answers in the form of the complete set of financial statements which include State of financial position, statement of comprehensive income and statement of changes in equity, supporting notes in accordance with generally accepted accounting practice (New Zealand).

I am attaching the question in the form of images and please get me the answer as soon as possible.

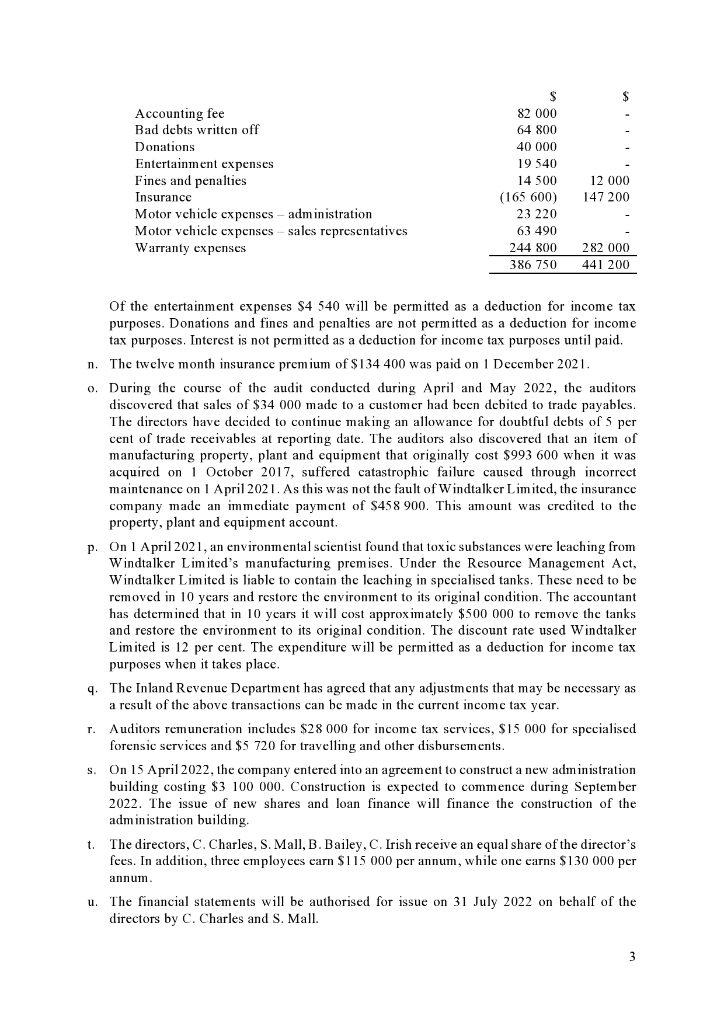

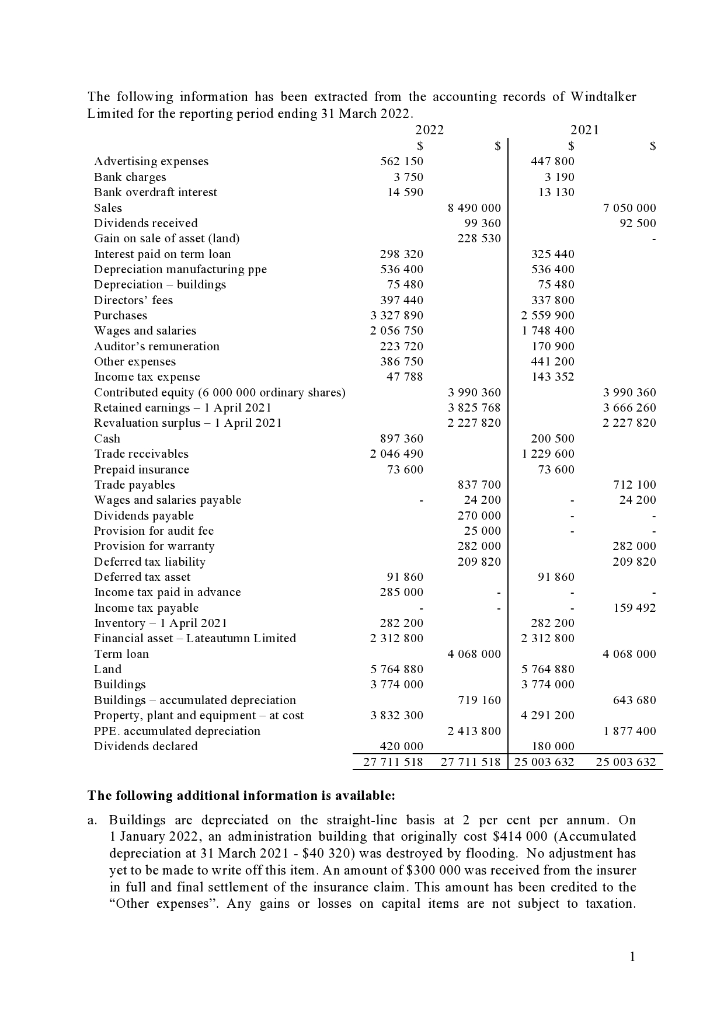

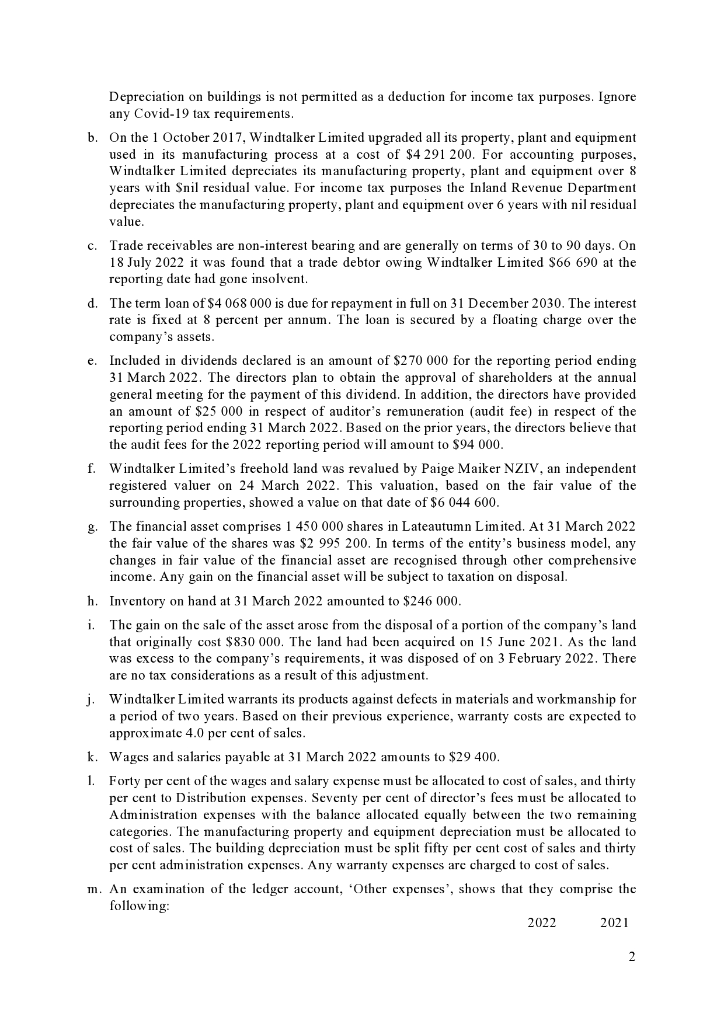

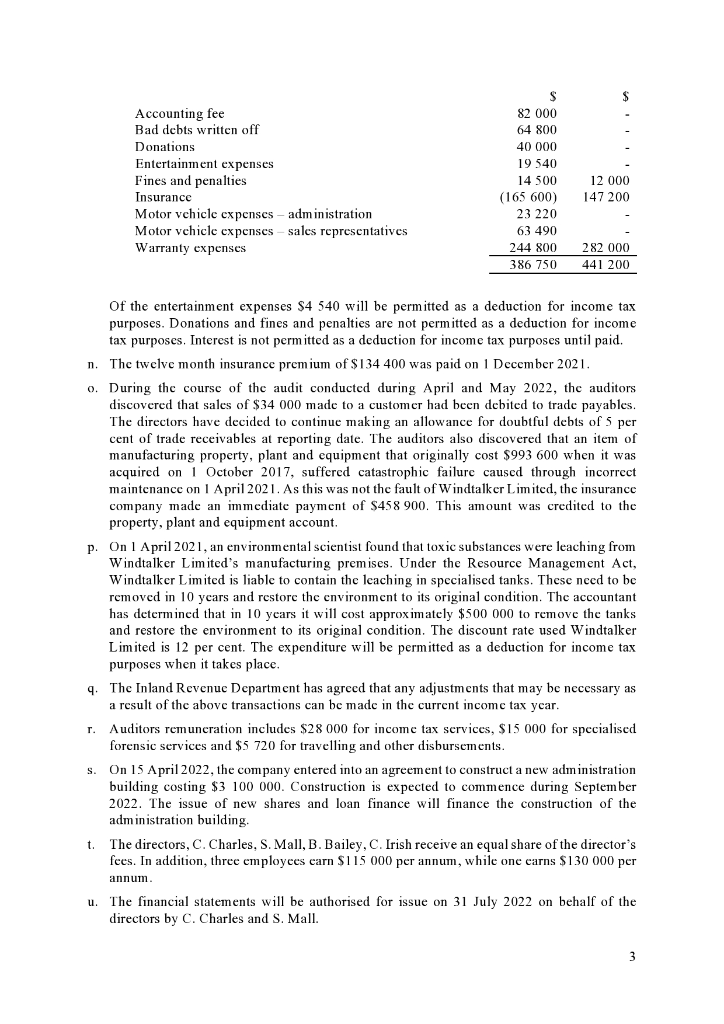

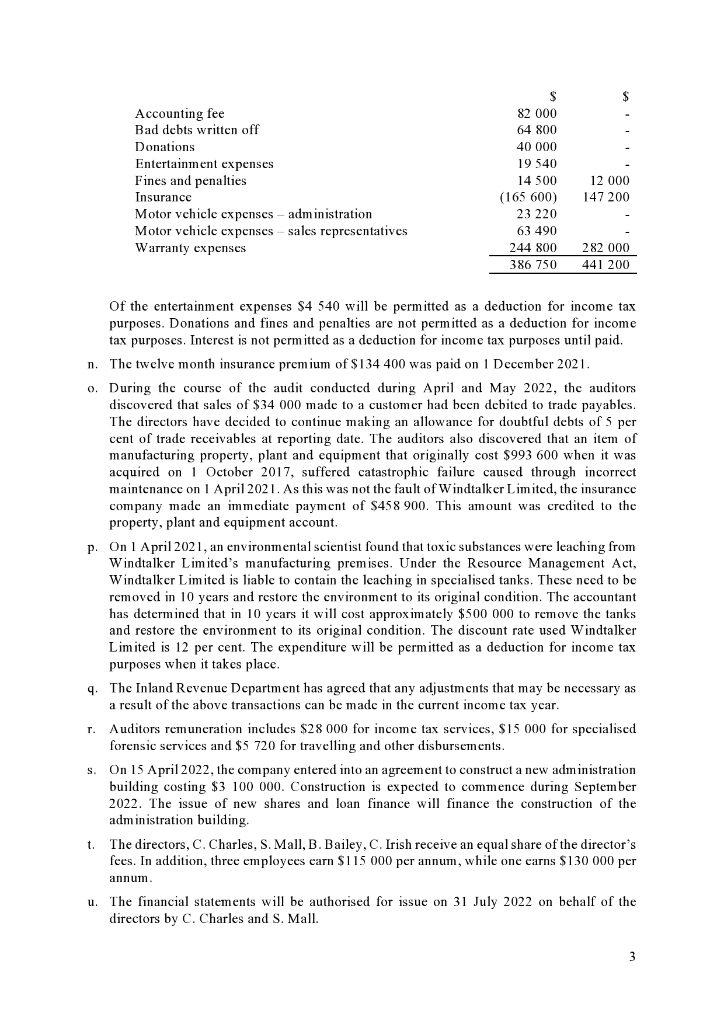

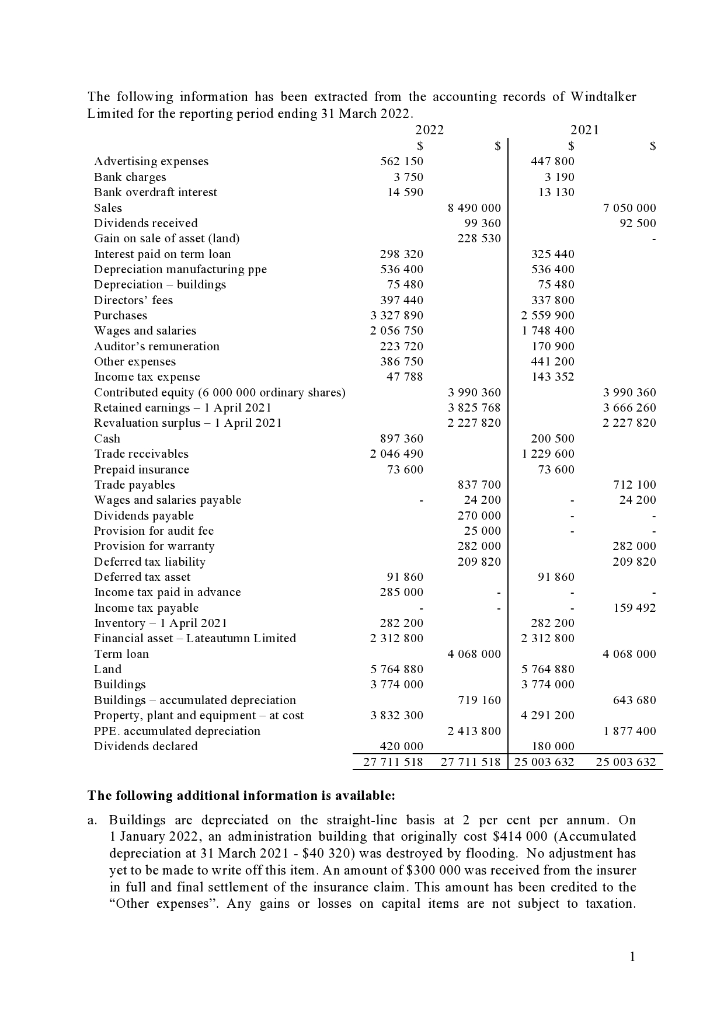

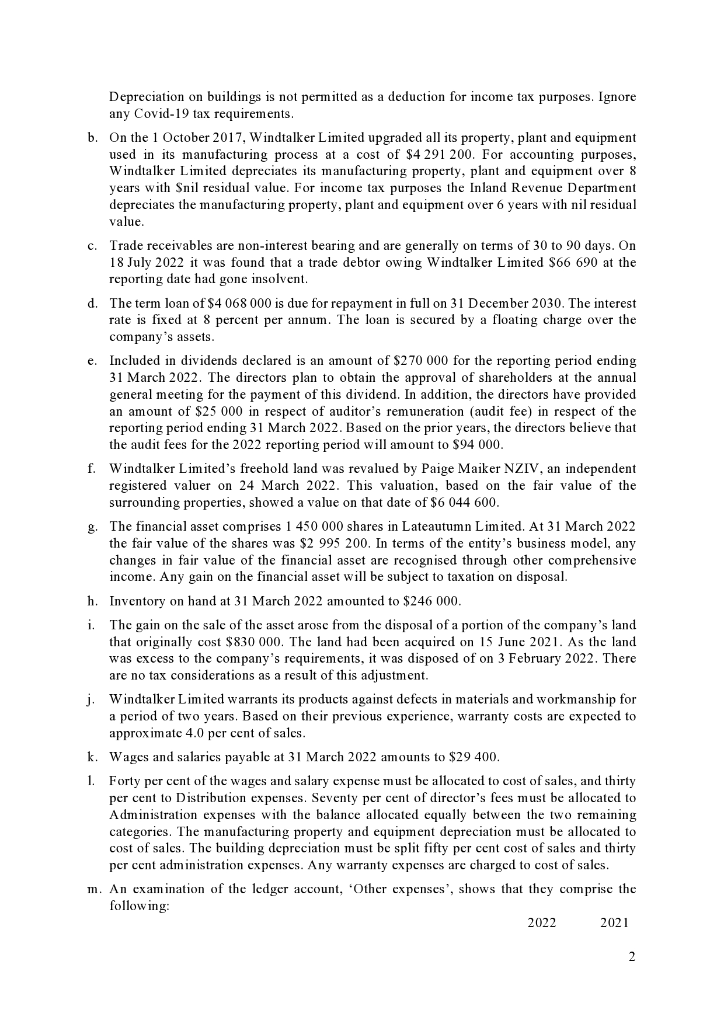

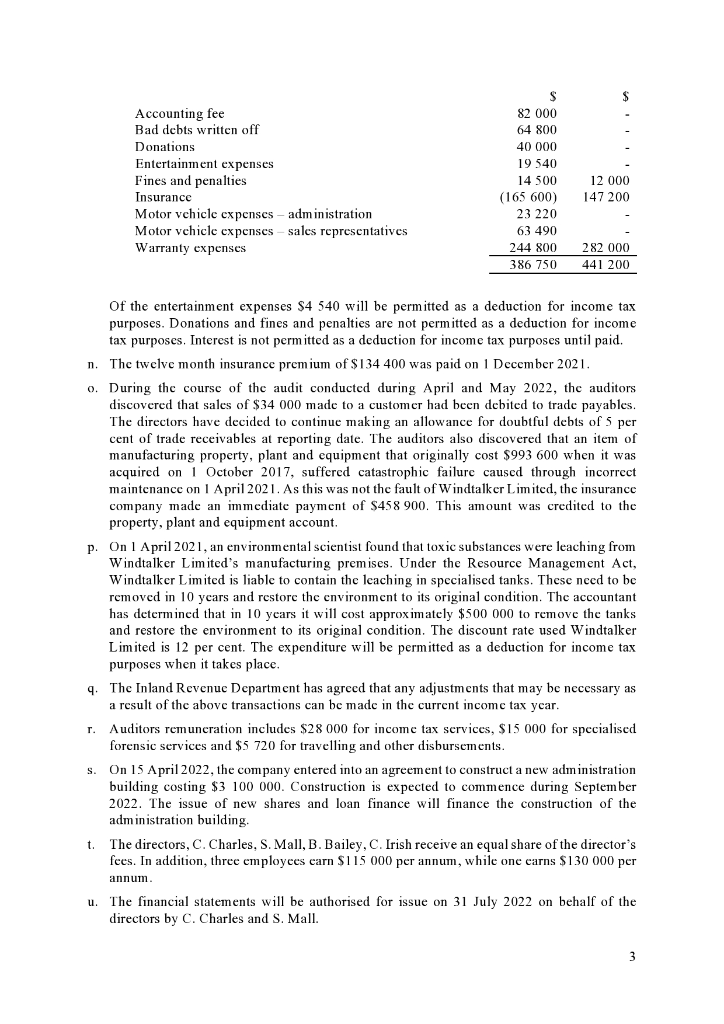

Accounting fee Bad debts written off Donations S 82 000 64 800 40 000 19 540 14 500 (165 600) 23 220 63 490 244 800 386 750 Entertainment expenses Fines and penalties Insurance Motor vehicle expenses - administration Motor vehicle expenses - sales representatives Warranty expenses 12 000 147 200 282 000 441 200 Of the entertainment expenses $4 540 will be permitted as a deduction for income tax purposes. Donations and fines and penalties are not permitted as a deduction for income tax purposes. Interest is not permitted as a deduction for income tax purposes until paid. n. The twelve month insurance premium of $134 400 was paid on 1 December 2021. 0. During the course of the audit conducted during April and May 2022, the auditors discovered that sales of $34 000 made to a customer had been debited to trade payables. The directors have decided to continue making an allowance for doubtful debts of 5 per cent of trade receivables at reporting date. The auditors also discovered that an item of manufacturing property, plant and equipment that originally cost $993 600 when it was acquired on 1 October 2017, suffered catastrophic failure caused through incorrect maintenance on 1 April 2021. As this was not the fault of Windtalker Limited, the insurance company made an immediate payment of $458 900. This amount was credited to the property, plant and equipment account. p. On 1 April 2021, an environmental scientist found that toxic substances were leaching from Windtalker Limited's manufacturing premises. Under the Resource Management Act, Windtalker Limited is liable to contain the leaching in specialised tanks. These need to be removed in 10 years and restore the environment to its original condition. The accountant has determined that in 10 years it will cost approximately $500 000 to remove the tanks and restore the environment to its original condition. The discount rate used Windtalker Limited is 12 per cent. The expenditure will be permitted as a deduction for income tax purposes when it takes place. The Inland Revenue Department has agreed that any adjustments that may be necessary as a result of the above transactions can be made in the current income tax ycar. Auditors remuneration includes $28 000 for income tax services, $15 000 for specialised forensic services and $5 720 for travelling and other disbursements. On 15 April 2022, the company