Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Antonio Melton, the chief executive officer of Benson Corporation, has assembled his top advisers to evaluate an investment opportunity. The advisers expect the company

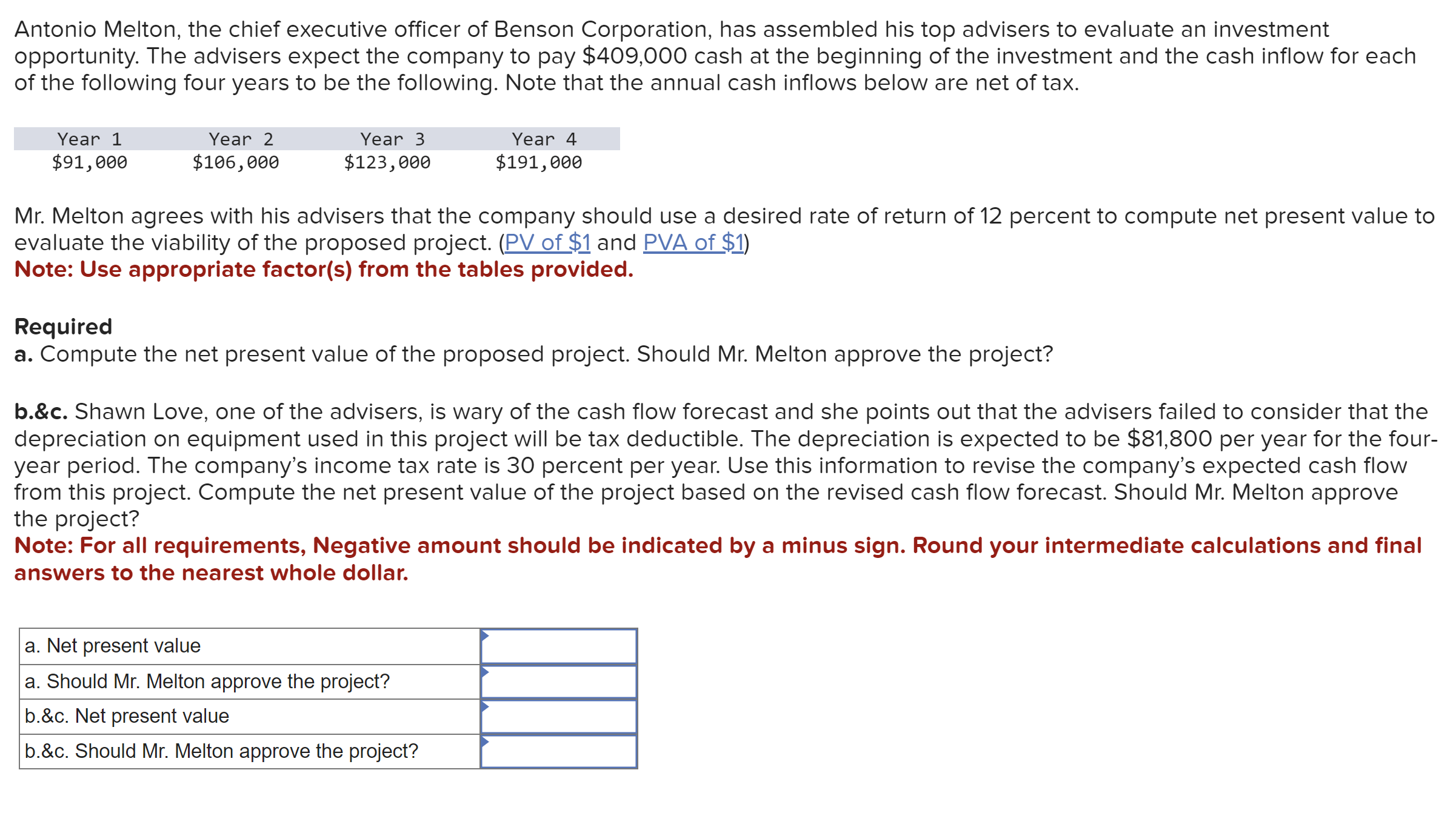

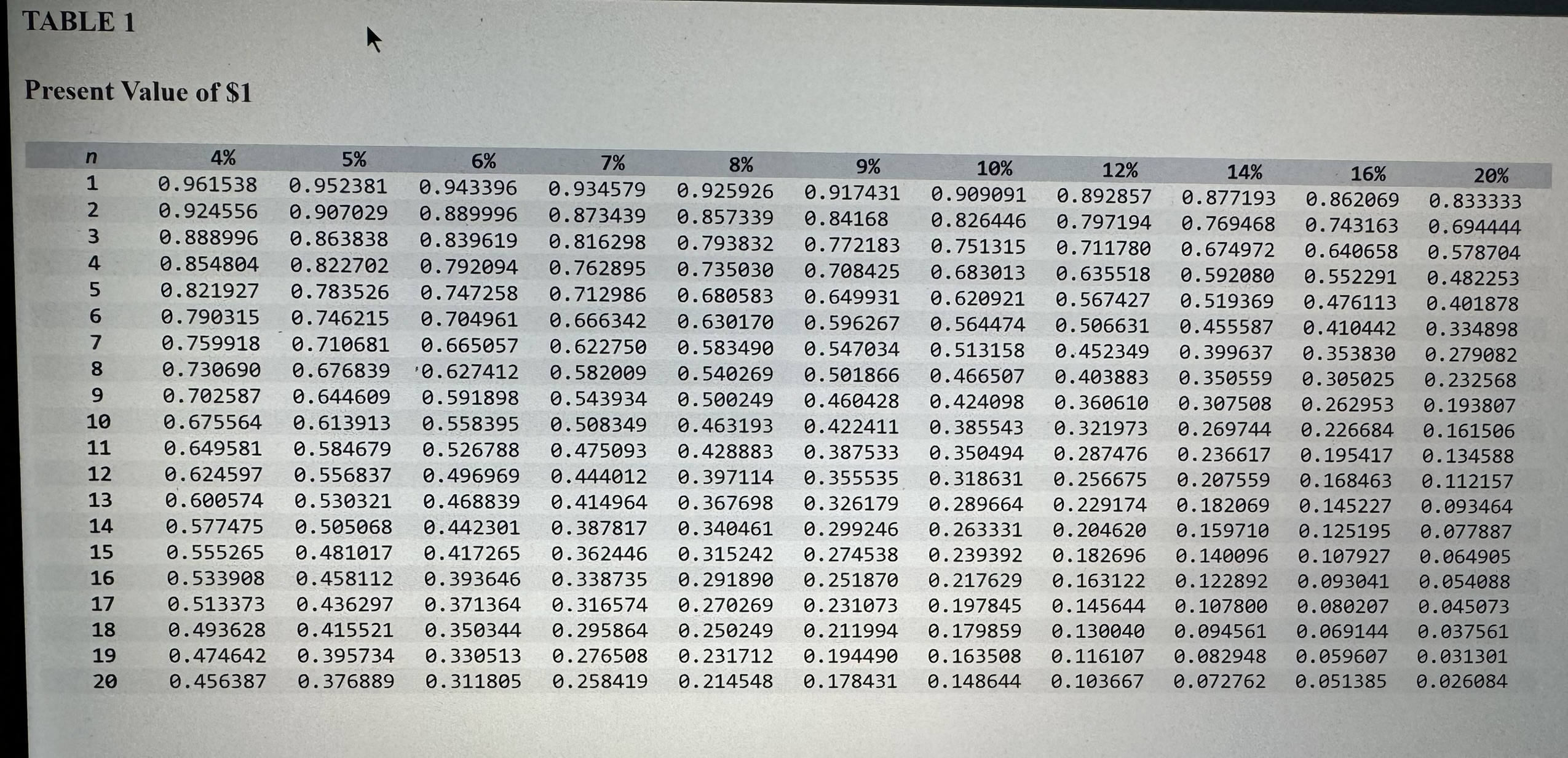

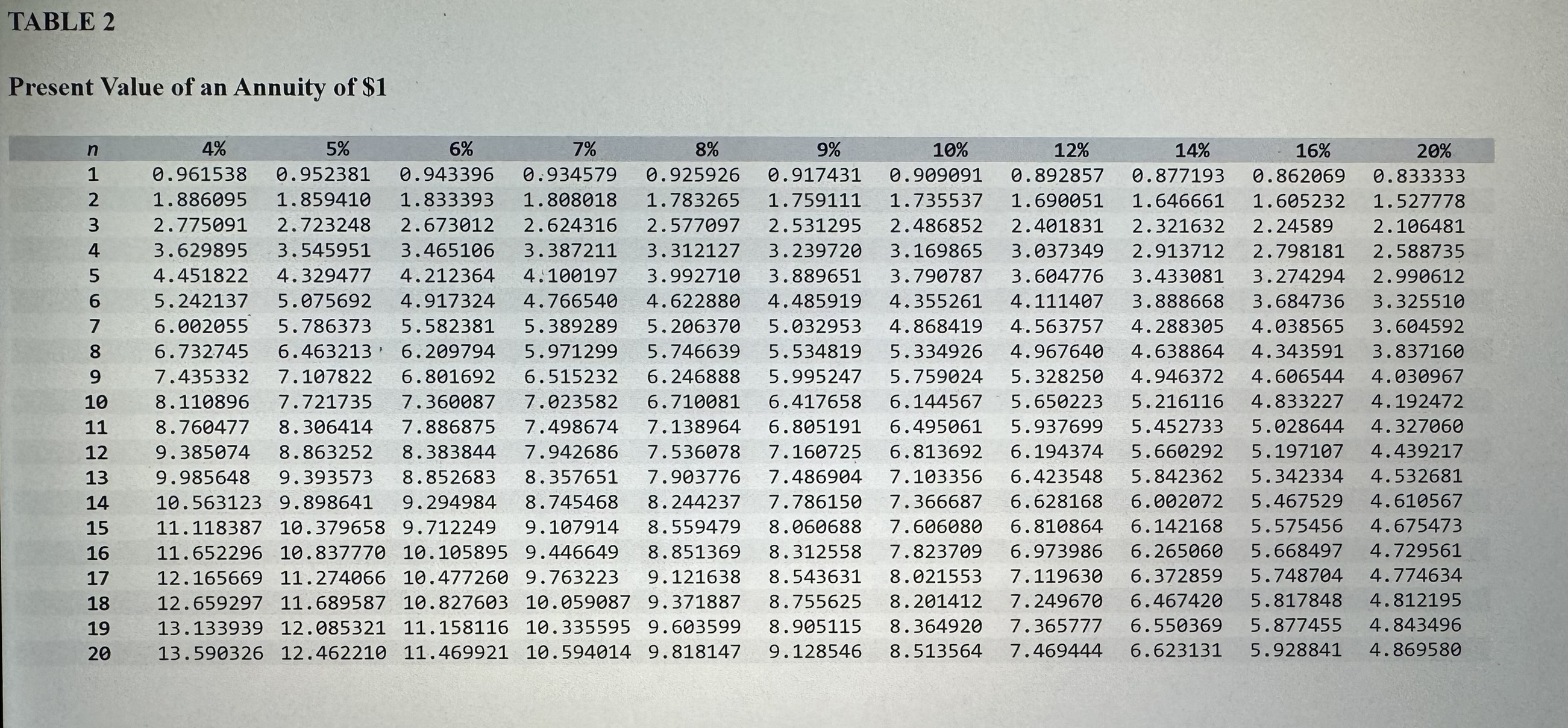

Antonio Melton, the chief executive officer of Benson Corporation, has assembled his top advisers to evaluate an investment opportunity. The advisers expect the company to pay $409,000 cash at the beginning of the investment and the cash inflow for each of the following four years to be the following. Note that the annual cash inflows below are net of tax. Year 1 $91,000 Year 2 $106,000 Year 3 $123,000 Year 4 $191,000 Mr. Melton agrees with his advisers that the company should use a desired rate of return of 12 percent to compute net present value to evaluate the viability of the proposed project. (PV of $1 and PVA of $1) Note: Use appropriate factor(s) from the tables provided. Required a. Compute the net present value of the proposed project. Should Mr. Melton approve the project? b.&c. Shawn Love, one of the advisers, is wary of the cash flow forecast and she points out that the advisers failed to consider that the depreciation on equipment used in this project will be tax deductible. The depreciation is expected to be $81,800 per year for the four- year period. The company's income tax rate is 30 percent per year. Use this information to revise the company's expected cash flow from this project. Compute the net present value of