Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Answers only Assume the following (1) sales =$200,000, (2) unit sales =10,000, (3) the contribution margin ratio =27%, and (4) net operating income =$10,000. Given

Answers only

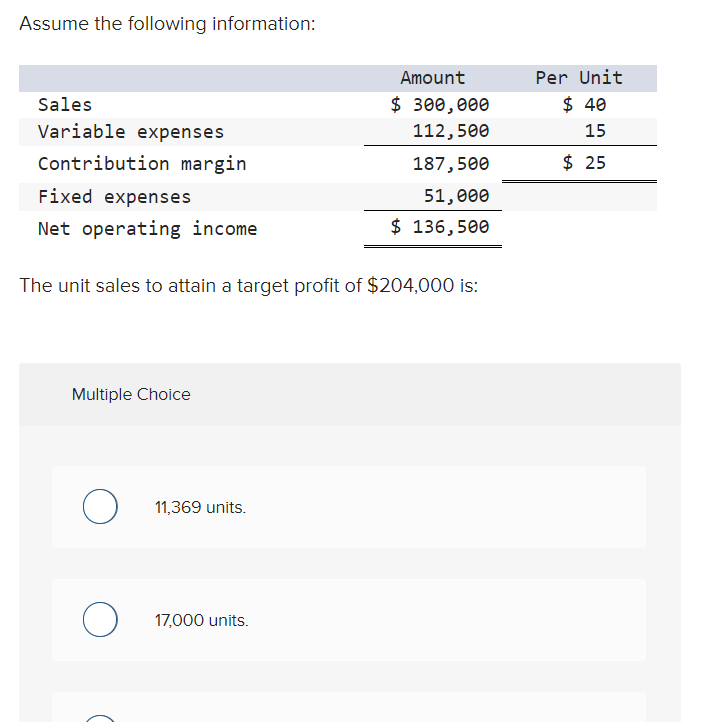

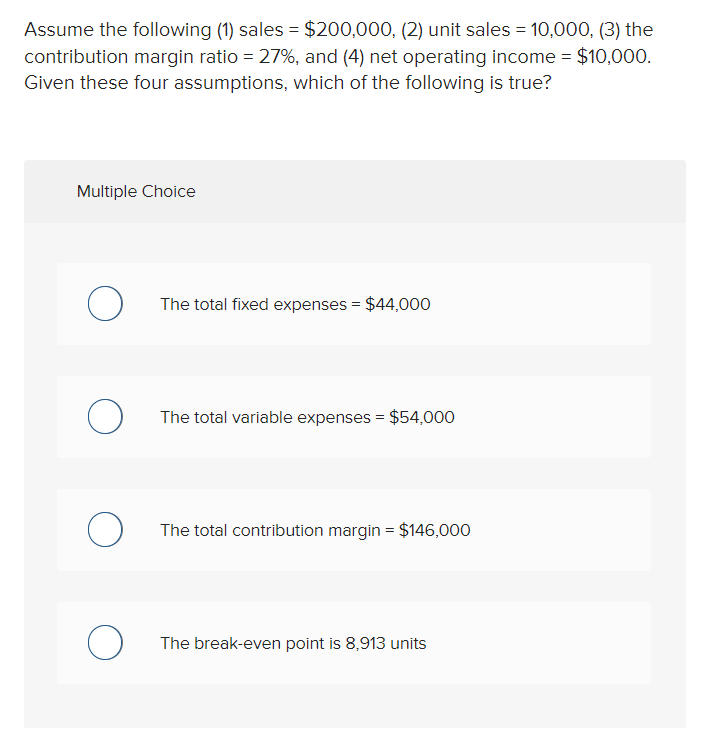

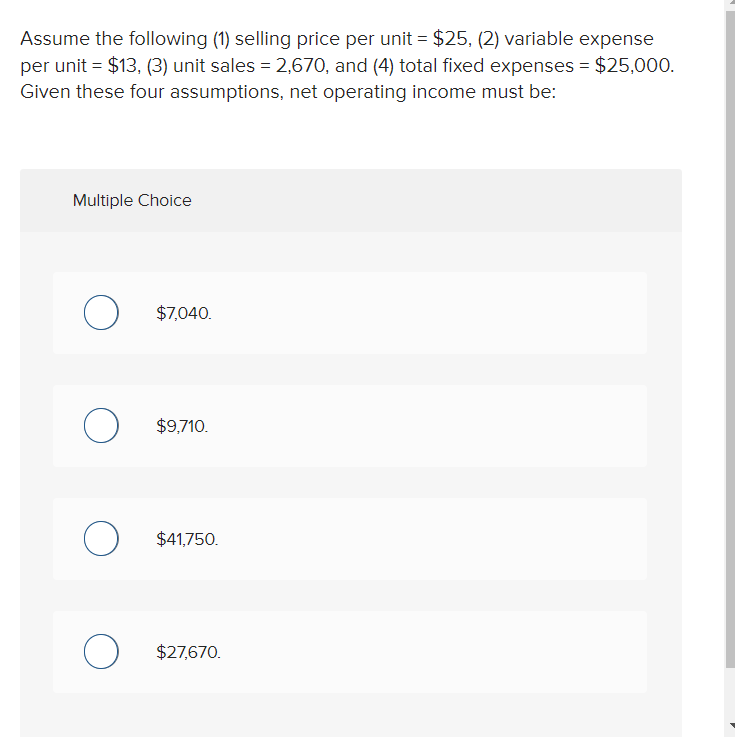

Assume the following (1) sales =$200,000, (2) unit sales =10,000, (3) the contribution margin ratio =27%, and (4) net operating income =$10,000. Given these four assumptions, which of the following is true? Multiple Choice The total fixed expenses =$44,000 The total variable expenses =$54,000 The total contribution margin =$146,000 The break-even point is 8,913 units Assume the following information: The unit sales to attain a target profit of $204,000 is: Multiple Choice 11,369 units. 17,000 units. Assume the following (1) selling price per unit =$25, (2) variable expense per unit =$13,(3) unit sales =2,670, and (4) total fixed expenses =$25,000. Given these four assumptions, net operating income must be: Multiple Choice $7,040. $9,710 $41,750. $27,670

Assume the following (1) sales =$200,000, (2) unit sales =10,000, (3) the contribution margin ratio =27%, and (4) net operating income =$10,000. Given these four assumptions, which of the following is true? Multiple Choice The total fixed expenses =$44,000 The total variable expenses =$54,000 The total contribution margin =$146,000 The break-even point is 8,913 units Assume the following information: The unit sales to attain a target profit of $204,000 is: Multiple Choice 11,369 units. 17,000 units. Assume the following (1) selling price per unit =$25, (2) variable expense per unit =$13,(3) unit sales =2,670, and (4) total fixed expenses =$25,000. Given these four assumptions, net operating income must be: Multiple Choice $7,040. $9,710 $41,750. $27,670 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started