entered into an agreement to construct a new administration building costing $3 100 000. Construction is expected to commence during September 2022. The issue of new shares and loan finance will finance the construction of the administration building. The directors, C. Charles, S. Mall, B. Bailey, C. Irish receive an equal share of the director's fees. In addition, three employees carn $115 000 per annum, while one carns $130 000 per 9 T. S t annum u. The financial statements will be authorised for issue on 31 July 2022 on behalf of the directors by C. Charles and S. Mall. 3 S Sales The following information has been extracted from the accounting records of Windtalker Limited for the reporting period ending 31 March 2022. 2022 2021 $ $ Advertising expenses 562 150 447 800 Bank charges 3750 3 190 Bank overdraft interest 14 590 13 130 8 490 000 7 050 000 Dividends received 99 360 92 500 Gain on sale of asset (land) 228 530 Interest paid on term loan 298 320 325 440 Depreciation manufacturing ppe 536 400 536 400 Depreciation - buildings 75 480 75 480 Directors' fees 397 440 337 800 Purchases 3 327 890 2 559 900 Wages and salaries 2 056 750 1 748 400 Auditor's remuneration 223 720 170 900 Other expenses 386 750 441 200 Income tax expense 47 788 143 352 Contributed equity (6 000 000 ordinary shares) 3 990 360 3 990 360 Retained earnings - 1 April 2021 3 825 768 3 666 260 Revaluation surplus - 1 April 2021 2 227 820 2 227 820 Cash 897 360 200 500 Trade receivables 2 046 490 1 229 600 Prepaid insurance 73 600 73 600 Trade payables 837 700 712 100 Wages and salaries payable 24 200 24 200 Dividends payable 270 000 Provision for audit foc 25 000 Provision for warranty 282 000 282 000 Deferred tax liability 209 820 209 820 Deferred tax asset 91 860 91 860 Income tax paid in advance 285 000 Income tax payable 159 492 Inventory - 1 April 2021 282 200 282 200 Financial asset - Lateautumn Limited 2 312 800 2 312 800 Term loan 4 068 000 4 068 000 Land 5 764 880 5 764 880 Buildings 3 774 000 3 774 000 Buildings - accumulated depreciation 719 160 643 680 Property, plant and equipment - at cost 3 832 300 4 291 200 PPE accumulated depreciation 2 413 800 1 1 877 400 Dividends declared 420 000 180 000 27 711 518 27 711 518 25 003 632 25 003 632 The following additional information is available: a. Buildings are depreciated on the straight-linc basis at 2 per cent per annum. On 1 January 2022, an administration building that originally cost $414 000 (Accumulated depreciation at 31 March 2021 - $40 320) was destroyed by flooding. No adjustment has yet to be made to write off this item. An amount of $300 000 was received from the insurer in full and final settlement of the insurance claim. This amount has been credited to the "Other expenses". Any gains or losses on capital items are not subject to taxation. Depreciation on buildings is not permitted as a deduction for income tax purposes. Ignore any Covid-19 tax requirements. b. On the 1 October 2017, Windtalker Limited upgraded all its property, plant and equipment used in its manufacturing process at a cost of $4 