Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Anthony is 58 years old. During the current year of assessment, he earned a salary R544 000 . He earned local dividends of R2 000

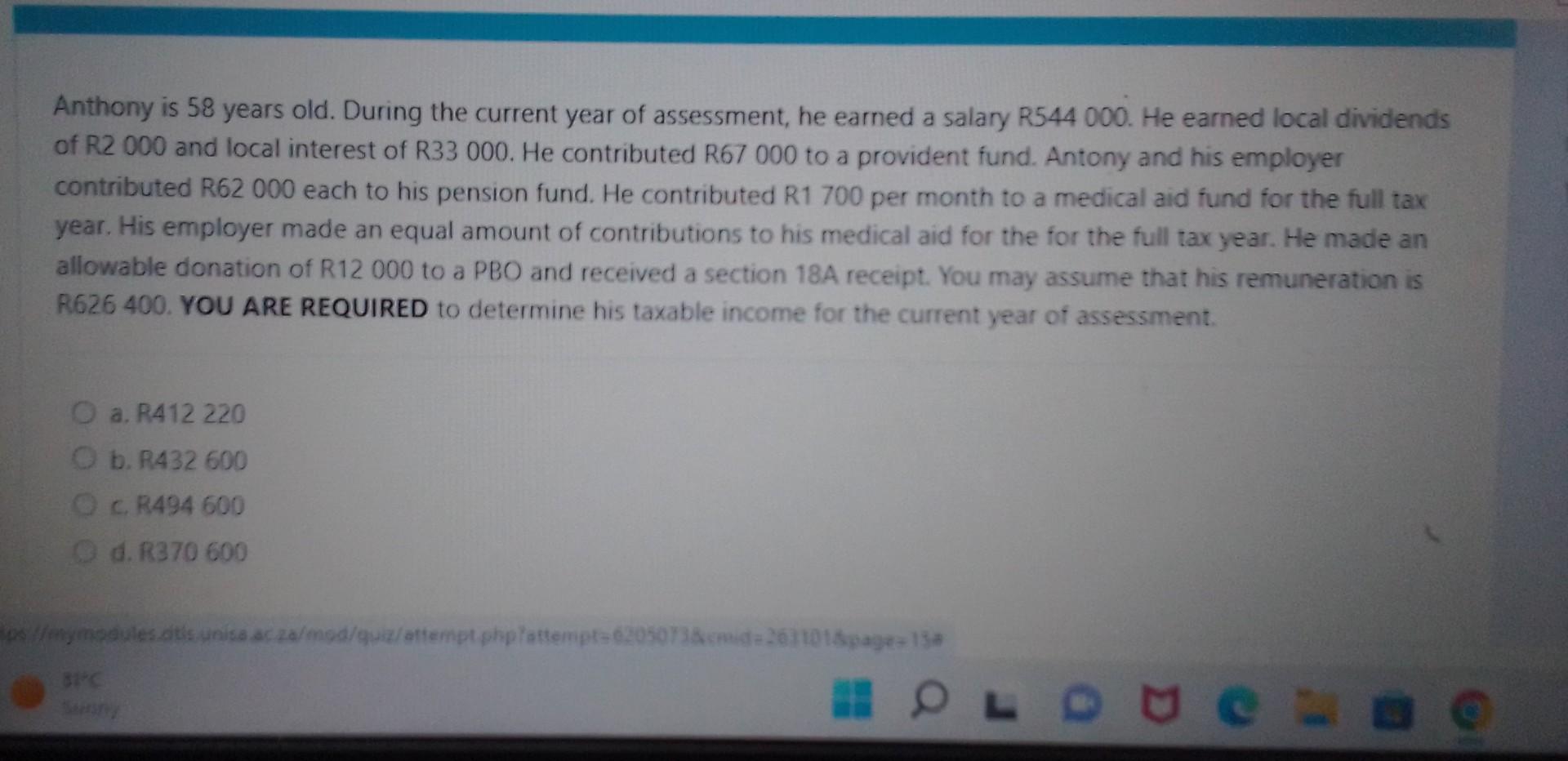

Anthony is 58 years old. During the current year of assessment, he earned a salary R544 000 . He earned local dividends of R2 000 and local interest of R33 000 . He contributed R67 000 to a provident fund. Antony and his employer contributed R62 000 each to his pension fund. He contributed R1 700 per month to a medical aid fund for the full tax year. His employer made an equal amount of contributions to his medical aid for the for the full tax year. He made an allowable donation of R12000 to a PBO and received a section 18A receipt. You may assume that his remuneration is R626 400. YOU ARE REQUIRED to determine his taxable income for the current year of assessment. a. R412 220 b. P432600 c. R494 600 d. R370 600

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started