Answered step by step

Verified Expert Solution

Question

1 Approved Answer

answers is given but how do we do this? Question No 3 (7 marks) The Belleville Railway Tunnel is considering two potential expansion projects. The

answers is given but how do we do this?

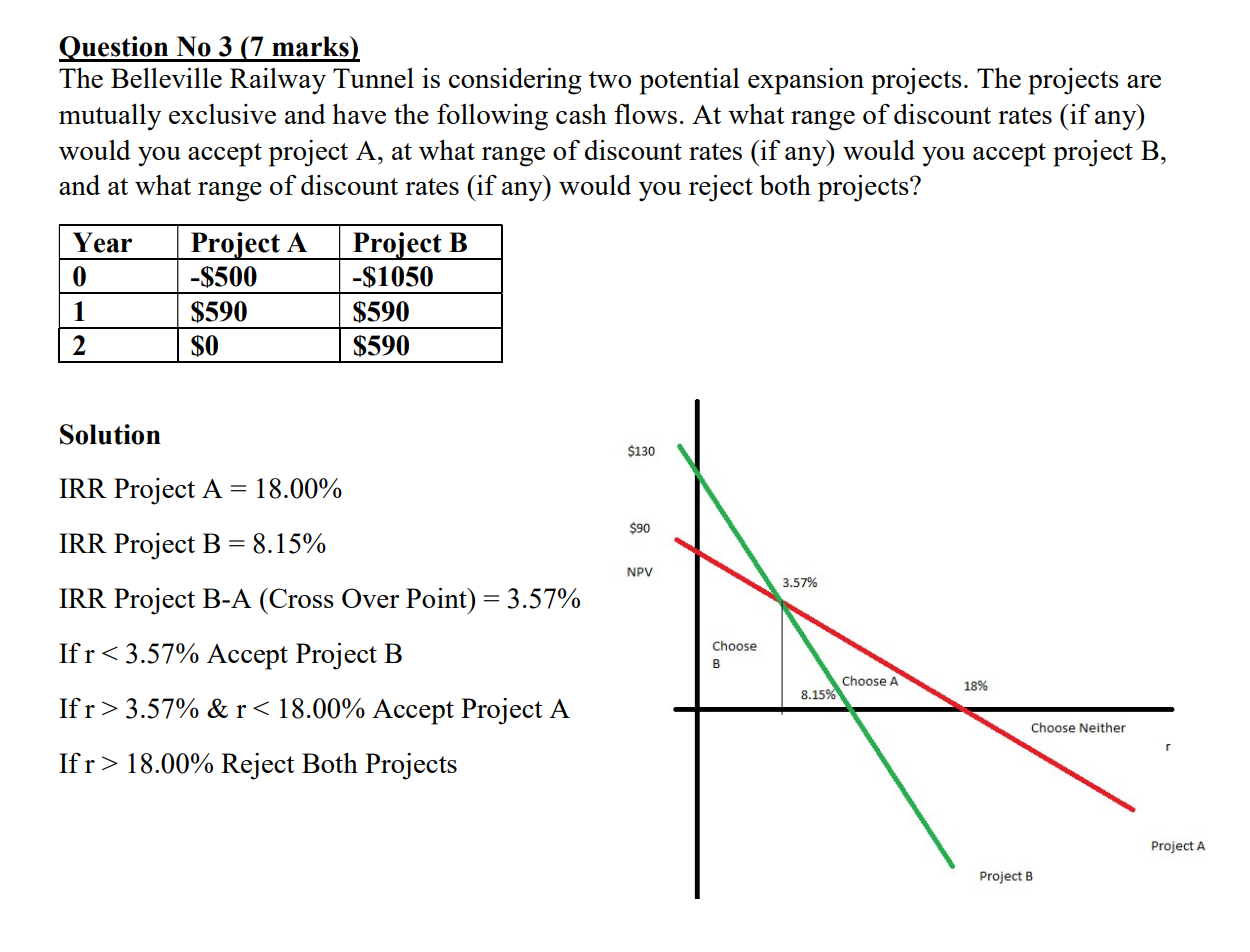

Question No 3 (7 marks) The Belleville Railway Tunnel is considering two potential expansion projects. The projects are mutually exclusive and have the following cash flows. At what range of discount rates (if any) would you accept project A, at what range of discount rates (if any) would you accept project B, and at what range of discount rates (if any) would you reject both projects? | Year Project A Project B 0 -$500 -$1050 $590 $590 2. $0 $590 Solution $130 $90 NPV 3.57% IRR Project A = 18.00% IRR Project B = 8.15% IRR Project B-A (Cross Over Point) = 3.57% Ifr 3.57% &r 18.00% Reject Both Projects Choose Choose A 18% 8.15% Choose Neither Project A Project B Question No 3 (7 marks) The Belleville Railway Tunnel is considering two potential expansion projects. The projects are mutually exclusive and have the following cash flows. At what range of discount rates (if any) would you accept project A, at what range of discount rates (if any) would you accept project B, and at what range of discount rates (if any) would you reject both projects? | Year Project A Project B 0 -$500 -$1050 $590 $590 2. $0 $590 Solution $130 $90 NPV 3.57% IRR Project A = 18.00% IRR Project B = 8.15% IRR Project B-A (Cross Over Point) = 3.57% Ifr 3.57% &r 18.00% Reject Both Projects Choose Choose A 18% 8.15% Choose Neither Project A Project BStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started