291 200. For accounting purposes, Windtalker Limited depreciates its manufacturing property, plant and equipment over 8 years with Snil residual value. For income tax purposes the Inland Revenue Department depreciates the manufacturing property, plant and equipment over 6 years with nil residual value. c. Trade receivables are non-interest bearing and are generally on terms of 30 to 90 days. On 18 July 2022 it was found that a trade debtor owing Windtalker Limited $66 690 at the reporting date had gone insolvent. d. The term loan of $4 068 000 is due for repayment in full on 31 December 2030. The interest rate is fixed at 8 percent per annum. The loan is secured by a floating charge over the company's assets. e. Included in dividends declared is an amount of $270 000 for the reporting period ending 31 March 2022. The directors plan to obtain the approval of shareholders at the annual general meeting for the payment of this dividend. In addition, the directors have provided an amount of $25 000 in respect of auditor's remuneration (audit fee) in respect of the reporting period ending 31 March 2022. Based on the prior years, the directors believe that the audit fees for the 2022 reporting period will amount to $94 000. f. Windtalker Limited's freehold land was revalued by Paige Maiker NZIV, an independent registered valuer on 24 March 2022. This valuation, based on the fair value of the surrounding properties, showed a value on that date of $6 044 600. g. The financial asset comprises 1 450 000 shares in Lateautumn Limited. At 31 March 2022 the fair value of the shares was $2 995 200. In terms of the entity's business model, any changes in fair value of the financial asset are recognised through other comprehensive income. Any gain on the financial asset will be subject to taxation on disposal. h. Inventory on hand at 31 March 2022 amounted to $246 000. i. The gain on the sale of the asset arose from the disposal of a portion of the company's land that originally cost $830 000. The land had been acquired on 15 June 2021. As the land was excess to the company's requirements, it was disposed of on 3 February 2022. There are no tax considerations as a result of this adjustment Windtalker Limited warrants its products against defects in materials and workmanship for a period of two years. Based on their previous experience, warranty costs are expected to approximate 4.0 per cent of sales. k. Wages and salaries payable at 31 March 2022 amounts to $29 400. 1. Forty per cent of the wages and salary expense must be allocated to cost of sales, and thirty per cent to Distribution expenses. Seventy per cent of director's fees must be allocated to Administration expenses with the balance allocated equally between the two remaining categories. The manufacturing property and equipment depreciation must be allocated to cost of sales. The building depreciation must be split fifty cent cost of sales and thirty per cent administration expenses. Any warranty expenses are charged to cost of sales. m. An examination of the ledger account, 'Other expenses', shows