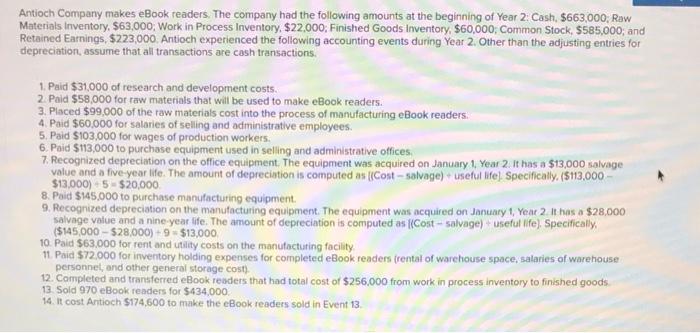

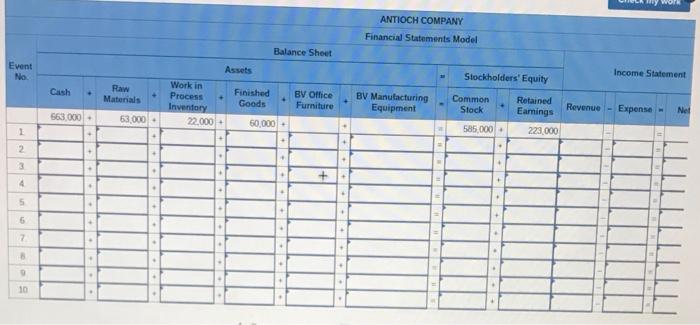

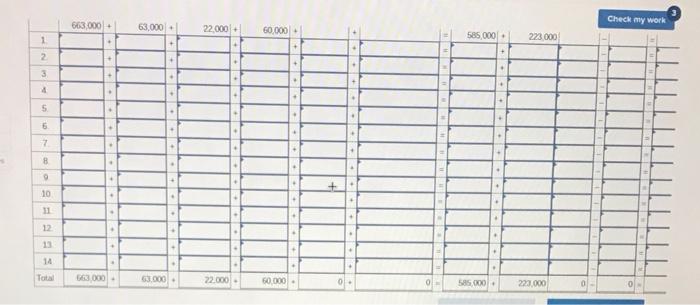

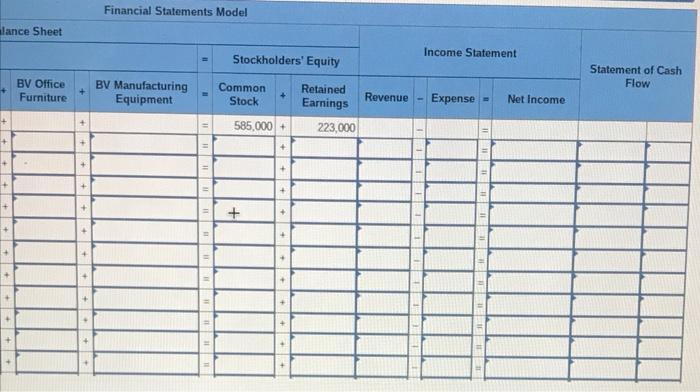

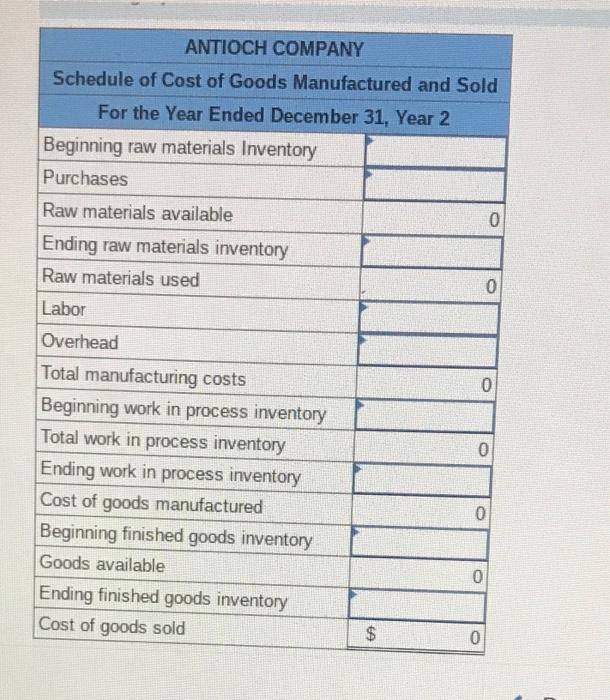

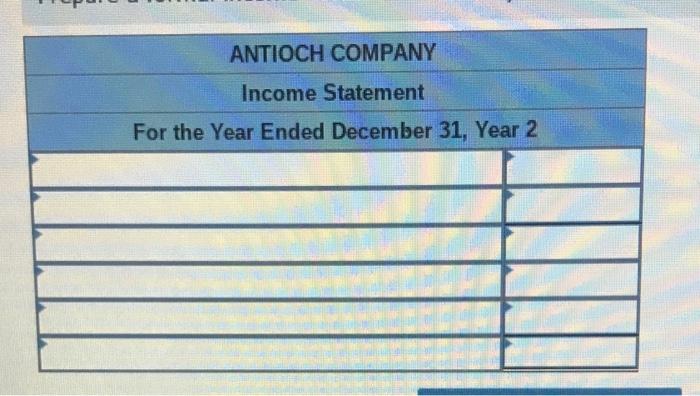

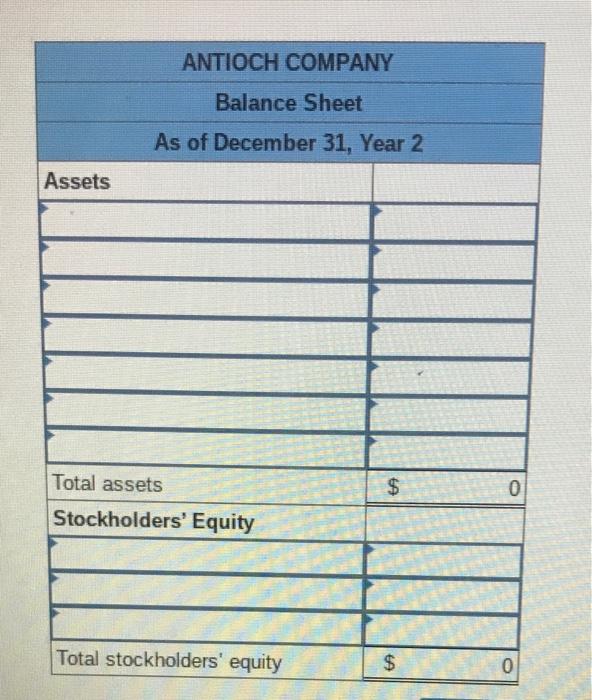

Antioch Company makes eBook readers. The company had the following amounts at the beginning of Year 2. Cash, $663,000, Raw Materials Inventory $63,000; Work in Process Inventory, $22,000, Finished Goods Inventory, $60,000, Common Stock, $585,000; and Retained Earnings, $223,000 Antioch experienced the following accounting events during Year 2. Other than the adjusting entries for depreciation, assume that all transactions are cash transactions 1. Paid $31,000 of research and development costs. 2. Poid $58,000 for raw materials that will be used to make eBook readers. 3. Placed $99,000 of the raw materials cost into the process of manufacturing eBook readers. 4. Paid $60,000 for salaries of selling and administrative employees 5. Paid S103,000 for wages of production workers. 6. Poid $113,000 to purchase equipment used in selling and administrative offices, 7. Recognized depreciation on the office equipment . The equipment was acquired on January 1 Year 2. It has a $13,000 salvage value and a five year life. The amount of depreciation is computed as (Cost-salvage) useful life). Specifically. ($113,000 $13,000) 5 - $20,000 8. Poid $145,000 to purchase manufacturing equipment 9. Recognized depreciation on the manufacturing equipment. The equipment was acquired on January 1, Yent 2. It has a $28,000 salvnge value and a nine-year life. The amount of depreciation is computed as f(Cost-salvage) useful life). Specifically, ($145,000 - $28,000) 9 $13,000 10. Paid $63,000 for rent and utility costs on the manufacturing facility 