Answered step by step

Verified Expert Solution

Question

1 Approved Answer

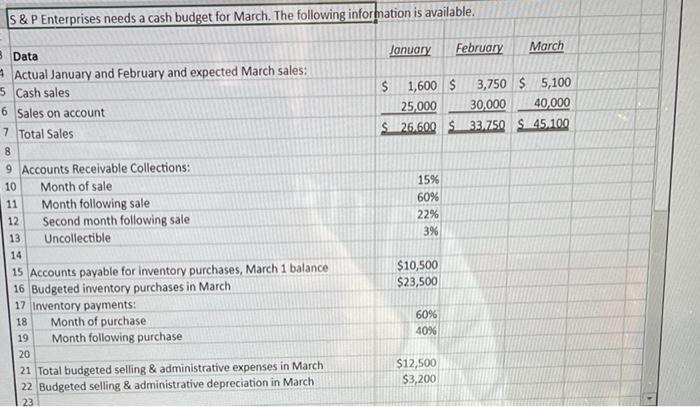

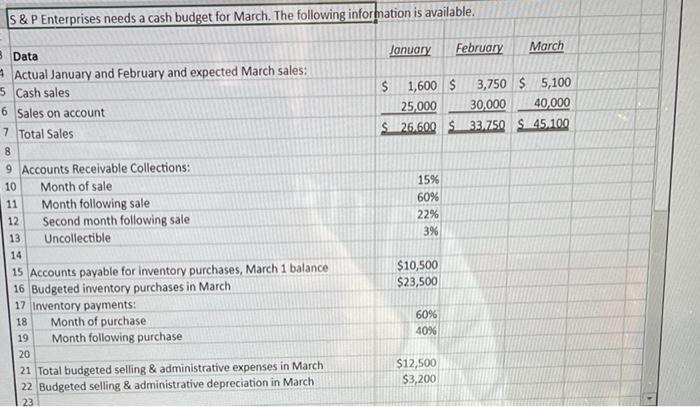

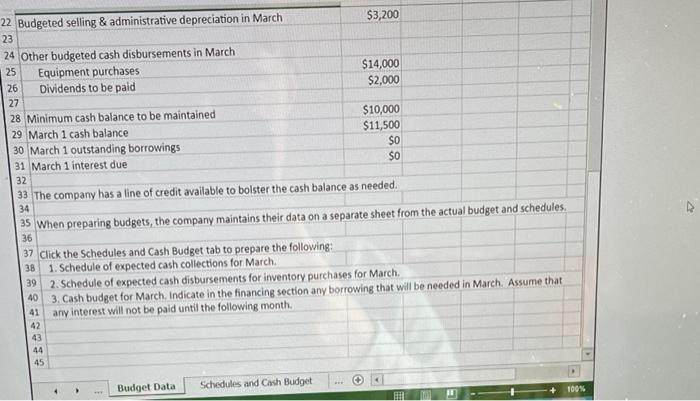

answers must be written as a formula on the spreadsheet S & P Enterprises needs a cash budget for March. The following information is available.

