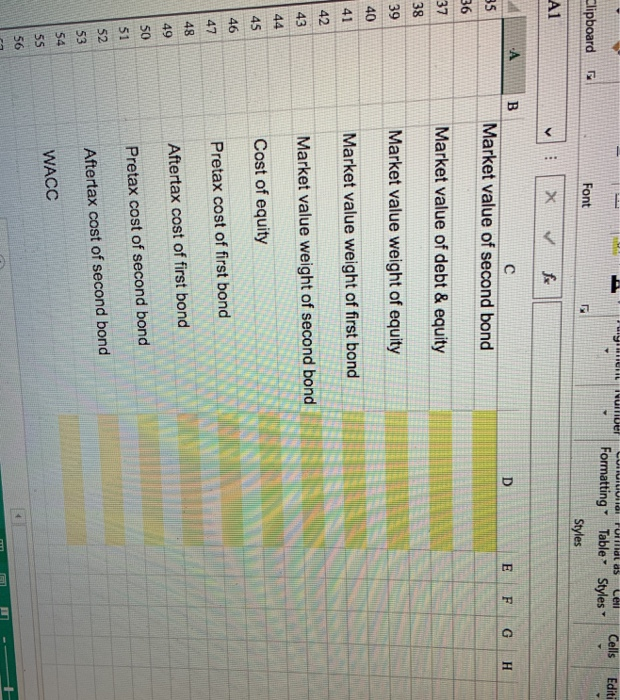

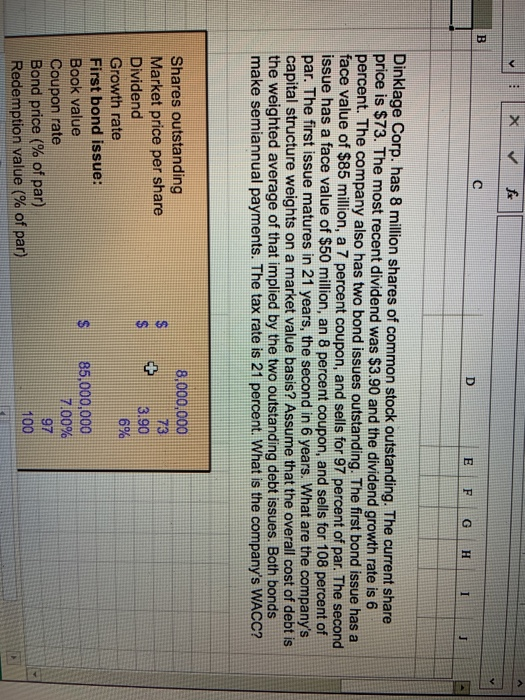

X B. D E F G H - J Dinklage Corp. has 8 million shares of common stock outstanding. The current share price is $73. The most recent dividend was $3.90 and the dividend growth rate is 6 percent. The company also has two bond issues outstanding. The first bond issue has a face value of $85 million, a 7 percent coupon, and sells for 97 percent of par. The second issue has a face value of $50 million, an 8 percent coupon, and sells for 108 percent of par. The first issue matures in 21 years, the second in 6 years. What are the company's capital structure weights on a market value basis? Assume that the overall cost of debt is the weighted average of that implied by the two outstanding debt issues. Both bonds make semiannual payments. The tax rate is 21 percent. What is the company's WACC? 8,000,000 1773 3.90 + 6 6% Shares outstanding Market price per share Dividend Growth rate First bond issue: Book value Coupon rate Bond price (% of par) Redemption value (% of par) $ 85,000,000 7.00% 97 100 B E F G 1 J D 8,000,000 73 3.90 6% $ Shares outstanding Market price per share Dividend Growth rate First bond issue: Book value Coupon rate Bond price (% of par) Redemption value % of par) Settlement date Maturity date Payments per year Second bond issue: Book value Coupon rate Bond price (% of par) Redemption value (% of par) Settlement date Maturity date Payments per year Tax rate 85,000,000 7.00% 97 100 01/01/00 01/01/21 2 $ 50,000,000 8.00% 108 100 01/01/00 01/01/06 2 21% + 100% Sheet1 Font Styles A1 X fix A B D E F G H 1 J 29 Complete the following analysis. Do not hard code values in your calculations. Leave the "Basis" input blank in the YIELD function. You must use the built-in Excel function to answer this question. 30 Market value of equity 31 32 33 Market value of first bond 34 35 Market value of second bond 36 37 Market value of debt & equity 38 39 40 Market value weight of equity 41 Market value weight of first bond 42 43 Market value weight of second bond 44 45 Cost of equity 46 47 Pretax cost of first bond 48 49 Aftertax cost of first bond Sheet1 + 100% READY iyil ILIVU liver LULUIVI PUT dl as Cell Cells Editi L Clipboard Font Formatting Table Styles Styles A1 X B D E F G H Market value of second bond 35 36 37 38 39 Market value of debt & equity Market value weight of equity 40 41 Market value weight of first bond 42 43 Market value weight of second bond 44 45 Cost of equity 46 47 Pretax cost of first bond 48 Aftertax cost of first bond 49 50 51 Pretax cost of second bond 52 Aftertax cost of second bond 53 54 WACC SS 56