Answered step by step

Verified Expert Solution

Question

1 Approved Answer

anuary 1969, Treasury Secretary Joseph W. Barr informed Congress that 155 taxpayers with ncomes exceeding $200,000 ($1.6 Million in 2022) had paid no federal income

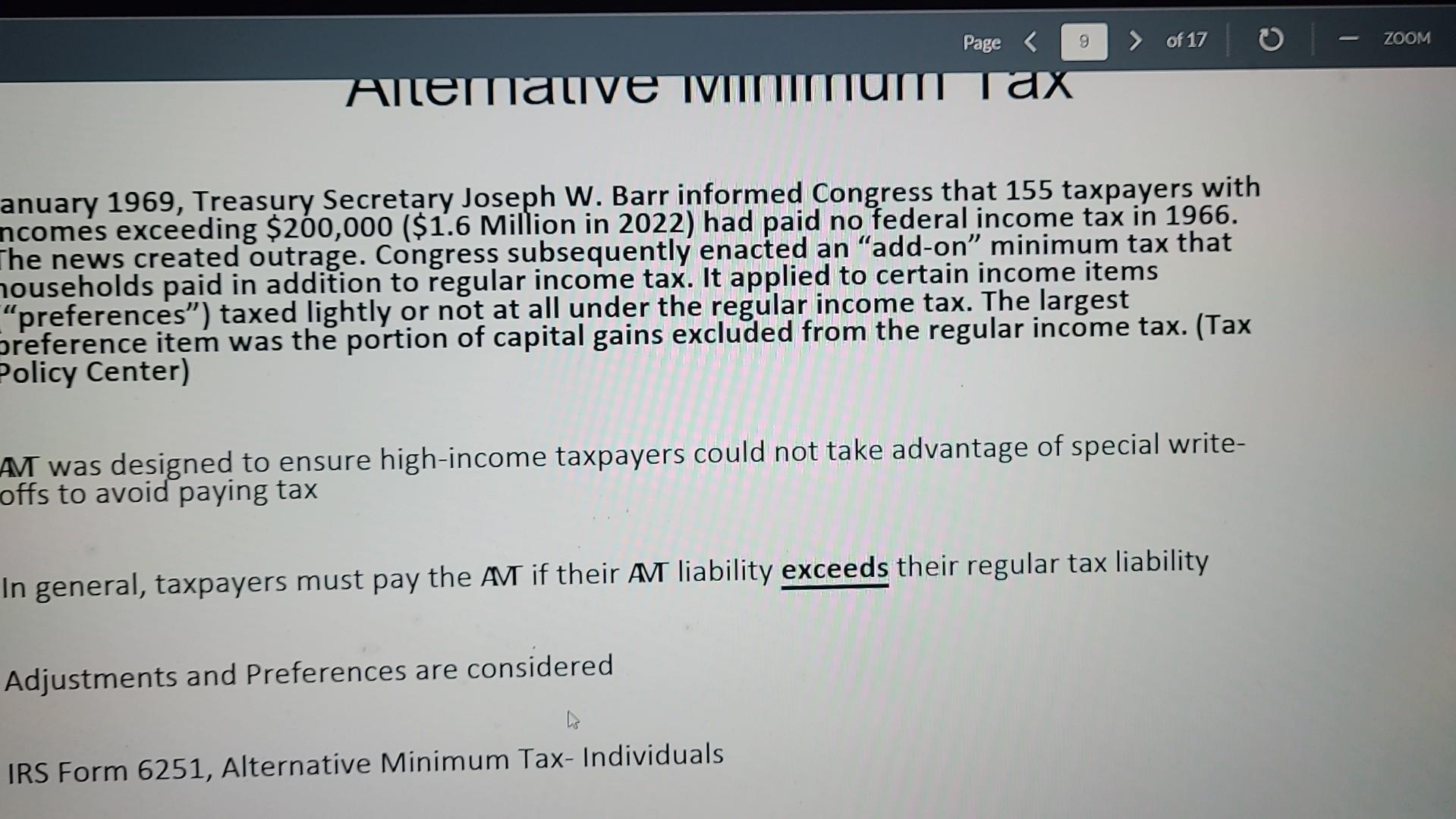

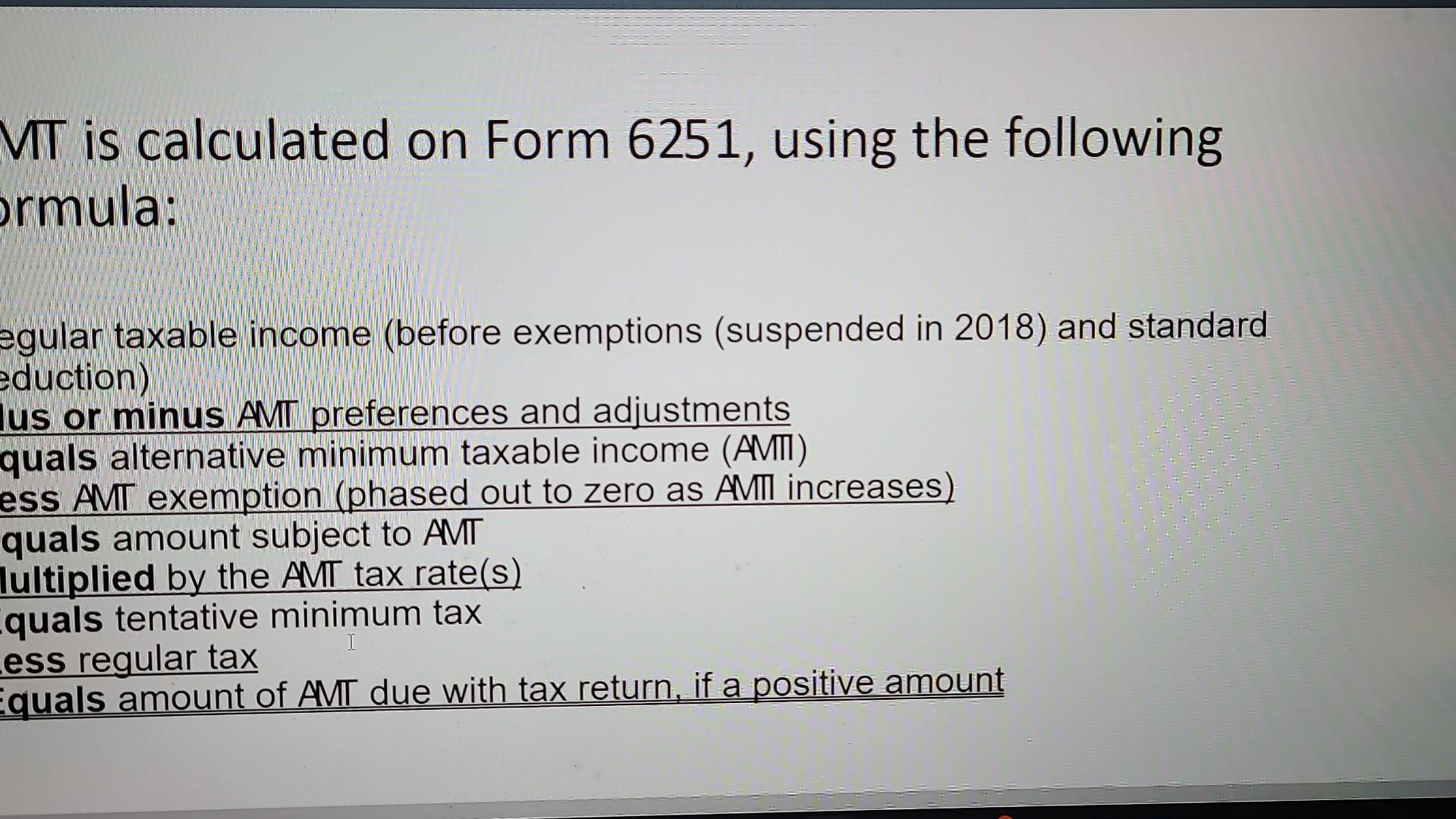

anuary 1969, Treasury Secretary Joseph W. Barr informed Congress that 155 taxpayers with ncomes exceeding \$200,000 (\$1.6 Million in 2022) had paid no federal income tax in 1966. The news created outrage. Congress subsequently enacted an "add-on" minimum tax that households paid in addition to regular income tax. It applied to certain income items "preferences") taxed lightly or not at all under the regular income tax. The largest oreference item was the portion of capital gains excluded from the regular income tax. (Tax Policy Center) AM was designed to ensure high-income taxpayers could not take advantage of special writeoffs to avoid paying tax In general, taxpayers must pay the AM if their AM liability exceeds their regular tax liability Adjustments and Preferences are considered IRS Form 6251, Alternative Minimum Tax-Individuals VT is calculated on Form 6251, using the following rmula: gular taxable income (before exemptions (suspended in 2018) and standard duction) us or minus AMT preferences and adjustments quals alternative minimum taxable income (AMT) ss AMT exemption (phased out to zero as AMM increases) quals amount subject to AMT ultiplied