Question

Antoine Manufacturing, Inc., plans to develop a new industrial-powered vacuum cleaner for household use that runs exclusively on rechargeable batteries. The product will take 6

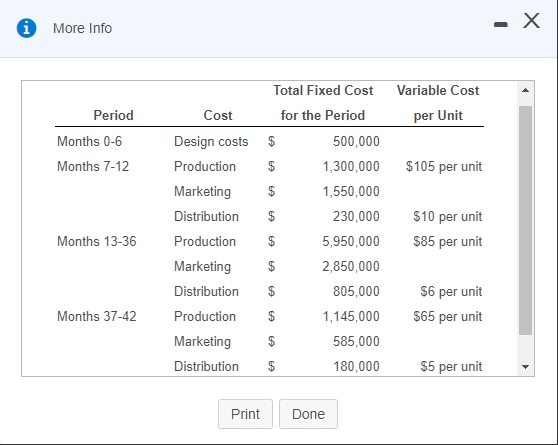

Antoine Manufacturing, Inc., plans to develop a new industrial-powered vacuum cleaner for household use that runs exclusively on rechargeable batteries. The product will take 6 months to design and test. The company expects the vacuum sweeper to sell 13,000 units during the first 6 months of sales; 27,000 units per year over the following 2 years; and 11,000 units over the final 6 months of the product's life cycle. The company expects the following costs:

Requirement:

| 1. | If Antoine prices the sweepers at $500 each, how much operating income will the company make over the product's life cycle? What is the operating income per unit? |

| 2. | Excluding the initial product design costs, what is the operating income in each of the three sales phases of the product's life cycle, assuming the price stays at $500? |

| 3. | How would you explain the change in budgeted operating income over the product's life cycle? What other factors does the company need to consider before developing the new vacuum sweeper? |

| 4. | Antoine is concerned about the operating income it will report in the first sales phase. It is considering pricing the vacuum sweeper at $550 for the first 6 months and decreasing the price to $500 thereafter. With this pricing strategy, Arnold expects to sell 11,000 units instead of 13,000 units in the first 6 months, and the same number of units for the remaining life cycle. Assuming the same cost structure given in the problem, which pricing strategy would you recommend? Explain. |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started