that they comprise the following: 2022 2021 2 Accounting fee Bad debts written off Donations S 82 000 64 800 40 000 19 540 14 500 (165 600) 23 220 63 490 244 800 386 750 Entertainment expenses Fines and penalties Insurance Motor vehicle expenses - administration Motor vehicle expenses - sales representatives Warranty expenses 12 000 147 200 282 000 441 200 Of the entertainment expenses $4 540 will be permitted as a deduction for income tax purposes. Donations and fines and penalties are not permitted as a deduction for income tax purposes. Interest is not permitted as a deduction for income tax purposes until paid. n. The twelve month insurance premium of $134 400 was paid on 1 December 2021. 0. During the course of the audit conducted during April and May 2022, the auditors discovered that sales of $34 000 made to a customer had been debited to trade payables. The directors have decided to continue making an allowance for doubtful debts of 5 per cent of trade receivables at reporting date. The auditors also discovered that an item of manufacturing property, plant and equipment that originally cost $993 600 when it was acquired on 1 October 2017, suffered catastrophic failure caused through incorrect maintenance on 1 April 2021. As this was not the fault of Windtalker Limited, the insurance company made an immediate payment of $458 900. This amount was credited to the property, plant and equipment account. p. On 1 April 2021, an environmental scientist found that toxic substances were leaching from Windtalker Limited's manufacturing premises. Under the Resource Management Act, Windtalker Limited is liable to contain the leaching in specialised tanks. These need to be removed in 10 years and restore the environment to its original condition. The accountant has determined that in 10 years it will cost approximately $500 000 to remove the tanks and restore the environment to its original condition. The discount rate used Windtalker Limited is 12 per cent. The expenditure will be permitted as a deduction for income tax purposes when it takes place. The Inland Revenue Department has agreed that any adjustments that may be necessary as a result of the above transactions can be made in the current income tax ycar. Auditors remuneration includes $28 000 for income tax services, $15 000 for specialised forensic services and $5 720 for travelling and other disbursements. On 15 April 2022, the company entered into an agreement to construct a new administration building costing $3 100 000. Construction is expected to commence during September 2022. The issue of new shares and loan finance will finance the construction of the administration building. The directors, C. Charles, S. Mall, B. Bailey, C. Irish receive an equal share of the director's fees. In addition, three employees carn $115 000 per annum, while one carns $130 000 per 9 T. S t annum u. The financial statements will be authorised for issue on 31 July 2022 on behalf of the directors by C. Charles and S. Mall. 3 Required: Prepare the financial statement and accompanying supporting notes for Windtalker Limited for the reporting period ended 31 March 2022 in a format suitable for external reporting purposes. You must comply with generally accepted accounting practice contained in the Financial Reporting Act 1993 and ALL relevant accounting standards. You are NOT required to provide Accounting Policy Notes, or a Statement of Cash Flows. 