answers must be written as a formula on the spreadsheet

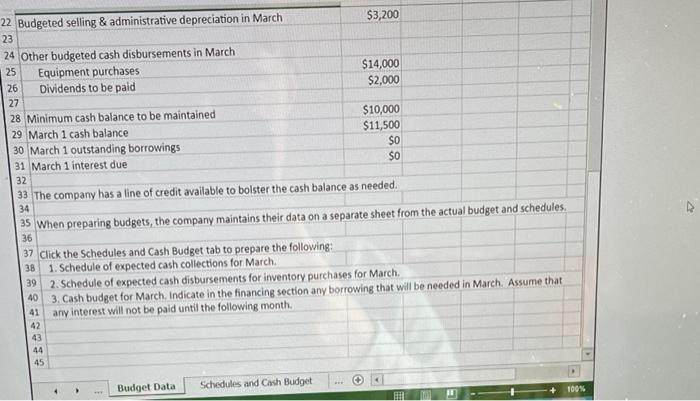

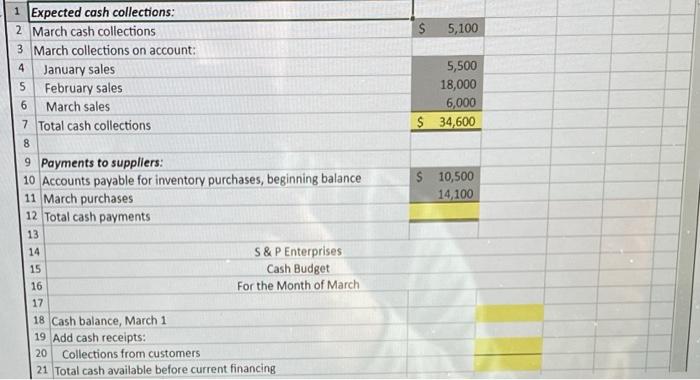

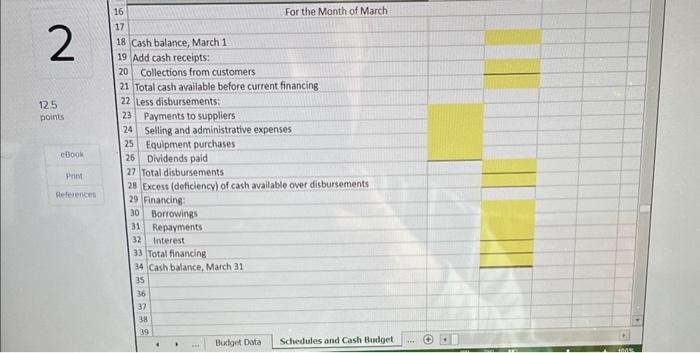

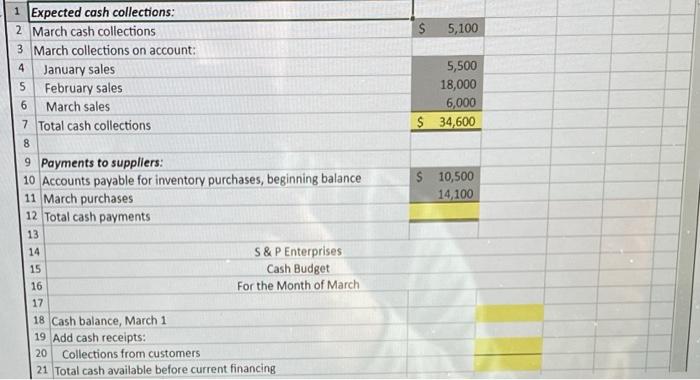

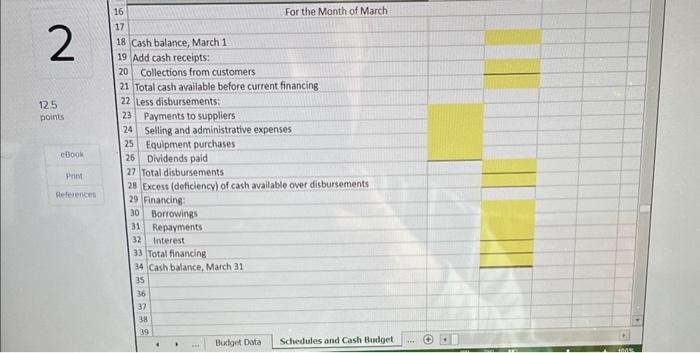

S \& P Enterprises needs a cash budget for March. The following information is available. Data January February March Actual January and February and expected March sales: 5 Cash sales \begin{tabular}{|rr|rr|r|r|} \hline$ & 1,600 & $ & 3,750 & $5,100 \\ \hline & 25,000 & & 30,000 & & 40,000 \\ \hline$ & 26,600 & & $33,750 & & $45,100 \\ \hline \end{tabular} Total Sales Accounts Receivable Collections: \begin{tabular}{|r|l|r|r|} \hline 10 & Month of sale & 15% \\ \hline 11 & Month following sale & 60% \\ \hline 12 & Second month following sale & 22% \\ \hline 13 & Uncollectible & 3% \\ \hline \end{tabular} 14 15 Accounts payable for inventory purchases, March 1 balance 16 Budgeted inventory purchases in March $10,500$23,500 17 Inventory payments: \begin{tabular}{l|l} 18 & Month of purchase \\ \hline 19 & Month following purchase \\ \hline 20 & \end{tabular} 60% 40% Total budgeted selling \& administrative expenses in March 22 Budgeted selling \& administrative depreciation in March $12,500 $3,200 Budgeted selling \& administrative depreciation in March $3,200 23 24 Other budgeted cash disbursements in March 25 Equipment purchases 26 Dividends to be paid $14,000$2,000 28 Minimum cash balance to be maintained 29 March 1 cash balance 30 March 1 outstanding borrowings 31 March 1 interest due 32 33 The company has a line of credit available to bolster the cash balance as needed. 34 35 When preparing budgets, the company maintains their data on a separate sheet from the actual budget and schedules. 36 37 Click the Schedules and Cash Budget tab to prepare the following: 38 1. Schedule of expected cash collections for March. 39 2. Schedule of expected cash disbursements for inventory purchases for March. 3. Cash budget for March. Indicate in the financing section any borrowing that will be needed in March. Assume that anv interest will not be paid until the following month. 1 Expected cash collections: 2 March cash collections 3 March collections on account: \begin{tabular}{|l|l} \hline 4 & January sales \\ \hline 5 & February sales \\ \hline 6 & March sales \\ \hline 7 & Total cash collections \\ \hline 8 & \end{tabular} 55,100 9 Payments to suppliers: 10 Accounts payable for inventory purchases, beginning balance 11 March purchases \begin{tabular}{rr} 5 & 10,500 \\ 14,100 \\ \hline \end{tabular} 12 Total cash payments 13 \begin{tabular}{l|c} 14 & S \& P Enterprises \\ 15 & Cash Budget \\ \hline 16 & Por the Month of March \end{tabular} For the Month of March Cash balance, March 1 Add cash receipts: 20 Collections from customers 21 Total cash available before current financing \( 1 6 \longdiv { \text { For the Month of March } } \) 17 18 Cash balance, March 1 19 Add cash receipts: 20 Collections from customers 21 Total cash available before current financing. 125 22 Less disbursements: points 23 Payments to suppliers Selling and administrative expenses Equipment purchases Dividends paid Total disbursements 28 Excess (deficiency) of cash available over disbursements 29 Financing: 30 Borrowings 31 Repayments 32 Interest 33 Total financing 34 Cash balance, March 31 35 36 37 38 39

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started