Answered step by step

Verified Expert Solution

Question

1 Approved Answer

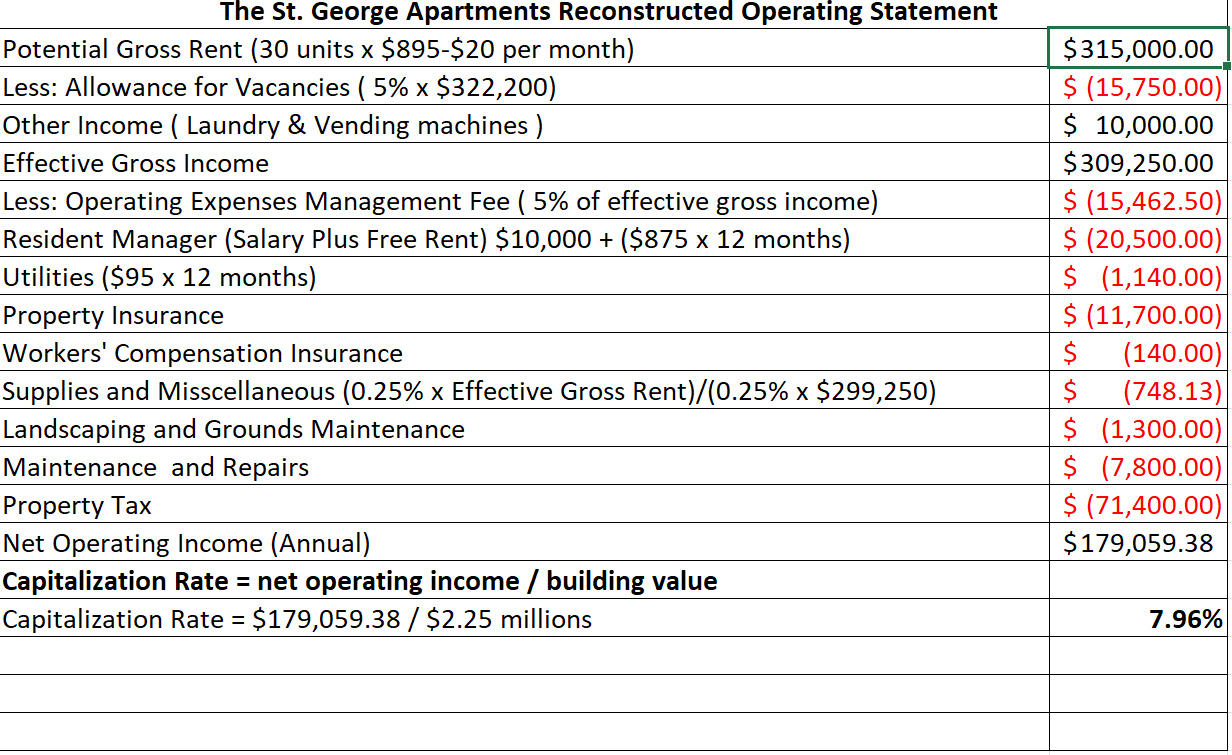

Anwer the following questions based on the table above. Based on NOI projection for the first year, estimate the mortgage loan that will be available

Anwer the following questions based on the table above.

- Based on NOI projection for the first year, estimate the mortgage loan that will be available if the lender requires a debt-coverage ratio of not less than 1.20. Anticipated loan terms are interest at 8.5% per annum, and level monthly payments to amortize the loan over 20 years. No discount points or loan origination fee is anticipated.

- Round your mortgage loan estimate from Assignment 1, to the nearest $100,000. Modify the St. George Apartments projection to derive a seven-year projection of before-tax cash flow, based on this loan.

- Using the mortgage loan from Assignment 2, develop a seven-year amortization schedule for the St. George Apartments. Include an anticipated remaining mortgage balance at the end of seven years. Using the forecasted future market value developed in Assignment 3 of the Case Problem for Part Two (rounded to the nearest $100,000), estimate before-tax cash flow from disposal, assuming the following: a. The property is sold at the end of the seventh year (i.e., before the first debt-service payment falls due for the eighth year) b.Transaction costs (brokerage, legal and accounting fees, and so forth) equal 8% of the selling price.

PLEASE USE EXCEL!!!

The St. George Apartments Reconstructed Operating Statement The St. George Apartments Reconstructed Operating StatementStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started