Answered step by step

Verified Expert Solution

Question

1 Approved Answer

any body? Urgent please Section B: Answer Two questions from 3. All questions carry equal marks Question 2 Alpha and Beta are in partnership sharing

any body?

Urgent please

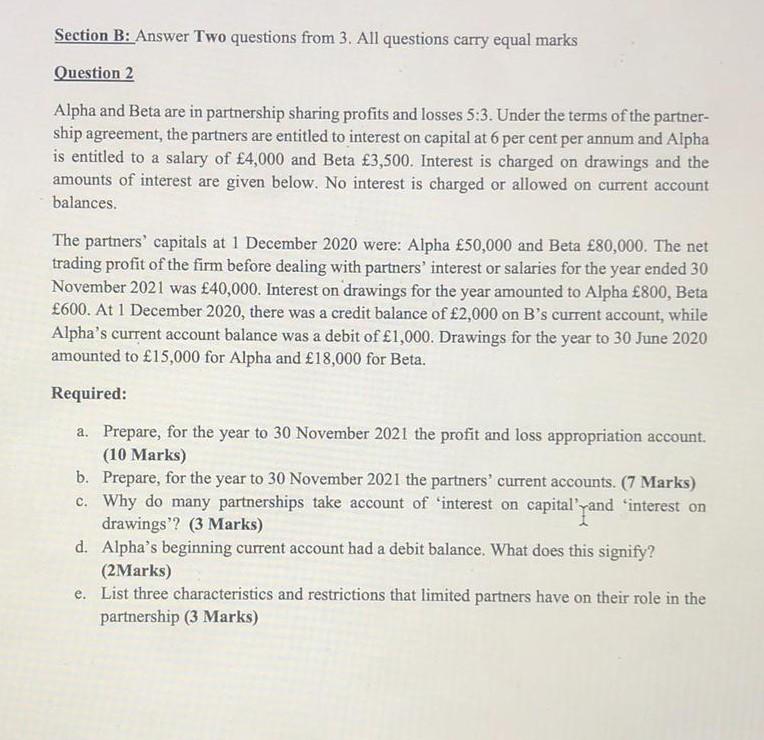

Section B: Answer Two questions from 3. All questions carry equal marks Question 2 Alpha and Beta are in partnership sharing profits and losses 5:3. Under the terms of the partner- ship agreement, the partners are entitled to interest on capital at 6 per cent per annum and Alpha is entitled to a salary of 4,000 and Beta 3,500. Interest is charged on drawings and the amounts of interest are given below. No interest is charged or allowed on current account balances. The partners' capitals at 1 December 2020 were: Alpha 50,000 and Beta 80,000. The net trading profit of the firm before dealing with partners' interest or salaries for the year ended 30 November 2021 was 40,000. Interest on drawings for the year amounted to Alpha 800, Beta 600. At 1 December 2020, there was a credit balance of 2,000 on B's current account, while Alpha's current account balance was a debit of 1,000. Drawings for the year to 30 June 2020 amounted to 15,000 for Alpha and 18,000 for Beta. Required: a. Prepare, for the year to 30 November 2021 the profit and loss appropriation account. (10 Marks) b. Prepare, for the year to 30 November 2021 the partners' current accounts. (7 Marks) c. Why do many partnerships take account of 'interest on capital'yand 'interest on drawings'? (3 Marks) d. Alpha's beginning current account had a debit balance. What does this signify? (2Marks) e. List three characteristics and restrictions that limited partners have on their role in the partnershipStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started