the project based on the revised cash flow forecast. Should Mr. Melton approve the project? Note: For all requirements, Negative amount should be indicated by a minus sign. Round your intermediate calculations and final answers to the nearest whole dollar. a. Net present value a. Should Mr. Melton approve the project? b.&c. Net present value b.&c. Should Mr. Melton approve the project? TABLE 1 Present Value of $1 n 4% 5% 1 0.961538 0.952381 2 0.924556 0.907029 6% 0.943396 0.889996 0.888996 0.863838 4 5 6 0.790315 0.746215 0.704961 0.666342 7 0.759918 0.710681 0.665057 8 9 10 11 12 13 14 15 16 17 18 19 20 7% 8% 9% 12% 16% 20% 0.934579 0.925926 0.917431 0.892857 0.862069 0.833333 0.873439 0.857339 0.84168 0.826446 0.797194 0.769468 0.743163 0.694444 0.839619 0.816298 0.793832 0.772183 0.751315 0.711780 0.674972 0.640658 0.578704 0.854804 0.822702 0.792094 0.762895 0.735030 0.708425 0.683013 0.635518 0.592080 0.552291 0.482253 0.821927 0.783526 0.747258 0.712986 0.680583 0.649931 0.620921 0.567427 0.519369 0.476113 0.401878 0.630170 0.596267 0.564474 0.506631 0.455587 0.410442 0.334898 0.622750 0.583490 0.547034 0.513158 0.452349 0.399637 0.353830 0.279082 0.730690 0.676839 '0.627412 0.582009 0.540269 0.501866 0.466507 0.403883 0.350559 0.305025 0.232568 0.702587 0.644609 0.591898 0.543934 0.500249 0.460428 0.424098 0.360610 0.307508 0.262953 0.193807 0.675564 0.613913 0.558395 0.508349 0.463193 0.422411 0.385543 0.321973 0.269744 0.226684 0.161506 0.649581 0.584679 0.526788 0.475093 0.428883 0.387533 0.350494 0.287476 0.236617 0.195417 0.134588 0.624597 0.556837 0.496969 0.444012 