Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Antonio and Bella are a married couple who are concerned about sustainability and their carbon footprint. Antonio is a member of a partnership, whilst Bella

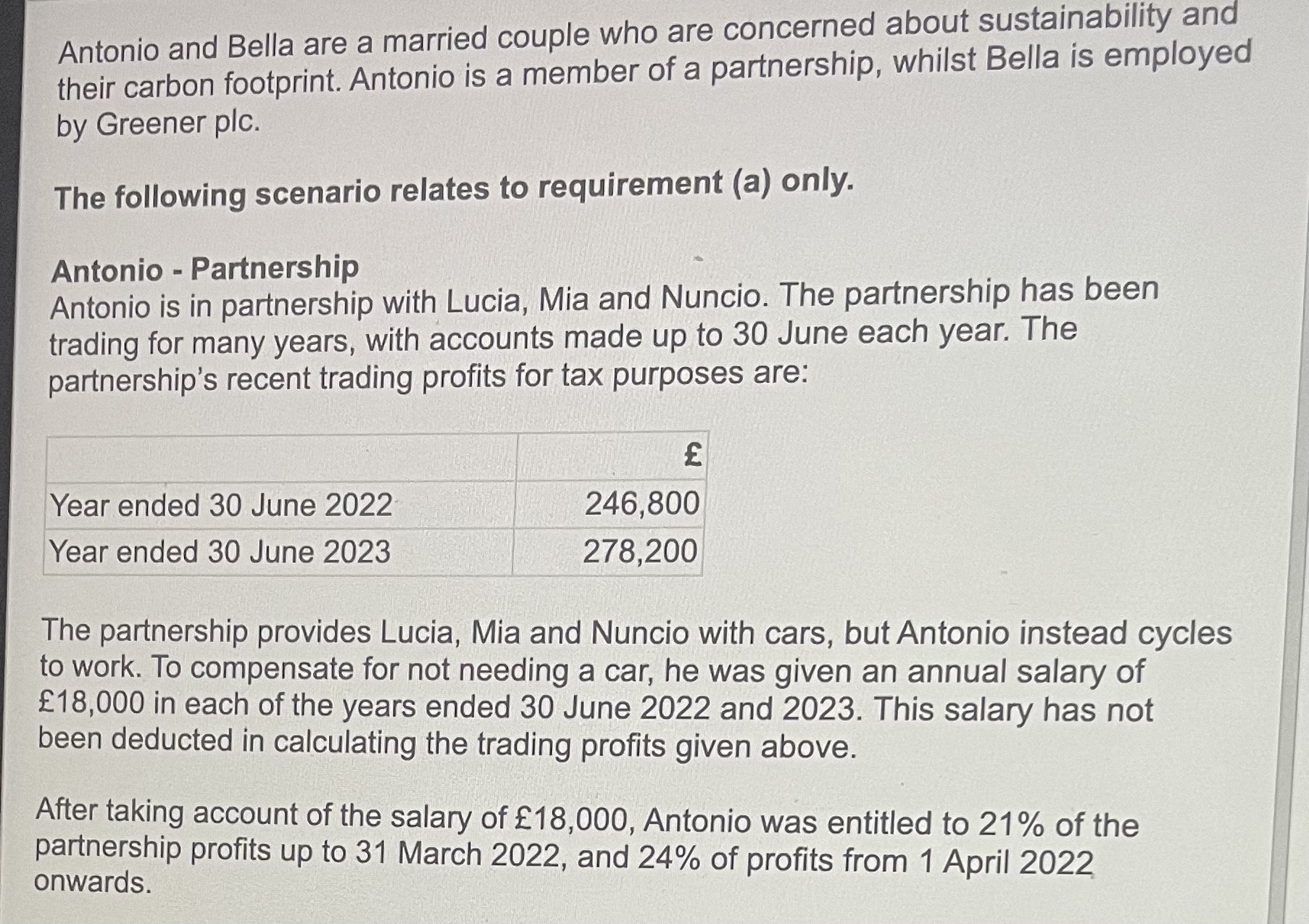

Antonio and Bella are a married couple who are concerned about sustainability and their carbon footprint. Antonio is a member of a partnership, whilst Bella is employed by Greener plc. The following scenario relates to requirement (a) only. Antonio - Partnership Antonio is in partnership with Lucia, Mia and Nuncio. The partnership has been trading for many years, with accounts made up to 30 June each year. The partnership's recent trading profits for tax purposes are: The partnership provides Lucia, Mia and Nuncio with cars, but Antonio instead cycles to work. To compensate for not needing a car, he was given an annual salary of 18,000 in each of the years ended 30 June 2022 and 2023. This salary has not been deducted in calculating the trading profits given above. After taking account of the salary of 18,000, Antonio was entitled to 21% of the partnership profits up to 31 March 2022, and 24\% of profits from 1 April 2022 onwards. (a) Calculate Antonio's trading income assessment for the tax year 2022-23

Antonio and Bella are a married couple who are concerned about sustainability and their carbon footprint. Antonio is a member of a partnership, whilst Bella is employed by Greener plc. The following scenario relates to requirement (a) only. Antonio - Partnership Antonio is in partnership with Lucia, Mia and Nuncio. The partnership has been trading for many years, with accounts made up to 30 June each year. The partnership's recent trading profits for tax purposes are: The partnership provides Lucia, Mia and Nuncio with cars, but Antonio instead cycles to work. To compensate for not needing a car, he was given an annual salary of 18,000 in each of the years ended 30 June 2022 and 2023. This salary has not been deducted in calculating the trading profits given above. After taking account of the salary of 18,000, Antonio was entitled to 21% of the partnership profits up to 31 March 2022, and 24\% of profits from 1 April 2022 onwards. (a) Calculate Antonio's trading income assessment for the tax year 2022-23 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started