11 Paid $72,000 for inventory holding expenses for completed eBook readers (rental of warehouse space, salaries of warehouse personnel, and other general storage cost) 12. Completed and transferred eBook readers that had total cost of $256.000 from work in process inventory to finished goods. 13. Sold 970 eBook readers for $434,000 14. It cost Antioch 5174,600 to make the eBook readers sold in Event 13. Wy work ANTIOCH COMPANY Financial Statements Model Balance Sheet Event No Assets Stockholders' Equity Income Statement Cash Raw Materials Work in Process Inventory 22.000 Finished Goods 60.000 BV Office Furniture BV Manufacturing Equipment Common Stock Revenue Expense Net 563.000 53,000 Retained Earnings 223,000 2 585.000 2 13 4 5 5 2 0 10 Check my work 663000+ 63,000+ 22.000 60,000 585.000 223.000 1 2 3 4 5 5 7 8 + 10 11 12 14 Total 3000 63.000 22.000 50.000 585.000 223.000 0 0 Financial Statements Model lance Sheet Income Statement Stockholders' Equity Statement of Cash Flow BV Office Furniture BV Manufacturing Equipment Common Stock Retained Earnings Revenue Expense Net Income 585,000 + 223,000 I 11 + + + + ANTIOCH COMPANY Schedule of Cost of Goods Manufactured and Sold For the Year Ended December 31, Year 2 Beginning raw materials Inventory Purchases Raw materials available 0 Ending raw materials inventory Raw materials used 0 Labor Overhead Total manufacturing costs 0 Beginning work in process inventory Total work in process inventory 0 Ending work in process inventory Cost of goods manufactured 0 Beginning finished goods inventory Goods available Ending finished goods inventory Cost of goods sold $ 0 0 ANTIOCH COMPANY Income Statement For the Year Ended December 31, Year 2 ANTIOCH COMPANY Balance Sheet As of December 31, Year 2 Assets $ 0 Total assets Stockholders' Equity Total stockholders' equity $ 0