Answered step by step

Verified Expert Solution

Question

1 Approved Answer

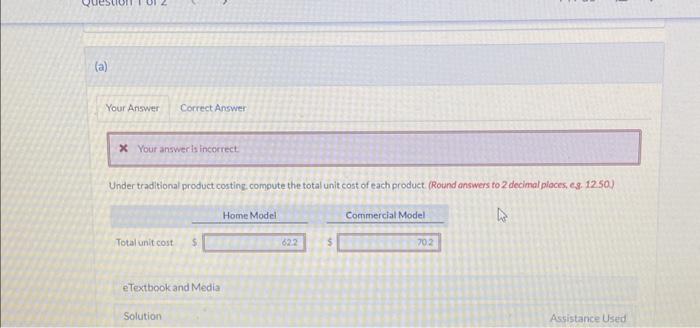

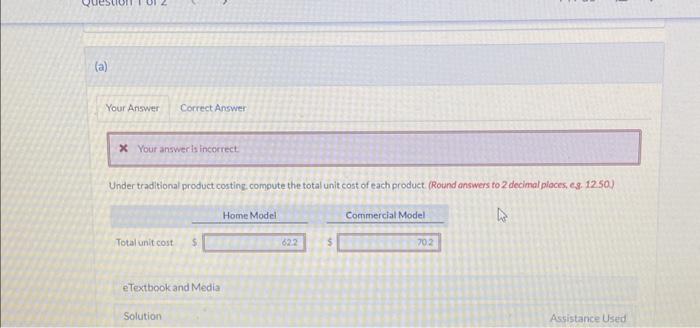

Answers Only part D and E Under traditional product costing. compute the total unit cost of each product (Rotand answers to 2 decimal pioces, es.

