Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Anticipating that in a few years they will have to purchase a new and expensive piece of machinery, a Production Company set up a saving

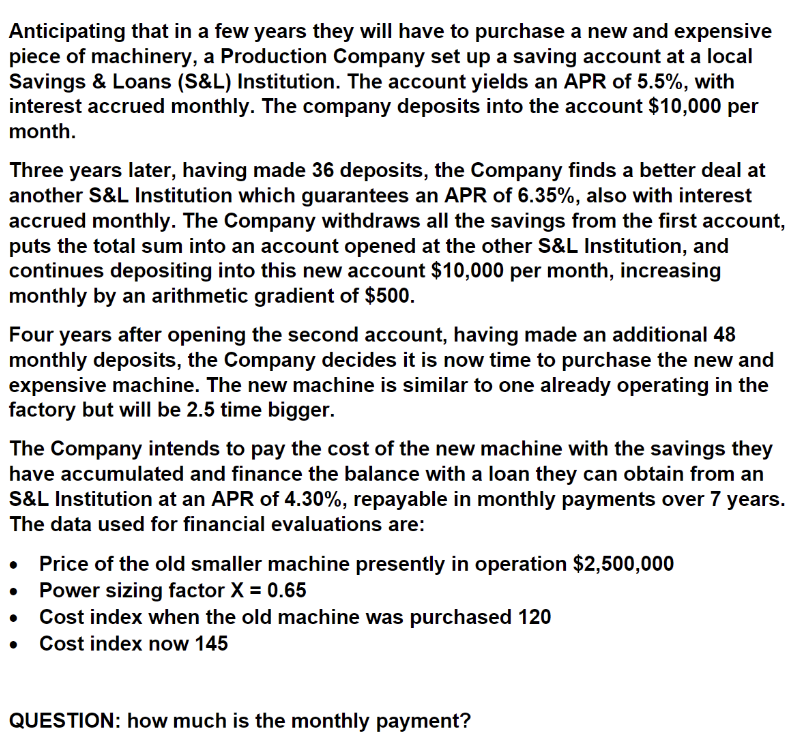

Anticipating that in a few years they will have to purchase a new and expensive piece of machinery, a Production Company set up a saving account at a local Savings \& Loans (S\&L) Institution. The account yields an APR of 5.5%, with interest accrued monthly. The company deposits into the account $10,000 per month. Three years later, having made 36 deposits, the Company finds a better deal at another S\&L Institution which guarantees an APR of 6.35%, also with interest accrued monthly. The Company withdraws all the savings from the first account, puts the total sum into an account opened at the other S\&L Institution, and continues depositing into this new account $10,000 per month, increasing monthly by an arithmetic gradient of $500. Four years after opening the second account, having made an additional 48 monthly deposits, the Company decides it is now time to purchase the new and expensive machine. The new machine is similar to one already operating in the factory but will be 2.5 time bigger. The Company intends to pay the cost of the new machine with the savings they have accumulated and finance the balance with a loan they can obtain from an S\&L Institution at an APR of 4.30%, repayable in monthly payments over 7 years. The data used for financial evaluations are: - Price of the old smaller machine presently in operation $2,500,000 - Power sizing factor X=0.65 - Cost index when the old machine was purchased 120 - Cost index now 145 QUESTION: how much is the monthly payment

Anticipating that in a few years they will have to purchase a new and expensive piece of machinery, a Production Company set up a saving account at a local Savings \& Loans (S\&L) Institution. The account yields an APR of 5.5%, with interest accrued monthly. The company deposits into the account $10,000 per month. Three years later, having made 36 deposits, the Company finds a better deal at another S\&L Institution which guarantees an APR of 6.35%, also with interest accrued monthly. The Company withdraws all the savings from the first account, puts the total sum into an account opened at the other S\&L Institution, and continues depositing into this new account $10,000 per month, increasing monthly by an arithmetic gradient of $500. Four years after opening the second account, having made an additional 48 monthly deposits, the Company decides it is now time to purchase the new and expensive machine. The new machine is similar to one already operating in the factory but will be 2.5 time bigger. The Company intends to pay the cost of the new machine with the savings they have accumulated and finance the balance with a loan they can obtain from an S\&L Institution at an APR of 4.30%, repayable in monthly payments over 7 years. The data used for financial evaluations are: - Price of the old smaller machine presently in operation $2,500,000 - Power sizing factor X=0.65 - Cost index when the old machine was purchased 120 - Cost index now 145 QUESTION: how much is the monthly payment Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started