0.397114 0.355535 0.318631 0.256675 0.207559 0.168463 0.112157 0.600574 0.530321 0.468839 0.414964 0.367698 0.326179 0.289664 0.229174 0.182069 0.145227 0.093464 0.577475 0.505068 0.442301 0.387817 0.340461 0.299246 0.263331 0.204620 0.159710 0.125195 0.077887 0.555265 0.481017 0.417265 0.362446 0.315242 0.274538 0.239392 0.182696 0.140096 0.107927 0.064905 0.533908 0.458112 0.393646 0.338735 0.291890 0.251870 0.217629 0.163122 0.122892 0.093041 0.054088 0.513373 0.436297 0.371364 0.316574 0.270269 0.231073 0.197845 0.145644 0.107800 0.080207 0.045073 0.493628 0.415521 0.350344 0.295864 0.250249 0.211994 0.179859 0.130040 0.094561 0.069144 0.037561 0.474642 0.395734 0.330513 0.276508 0.231712 0.194490 0.163508 0.116107 0.082948 0.059607 0.031301 0.456387 0.376889 0.311805 0.258419 0.214548 0.178431 0.148644 0.103667 0.072762 0.051385 0.026084 10% 0.909091 14% 0.877193 TABLE 2 Present Value of an Annuity of $1 n 4% 1 0.961538 2 5% 6% 0.952381 0.943396 1.886095 1.859410 1.833393 3 4 5 7% 0.934579 1.808018 2.775091 2.723248 2.673012 2.624316 3.629895 3.545951 3.465106 3.387211 4.451822 4.329477 4.212364 4.100197 8% 0.925926 6 5.242137 5.075692 4.917324 4.766540 7 6.002055 5.786373 5.582381 8 9 10 11 12 13 14 15 16 17 18 19 20 16% 0.862069 1.605232 2.577097 2.531295 2.486852 2.401831 2.321632 2.24589 2.106481 3.312127 3.239720 3.169865 3.037349 2.913712 2.798181 2.588735 3.992710 3.889651 3.790787 3.604776 3.433081 3.274294 2.990612 4.622880 4.485919 4.355261 4.111407 3.888668 3.684736 3.325510 5.389289 5.206370 5.032953 4.868419 4.563757 4.288305 4.038565 3.604592 6.732745 6.463213 