Answers Only part D and E

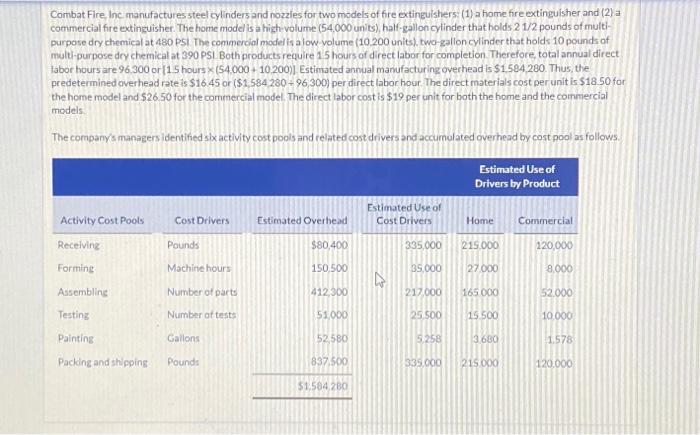

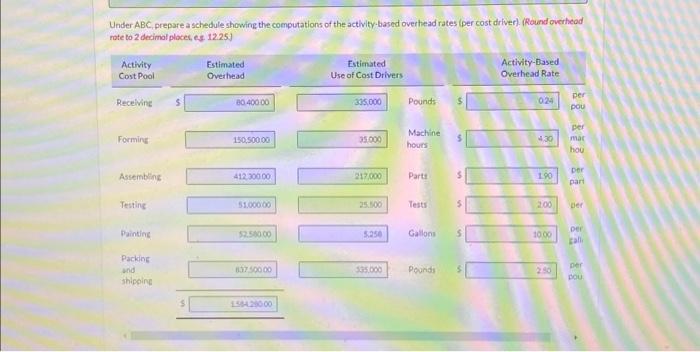

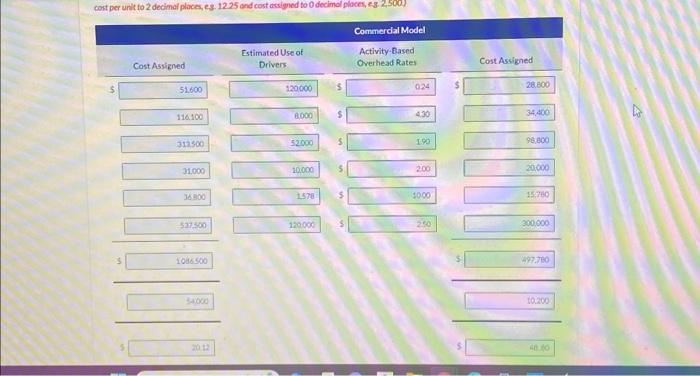

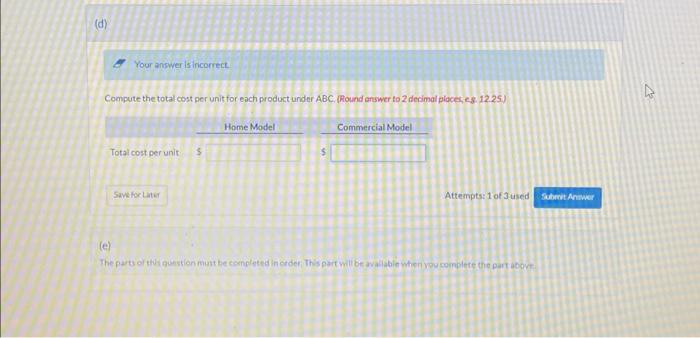

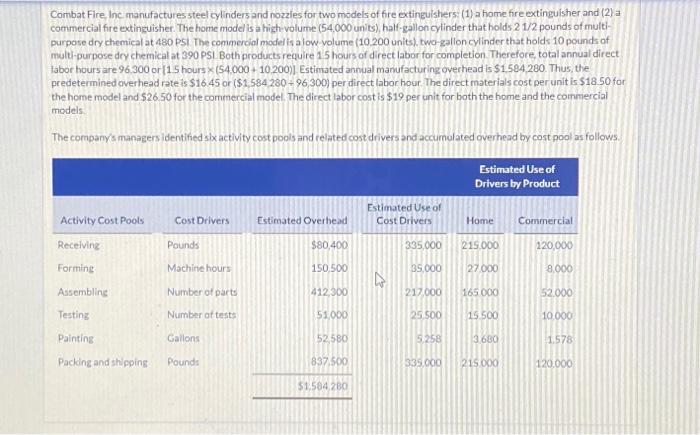

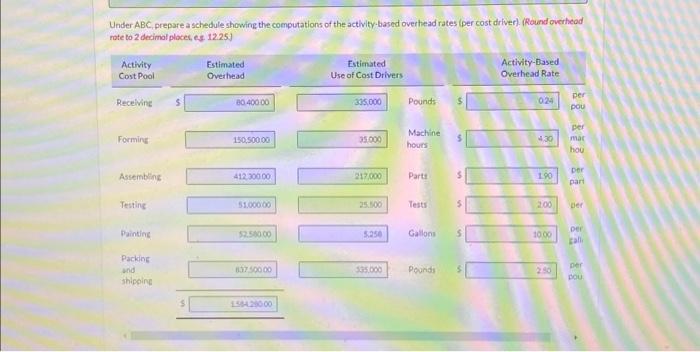

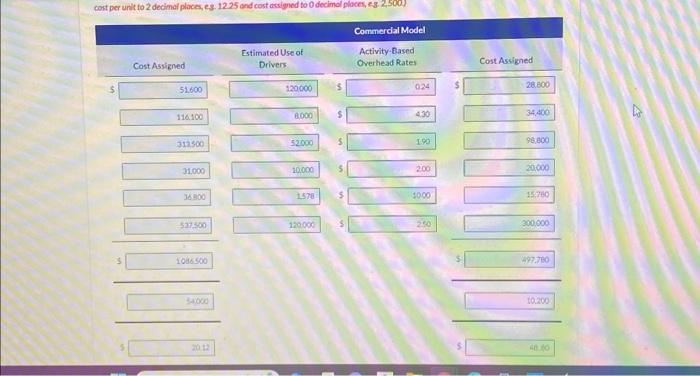

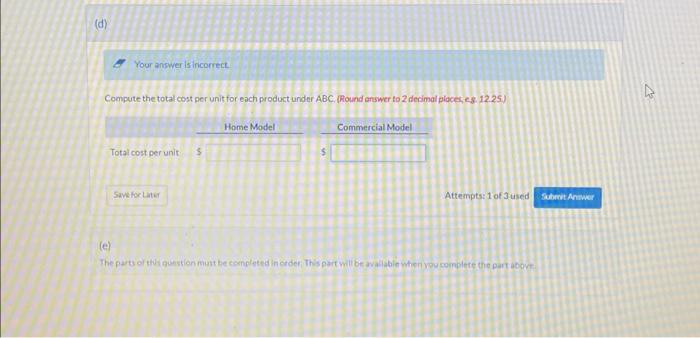

Under traditional product costing. compute the total unit cost of each product (Rotand answers to 2 decimal pioces, es. 1250 ) Under ABC, prepare a schedule showirg the computations of the activity-based over head rates (per cost driver). (Round overheod rote to 2 decimal places, es 12.25 The parts of this question must be completed in order. This part will be available when you complete the part above. cont per urit fo 2 decimai places, 5.3 .12 .25 end cost assigned to 0 decimol places, es. 2,500) Compute the total cost per unit for each product under ABC, (Round enswer to 2 decimal places 3. 12.25) Attempts: 1 of 3 used (e) Combat Fire, inc manufactures steel cylinders and nozzles for two models of fire extinguishers: (1) a home fire extinguisher and (2) a commercial fire extinguisher. The home model is a high volume ( 54,000 units), half-galloncylinder that holds 21/2 pounds of multipurpose dry chemical at 430 PSI. The commercial model is a low -volume (10.200 units), two-gallon cylinder that holds 10 pounds of multi-purpose dry chemical at 390 PSI Both products require 15 hours of direct labor for completion. Therefore, total annual direct labor hours are 96,300 or [1,5 hours ($4,000+10,200)]. Estimated annual manufacturing overhead is $1,584,280. Thus, the predetermined overhead rate is $16.45 or ($1,584,28096,300) per direct labor hour-The direct materials cost per unit is $1850 for the home model and $26.50 for the commercial model. The direct labor cost is $19 per unit for both the home and the commercial models. The company's managers identified six activity cost pools and related cost drivers and accumulated overhead by cost pool as follows

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started