4 Accounting fee Bad debts written off Donations S 82 000 64 800 40 000 19 540 14 500 (165 600) 23 220 63 490 244 800 386 750 Entertainment expenses Fines and penalties Insurance Motor vehicle expenses - administration Motor vehicle expenses - sales representatives Warranty expenses 12 000 147 200 282 000 441 200 Of the entertainment expenses $4 540 will be permitted as a deduction for income tax purposes. Donations and fines and penalties are not permitted as a deduction for income tax purposes. Interest is not permitted as a deduction for income tax purposes until paid. n. The twelve month insurance premium of $134 400 was paid on 1 December 2021. 0. During the course of the audit conducted during April and May 2022, the auditors discovered that sales of $34 000 made to a customer had been debited to trade payables. The directors have decided to continue making an allowance for doubtful debts of 5 per cent of trade receivables at reporting date. The auditors also discovered that an item of manufacturing property, plant and equipment that originally cost $993 600 when it was acquired on 1 October 2017, suffered catastrophic failure caused through incorrect maintenance on 1 April 2021. As this was not the fault of Windtalker Limited, the insurance company made an immediate payment of $458 900. This amount was credited to the property, plant and equipment account. p. On 1 April 2021, an environmental scientist found that toxic substances were leaching from Windtalker Limited's manufacturing premises. Under the Resource Management Act, Windtalker Limited is liable to contain the leaching in specialised tanks. These need to be removed in 10 years and restore the environment to its original condition. The accountant has determined that in 10 years it will cost approximately $500 000 to remove the tanks and restore the environment to its original condition. The discount rate used Windtalker Limited is 12 per cent. The expenditure will be permitted as a deduction for income tax purposes when it takes place. The Inland Revenue Department has agreed that any adjustments that may be necessary as a result of the above transactions can be made in the current income tax ycar. Auditors remuneration includes $28 000 for income tax services, $15 000 for specialised forensic services and $5 720 for travelling and other disbursements. On 15 April 2022, the company entered into an agreement to construct a new administration building costing $3 100 000. Construction is expected to commence during September 2022. The issue of new shares and loan finance will finance the construction of the administration building. The directors, C. Charles, S. Mall, B. Bailey, C. Irish receive an equal share of the director's fees. In addition, three employees carn $115 000 per annum, while one carns $130 000 per 9 T. S t annum u. The financial statements will be authorised for issue on 31 July 2022 on behalf of the directors by C. Charles and S. Mall. 3 S Sales The following information has been extracted from the accounting records of Windtalker Limited for the reporting period ending 31 March 2022. 