6.209794 5.971299 5.746639 5.534819 5.334926 4.967640 4.638864 4.343591 3.837160 7.435332 7.107822 6.801692 6.515232 6.246888 5.995247 5.759024 5.328250 4.946372 4.606544 4.030967 8.110896 7.721735 7.360087 7.023582 6.710081 6.417658 6.144567 5.650223 5.216116 4.833227 4.192472 8.760477 8.306414 7.886875 7.498674 7.138964 6.805191 6.495061 5.937699 5.452733 5.028644 4.327060 9.385074 8.863252 8.383844 7.942686 7.536078 7.160725 6.813692 6.194374 5.660292 5.197107 4.439217 9.985648 9.393573 8.852683 8.357651 7.903776 7.486904 7.103356 6.423548 5.842362 5.342334 4.532681 10.563123 9.898641 9.294984 8.745468 8.244237 7.786150 7.366687 6.628168 6.002072 5.467529 4.610567 11.118387 10.379658 9.712249 9.107914 8.559479 8.060688 7.606080 6.810864 6.142168 5.575456 4.675473 11.652296 10.837770 10.105895 9.446649 8.851369 8.312558 7.823709 6.973986 6.265060 5.668497 4.729561 12.165669 11.274066 10.477260 9.763223 9.121638 8.543631 8.021553 7.119630 6.372859 5.748704 4.774634 12.659297 11.689587 10.827603 10.059087 9.371887 8.755625 8.201412 7.249670 6.467420 5.817848 4.812195 13.133939 12.085321 11.158116 10.335595 9.603599 8.905115 8.364920 7.365777 6.550369 5.877455 4.843496 13.590326 12.462210 11.469921 10.594014 9.818147 9.128546 8.513564 7.469444 6.623131 5.928841 4.869580 9% 0.917431 14% 0.877193 1.783265 1.759111 1.735537 1.690051 1.646661 10% 0.909091 12% 0.892857 20% 0.833333 1.527778

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a NPV calculation is given below Year Inflow PV 12 NPV 1 91000 0892857 812...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started