Answers must be in formula format.

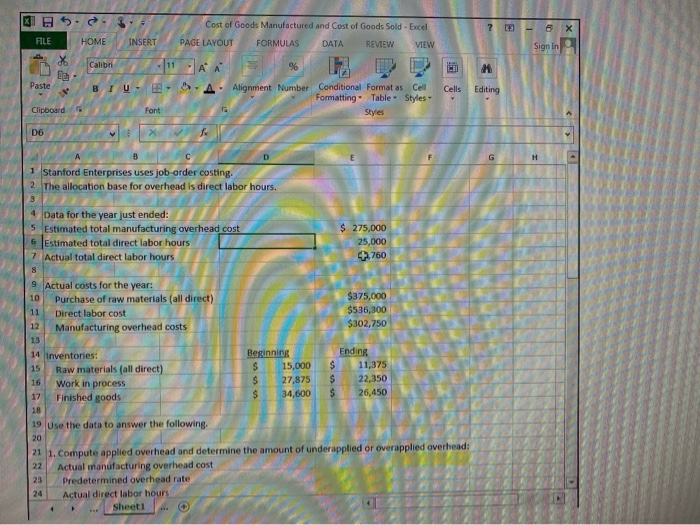

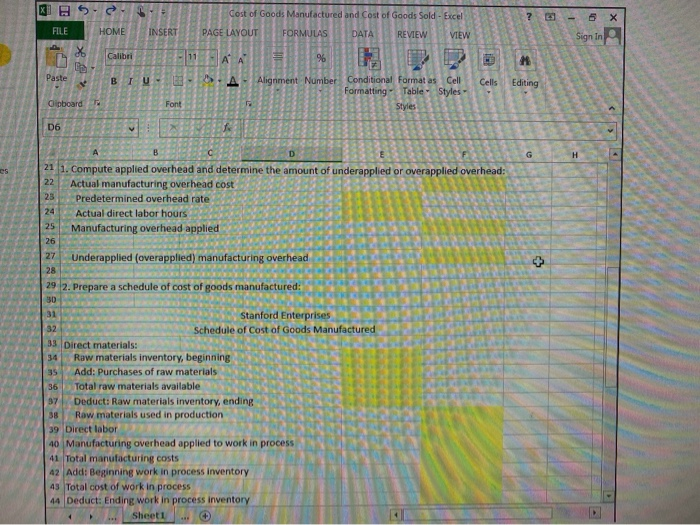

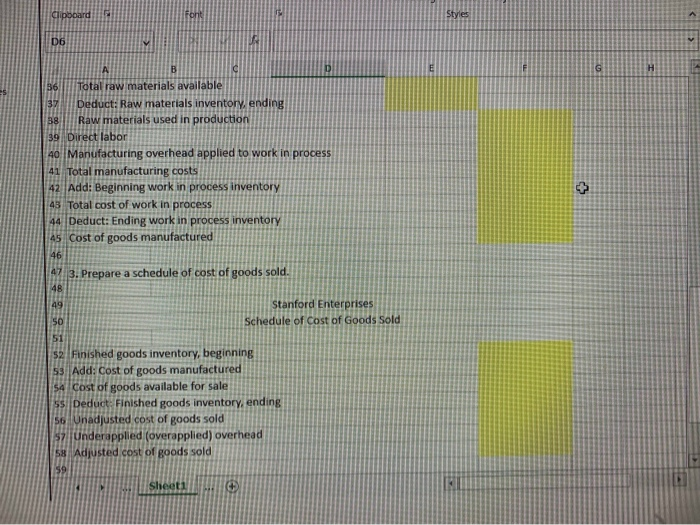

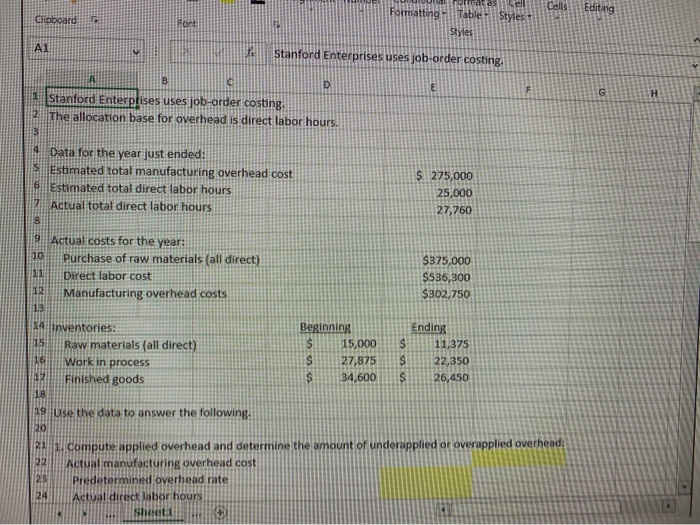

? - x 6 Sign In 5. Cost of Goods Manufactured and Cost of Goods Sold - Excel FILE HOME INSERT PAGE LAYOUT FORMULAS DATA REVIEW VIEW % Call br11AA Paste B T U A Alignment Number Conditional Format as Cell Formatting Table Styles - Clipboard Cells Editing Font one D6 ABC Stanford Enterprises uses job-order costing. 2 The allocation base for overhead is direct labor hours. M Data for the year just ended: 5 Estimated total manufacturing overhead cost Estimated total direct labor hours 7 Actual total direct labor hours $ 275,000 25,000 4760 9 Actual costs for the year: 10 Purchase of raw materials (all direct) 11 Direct labor cost Manufacturing overhead costs $375,000 $536,300 $302,750 14 Inventories: Raw materials (all direct) 16 Work in process Beginning 15,000 $ 27,875 34,600 S $ $ Ending 11.375 22,350 26,450 17 Finished goods mshed goods of underapplied or overapplied overhead: 19 Use the data to answer the following. 20 21 1. Compute applied overhead and determine the amoun Actual manufacturing overhead cost 23 Predetermined overhead rate 24 Actual direct labor hours Sheet1 36 Total raw materials available 37 Deduct: Raw materials inventory, ending Raw materials used in production 39 Direct labor 40 Manufacturing overhead applied to work in process 41 Total manufacturing costs 42 Add: Beginning work in process inventory 43 Total cost of work in process 44 Deduct: Ending work in process inventory 45 Cost of goods manufactured 47 3. Prepare a schedule of cost of goods sold. Stanford Enterprises Schedule of cost of Goods Sold 52 Finished goods inventory, beginning 53 Add: Cost of goods manufactured 54 Cost of goods available for sale 55. Deduct: Finished goods inventory, ending 56 Unadjusted cost of goods sold 57 Underapplied (overapplied) overhead se adjusted cost of goods sold Sheet Table Style Clipboard Stanford Enterprises uses job-order costing. Stanford Enterprises uses job-order costing. The allocation base for overhead is direct labor Data for the year just ended: Estimated total manufacturing overhead cost Estimated total direct labor hours Actual total direct labor hours $ 275,000 25.000 27.760 Actual costs for the year: Purchase of raw materials (all direct) Direct labor cost Manufacturing overhead costs $375,000 $536,300 $302,750 $ nventories: Raw materials (all direct) Work in process Finished goods Beginning 15,000 27,875 34,600 Ending 11,375 22,350 26,450 S 19 Use the data to answer the following: 1. Compute applied overhead and determine the amount of underapplied or overapplied ou 22 | Actual manufacturing overhead cost Predetermined overhead rate 24|||||| Actual direct labor hours Sheet