2022 2021 $ $ Advertising expenses 562 150 447 800 Bank charges 3750 3 190 Bank overdraft interest 14 590 13 130 8 490 000 7 050 000 Dividends received 99 360 92 500 Gain on sale of asset (land) 228 530 Interest paid on term loan 298 320 325 440 Depreciation manufacturing ppe 536 400 536 400 Depreciation - buildings 75 480 75 480 Directors' fees 397 440 337 800 Purchases 3 327 890 2 559 900 Wages and salaries 2 056 750 1 748 400 Auditor's remuneration 223 720 170 900 Other expenses 386 750 441 200 Income tax expense 47 788 143 352 Contributed equity (6 000 000 ordinary shares) 3 990 360 3 990 360 Retained earnings - 1 April 2021 3 825 768 3 666 260 Revaluation surplus - 1 April 2021 2 227 820 2 227 820 Cash 897 360 200 500 Trade receivables 2 046 490 1 229 600 Prepaid insurance 73 600 73 600 Trade payables 837 700 712 100 Wages and salaries payable 24 200 24 200 Dividends payable 270 000 Provision for audit foc 25 000 Provision for warranty 282 000 282 000 Deferred tax liability 209 820 209 820 Deferred tax asset 91 860 91 860 Income tax paid in advance 285 000 Income tax payable 159 492 Inventory - 1 April 2021 282 200 282 200 Financial asset - Lateautumn Limited 2 312 800 2 312 800 Term loan 4 068 000 4 068 000 Land 5 764 880 5 764 880 Buildings 3 774 000 3 774 000 Buildings - accumulated depreciation 719 160 643 680 Property, plant and equipment - at cost 3 832 300 4 291 200 PPE accumulated depreciation 2 413 800 1 1 877 400 Dividends declared 420 000 180 000 27 711 518 27 711 518 25 003 632 25 003 632 The following additional information is available: a. Buildings are depreciated on the straight-linc basis at 2 per cent per annum. On 1 January 2022, an administration building that originally cost $414 000 (Accumulated depreciation at 31 March 2021 - $40 320) was destroyed by flooding. No adjustment has yet to be made to write off this item. An amount of $300 000 was received from the insurer in full and final settlement of the insurance claim. This amount has been credited to the "Other expenses". Any gains or losses on capital items are not subject to taxation. Depreciation on buildings is not permitted as a deduction for income tax purposes. Ignore any Covid-19 tax requirements. b. On the 1 October 2017, Windtalker Limited upgraded all its property, plant and equipment used in its manufacturing process at a cost of $4 291 200. For accounting purposes, Windtalker Limited depreciates its manufacturing property, plant and equipment over 8 years with Snil residual value. For income tax purposes the Inland Revenue Department depreciates the manufacturing property, plant and equipment over 6 years with nil residual value. c. Trade receivables are non-interest bearing