Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Antonio is single and has taxable income of $150,000 without considering the sale of a capital asset (land held for investment) in September of 2016

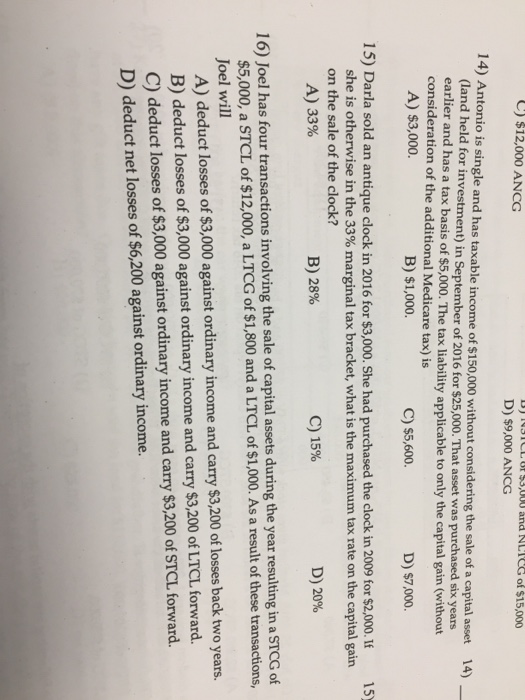

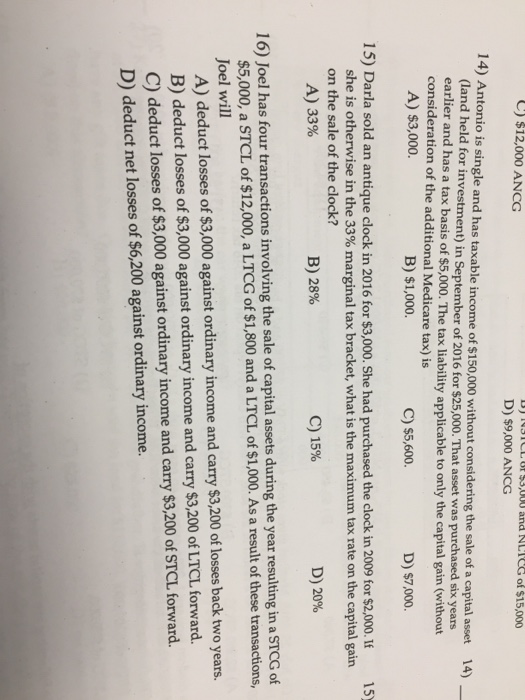

Antonio is single and has taxable income of $150,000 without considering the sale of a capital asset (land held for investment) in September of 2016 for $25,000. That asset was purchased six years earlier and has a tax basis of $5,000. The tax liability applicable to only the capital gain (without consideration of the additional Medicare tax) is A) $3,000. B) $1,000. C) $5, 600. D) $7,000. Darla sold an antique clock in 2016 for $3,000. She had purchased the clock in 2009 for $2,000. If she is otherwise in the 33% marginal tax bracket, what is the maximum tax rate on the capital gain on the sale of the clock? A) 33% B) 28% C) 15% D) 20% Joel has four transactions involving the sale of capital assets during the year resulting in a STCG of $5,000, a STCL of $12,000, a LTCG of $1, 800 and a LTCL of $1,000. As a result of these transactions, Joel will A) deduct losses of $3,000 against ordinary income and carry $3, 200 of losses back two years. B) deduct losses of $3,000 against ordinary income and carry $3200 of LTCL forward. C) deduct losses of $3,000 against ordinary income and carry $3, 200 of STCL forward. D) deduct net losses of $6, 200 against ordinary income

Antonio is single and has taxable income of $150,000 without considering the sale of a capital asset (land held for investment) in September of 2016 for $25,000. That asset was purchased six years earlier and has a tax basis of $5,000. The tax liability applicable to only the capital gain (without consideration of the additional Medicare tax) is A) $3,000. B) $1,000. C) $5, 600. D) $7,000. Darla sold an antique clock in 2016 for $3,000. She had purchased the clock in 2009 for $2,000. If she is otherwise in the 33% marginal tax bracket, what is the maximum tax rate on the capital gain on the sale of the clock? A) 33% B) 28% C) 15% D) 20% Joel has four transactions involving the sale of capital assets during the year resulting in a STCG of $5,000, a STCL of $12,000, a LTCG of $1, 800 and a LTCL of $1,000. As a result of these transactions, Joel will A) deduct losses of $3,000 against ordinary income and carry $3, 200 of losses back two years. B) deduct losses of $3,000 against ordinary income and carry $3200 of LTCL forward. C) deduct losses of $3,000 against ordinary income and carry $3, 200 of STCL forward. D) deduct net losses of $6, 200 against ordinary income

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started