Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Answers needed for each part with step by step solution thanks :) An insurance company is currently carrying out a premium pricing of two classes

Answers needed for each part with step by step solution thanks :)

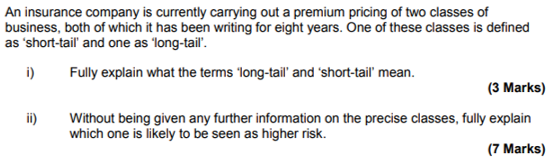

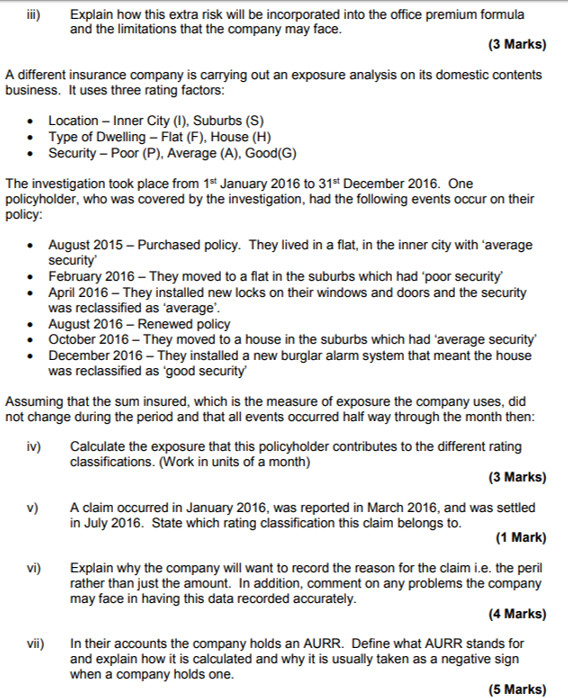

An insurance company is currently carrying out a premium pricing of two classes of business, both of which it has been writing for eight years. One of these classes is defined as 'short-tail' and one as 'long-tail'. i) Fully explain what the terms 'long-tail' and 'short-tail' mean. (3 Marks) Without being given any further information on the precise classes, fully explain which one is likely to be seen as hig her risk (7 Marks) Explain how this extra risk will be incorporated into the office premium formula and the limitations that the company may face (3 Marks) A different insurance company is carrying out an exposure analysis on its domestic contents business. It uses three rating factors: Location Inner City (I), Suburbs (S) Type of Dwelling Flat (F), House (H) Security - Poor (P), Average (A), Good(G) The investigation took place from 1 January 2016 to 31st December 2016. One policyholder, who was covered by the investigation, had the following events occur on their policy: August 2015- Purchased policy. They lived in a flat, in the inner city with 'average security February 2016 They moved to a flat in the suburbs which had 'poor security April 2016 They installed new locks on their windows and doors and the security was reclassified as average' August 2016-Renewed policy October 2016 They moved to a house in the suburbs which had 'average security December 2016- They installed a new burglar alarm system that meant the house was reclassified as 'good security Assuming that thee sum insured, which is the measure of exposure the company uses, did not change during the period and that all events occurred half way through the month then: iv) Calculate the exposure that this policyholder contributes to the different rating classifications. (Work in units of a month) (3 Marks) A claim occurred in January 2016, was reported in March 2016, and was settled in July 2016. State which rating classification this claim belongs to. v) (1 Mark) vi Explain why the company will want to record the reason for the claim i.e. the peril rather than just the amount. In addition, comment on any problems the company may face in having this data recorded accurately (4 Marks) vii) In their accounts the company holds an AURR. Define what AURR stands for and explain how it is calculated and why it is usually taken as a negative sign when a company holds one. (5 Marks) An insurance company is currently carrying out a premium pricing of two classes of business, both of which it has been writing for eight years. One of these classes is defined as 'short-tail' and one as 'long-tail'. i) Fully explain what the terms 'long-tail' and 'short-tail' mean. (3 Marks) Without being given any further information on the precise classes, fully explain which one is likely to be seen as hig her risk (7 Marks) Explain how this extra risk will be incorporated into the office premium formula and the limitations that the company may face (3 Marks) A different insurance company is carrying out an exposure analysis on its domestic contents business. It uses three rating factors: Location Inner City (I), Suburbs (S) Type of Dwelling Flat (F), House (H) Security - Poor (P), Average (A), Good(G) The investigation took place from 1 January 2016 to 31st December 2016. One policyholder, who was covered by the investigation, had the following events occur on their policy: August 2015- Purchased policy. They lived in a flat, in the inner city with 'average security February 2016 They moved to a flat in the suburbs which had 'poor security April 2016 They installed new locks on their windows and doors and the security was reclassified as average' August 2016-Renewed policy October 2016 They moved to a house in the suburbs which had 'average security December 2016- They installed a new burglar alarm system that meant the house was reclassified as 'good security Assuming that thee sum insured, which is the measure of exposure the company uses, did not change during the period and that all events occurred half way through the month then: iv) Calculate the exposure that this policyholder contributes to the different rating classifications. (Work in units of a month) (3 Marks) A claim occurred in January 2016, was reported in March 2016, and was settled in July 2016. State which rating classification this claim belongs to. v) (1 Mark) vi Explain why the company will want to record the reason for the claim i.e. the peril rather than just the amount. In addition, comment on any problems the company may face in having this data recorded accurately (4 Marks) vii) In their accounts the company holds an AURR. Define what AURR stands for and explain how it is calculated and why it is usually taken as a negative sign when a company holds oneStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started