and are generally on terms of 30 to 90 days. On 18 July 2022 it was found that a trade debtor owing Windtalker Limited $66 690 at the reporting date had gone insolvent. d. The term loan of $4 068 000 is due for repayment in full on 31 December 2030. The interest rate is fixed at 8 percent per annum. The loan is secured by a floating charge over the company's assets. e. Included in dividends declared is an amount of $270 000 for the reporting period ending 31 March 2022. The directors plan to obtain the approval of shareholders at the annual general meeting for the payment of this dividend. In addition, the directors have provided an amount of $25 000 in respect of auditor's remuneration (audit fee) in respect of the reporting period ending 31 March 2022. Based on the prior years, the directors believe that the audit fees for the 2022 reporting period will amount to $94 000. f. Windtalker Limited's freehold land was revalued by Paige Maiker NZIV, an independent registered valuer on 24 March 2022. This valuation, based on the fair value of the surrounding properties, showed a value on that date of $6 044 600. g. The financial asset comprises 1 450 000 shares in Lateautumn Limited. At 31 March 2022 the fair value of the shares was $2 995 200. In terms of the entity's business model, any changes in fair value of the financial asset are recognised through other comprehensive income. Any gain on the financial asset will be subject to taxation on disposal. h. Inventory on hand at 31 March 2022 amounted to $246 000. i. The gain on the sale of the asset arose from the disposal of a portion of the company's land that originally cost $830 000. The land had been acquired on 15 June 2021. As the land was excess to the company's requirements, it was disposed of on 3 February 2022. There are no tax considerations as a result of this adjustment Windtalker Limited warrants its products against defects in materials and workmanship for a period of two years. Based on their previous experience, warranty costs are expected to approximate 4.0 per cent of sales. k. Wages and salaries payable at 31 March 2022 amounts to $29 400. 1. Forty per cent of the wages and salary expense must be allocated to cost of sales, and thirty per cent to Distribution expenses. Seventy per cent of director's fees must be allocated to Administration expenses with the balance allocated equally between the two remaining categories. The manufacturing property and equipment depreciation must be allocated to cost of sales. The building depreciation must be split fifty cent cost of sales and thirty per cent administration expenses. Any warranty expenses are charged to cost of sales. m. An examination of the ledger account, 'Other expenses', shows that they comprise the following: 2022 2021 2 Accounting fee Bad debts written off Donations S 82 000 64 800 40 000 19 540 14 500 (165 600) 23 220 63 490 244 800 386 750 Entertainment expenses Fines and penalties Insurance Motor vehicle expenses - administration Motor vehicle expenses - sales representatives Warranty expenses 12 000 147 200 282 000 441 200 Of the entertainment expenses $4 540 will be permitted as a deduction for income tax purposes. Donations and fines and penalties are not permitted as a deduction for income tax purposes. Interest is not permitted as a deduction for income tax purposes until paid. n. The twelve month insurance premium of $134 400 was paid on 1 December 2021. 