by the AMT tax rate(s) quals tentative minimum tax ess regular tax quals amount of AMT due with tax return, if a positive amount anuary 1969, Treasury Secretary Joseph W. Barr informed Congress that 155 taxpayers with ncomes exceeding \$200,000 (\$1.6 Million in 2022) had paid no federal income tax in 1966. The news created outrage. Congress subsequently enacted an "add-on" minimum tax that households paid in addition to regular income tax. It applied to certain income items "preferences") taxed lightly or not at all under the regular income tax. The largest oreference item was the portion of capital gains excluded from the regular income tax. (Tax Policy Center) AM was designed to ensure high-income taxpayers could not take advantage of special writeoffs to avoid paying tax In general, taxpayers must pay the AM if their AM liability exceeds their regular tax liability Adjustments and Preferences are considered IRS Form 6251, Alternative Minimum Tax-Individuals VT is calculated on Form 6251, using the following rmula: gular taxable income (before exemptions (suspended in 2018) and standard duction) us or minus AMT preferences and adjustments quals alternative minimum taxable income (AMT) ss AMT exemption (phased out to zero as AMM increases) quals amount subject to AMT ultiplied by the AMT tax rate(s) quals tentative minimum tax ess regular tax quals amount of AMT due with tax return, if a positive amount

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started