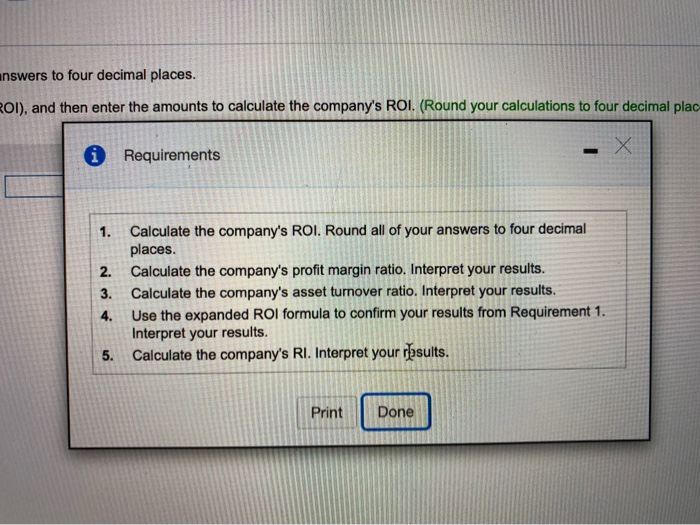

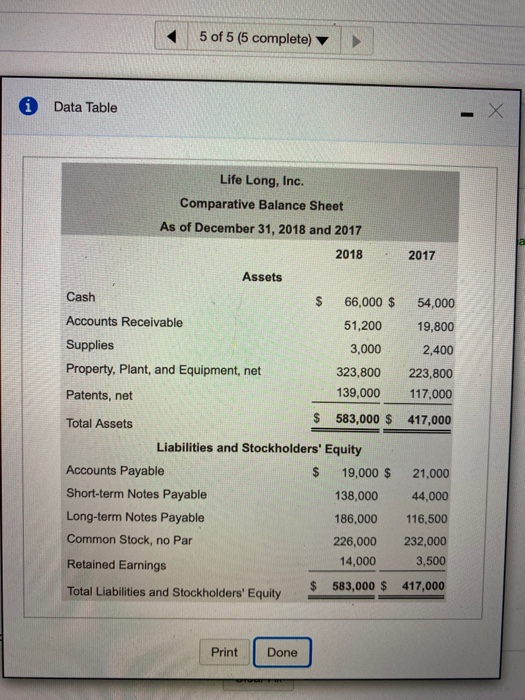

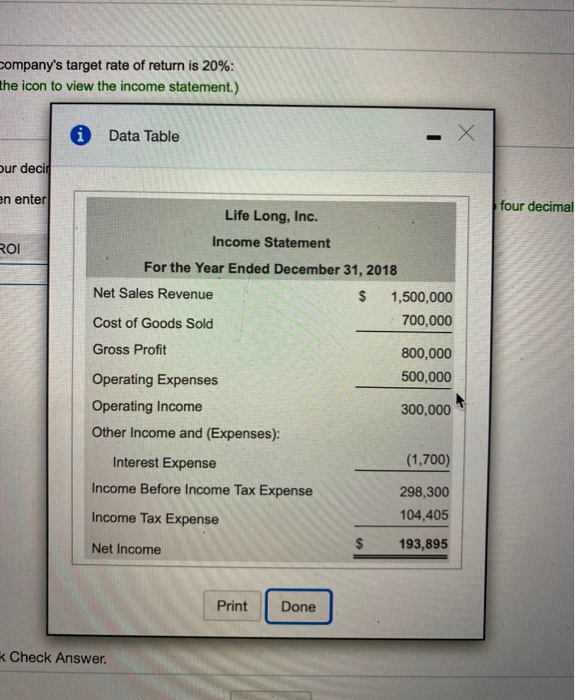

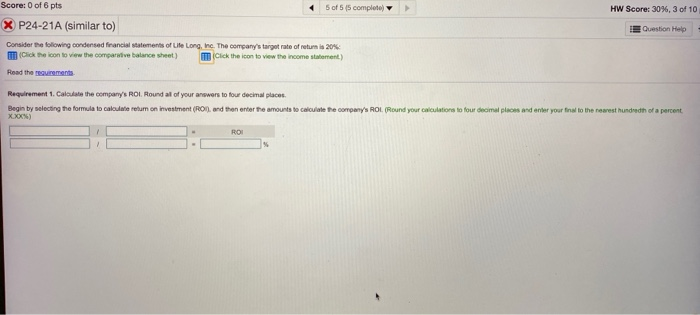

answers to four decimal places. Ol), and then enter the amounts to calculate the company's ROI. (Round your calculations to four decimal plac * Requirements 1. 2. 3. 4. Calculate the company's ROI. Round all of your answers to four decimal places. Calculate the company's profit margin ratio. Interpret your results. Calculate the company's asset turnover ratio. Interpret your results. Use the expanded ROI formula to confirm your results from Requirement 1. Interpret your results. Calculate the company's RI. Interpret your rosults. 5. Print Done 5 of 5 (5 complete) 0 Data Table Life Long, Inc. Comparative Balance Sheet As of December 31, 2018 and 2017 2018 2017 Assets Cash $ Accounts Receivable Supplies Property, Plant, and Equipment, net 66,000 $ 54,000 51,200 19,800 3,000 2,400 323,800 223,800 139,000 117,000 583,000 $ 417,000 Patents, net Total Assets Liabilities and Stockholders' Equity Accounts Payable $ 19,000 $ 21,000 Short-term Notes Payable 138,000 44,000 Long-term Notes Payable 186,000 116,500 Common Stock, no Par 226,000 232,000 Retained Earnings 14,000 3,500 Total Liabilities and Stockholders' Equity 583,000 $ 417,000 Print Done company's target rate of return is 20%: the icon to view the income statement.) Data Table - X our decir en enter four decimal ROI Life Long, Inc. Income Statement For the Year Ended December 31, 2018 Net Sales Revenue $ 1,500,000 Cost of Goods Sold 700,000 Gross Profit 800,000 Operating Expenses 500,000 Operating Income 300,000 Other Income and (Expenses): Interest Expense (1,700) Income Before Income Tax Expense 298,300 Income Tax Expense 104,405 Net Income $ 193,895 Print Done * Check Answer. Score: 0 of 6 pts 5 of 5 (5 completo HW Score: 30%, 3 of 10 Question Help P24-21A (similar to) Consider the following condensed financial statements of Lite Long, Inc. The company's targot rate of return is 20% Click the icon to view the comparative balance sheet) Click the icon to view the income statement) Read the requirements Requirement 1. Calculate the company's ROI. Round all of your answers to four decimal places Begin by selecting the formula to calculate retum on investment (RON, and then enter the amounts to calculate the company's ROI Round your calculations to four decimal plans and enter your final to the newest hududh of a percent xxx) ROI