0. During the course of the audit conducted during April and May 2022, the auditors discovered that sales of $34 000 made to a customer had been debited to trade payables. The directors have decided to continue making an allowance for doubtful debts of 5 per cent of trade receivables at reporting date. The auditors also discovered that an item of manufacturing property, plant and equipment that originally cost $993 600 when it was acquired on 1 October 2017, suffered catastrophic failure caused through incorrect maintenance on 1 April 2021. As this was not the fault of Windtalker Limited, the insurance company made an immediate payment of $458 900. This amount was credited to the property, plant and equipment account. p. On 1 April 2021, an environmental scientist found that toxic substances were leaching from Windtalker Limited's manufacturing premises. Under the Resource Management Act, Windtalker Limited is liable to contain the leaching in specialised tanks. These need to be removed in 10 years and restore the environment to its original condition. The accountant has determined that in 10 years it will cost approximately $500 000 to remove the tanks and restore the environment to its original condition. The discount rate used Windtalker Limited is 12 per cent. The expenditure will be permitted as a deduction for income tax purposes when it takes place. The Inland Revenue Department has agreed that any adjustments that may be necessary as a result of the above transactions can be made in the current income tax ycar. Auditors remuneration includes $28 000 for income tax services, $15 000 for specialised forensic services and $5 720 for travelling and other disbursements. On 15 April 2022, the company entered into an agreement to construct a new administration building costing $3 100 000. Construction is expected to commence during September 2022. The issue of new shares and loan finance will finance the construction of the administration building. The directors, C. Charles, S. Mall, B. Bailey, C. Irish receive an equal share of the director's fees. In addition, three employees carn $115 000 per annum, while one carns $130 000 per 9 T. S t annum u. The financial statements will be authorised for issue on 31 July 2022 on behalf of the directors by C. Charles and S. Mall. 3 Required: Prepare the financial statement and accompanying supporting notes for Windtalker Limited for the reporting period ended 31 March 2022 in a format suitable for external reporting purposes. You must comply with generally accepted accounting practice contained in the Financial Reporting Act 1993 and ALL relevant accounting standards. You are NOT required to provide Accounting Policy Notes, or a Statement of Cash Flows. 4